Tech Sector Drives S&P 500 Recovery, Erasing Projected 2025 Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Sector Drives S&P 500 Recovery, Erasing Projected 2025 Losses

The tech sector's remarkable resurgence has spearheaded a stunning recovery for the S&P 500, erasing projected losses that were anticipated to extend well into 2025. This unexpected turnaround has left market analysts scrambling to reassess their forecasts and understand the driving forces behind this significant shift. The recovery is a testament to the resilience of the tech industry and its capacity for rapid adaptation in the face of economic uncertainty.

A Stunning Reversal of Fortune:

For much of 2023, the S&P 500 grappled with persistent inflation, rising interest rates, and geopolitical instability. These factors contributed to widespread predictions of substantial losses extending into the latter half of 2024 and potentially beyond. Tech stocks, already reeling from a previous downturn, seemed particularly vulnerable. However, the narrative has dramatically shifted.

The unexpected surge in tech stock performance is attributed to several key factors:

-

AI-Driven Growth: The explosive growth of artificial intelligence (AI) has breathed new life into the sector. Companies at the forefront of AI development, such as Nvidia and Google's parent company Alphabet, have seen their stock prices skyrocket, significantly boosting the overall market performance. This AI boom has driven substantial investment and created a sense of optimism about future growth prospects.

-

Strong Earnings Reports: Several major tech companies have exceeded expectations with their recent earnings reports, showcasing strong revenue growth and demonstrating their ability to navigate a challenging economic climate. This positive news has reassured investors and fueled further buying activity. This contrasts sharply with the pessimistic outlook just months ago.

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential cooling-off period. This has reduced fears of aggressive interest rate hikes by the Federal Reserve, leading to increased investor confidence across various sectors, including technology. Reduced inflation expectations have a ripple effect on the entire market.

-

Increased Investor Confidence: The combined effect of strong earnings, AI-driven innovation, and easing inflation concerns has significantly boosted investor confidence. This has led to a renewed appetite for risk, with investors pouring money back into the tech sector. This is a major psychological shift from the risk-averse sentiment prevalent earlier in the year.

Looking Ahead: Sustainability and Challenges Remain:

While the current recovery is undeniably impressive, it's crucial to approach the future with a balanced perspective. Several challenges remain:

-

Geopolitical Uncertainty: Global geopolitical instability continues to pose a risk to the market. Uncertainties surrounding international relations can easily impact investor sentiment and market volatility.

-

Interest Rate Volatility: Although inflation is easing, the Federal Reserve's future interest rate decisions remain uncertain. Any unexpected increase could impact the market's trajectory.

-

Valuation Concerns: The rapid rise in tech valuations raises questions about potential overvaluation in certain segments. A correction is always a possibility.

Conclusion:

The tech sector's remarkable performance has undeniably driven the S&P 500's recovery, exceeding even the most optimistic forecasts. However, sustained growth requires continued innovation, prudent management of risks, and a careful consideration of the lingering economic uncertainties. While the current trend is positive, investors should maintain a watchful eye on evolving market conditions. The future remains dynamic, and continued monitoring is crucial for informed decision-making. Learn more about navigating the evolving stock market by reading our comprehensive guide on [link to relevant article/resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Sector Drives S&P 500 Recovery, Erasing Projected 2025 Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Donde Ver El Alaves Valencia Transmision En Vivo Por Tv Y Streaming Online

May 14, 2025

Donde Ver El Alaves Valencia Transmision En Vivo Por Tv Y Streaming Online

May 14, 2025 -

Action Packed Family Fun The Nobody 2 Trailer Promises Violent Mayhem

May 14, 2025

Action Packed Family Fun The Nobody 2 Trailer Promises Violent Mayhem

May 14, 2025 -

Alaves Vs Corberans Team A Battle Of Intensity Predicted

May 14, 2025

Alaves Vs Corberans Team A Battle Of Intensity Predicted

May 14, 2025 -

International Leaders Petition Pope Leo Xiv On Climate Change Following Francis Papacy

May 14, 2025

International Leaders Petition Pope Leo Xiv On Climate Change Following Francis Papacy

May 14, 2025 -

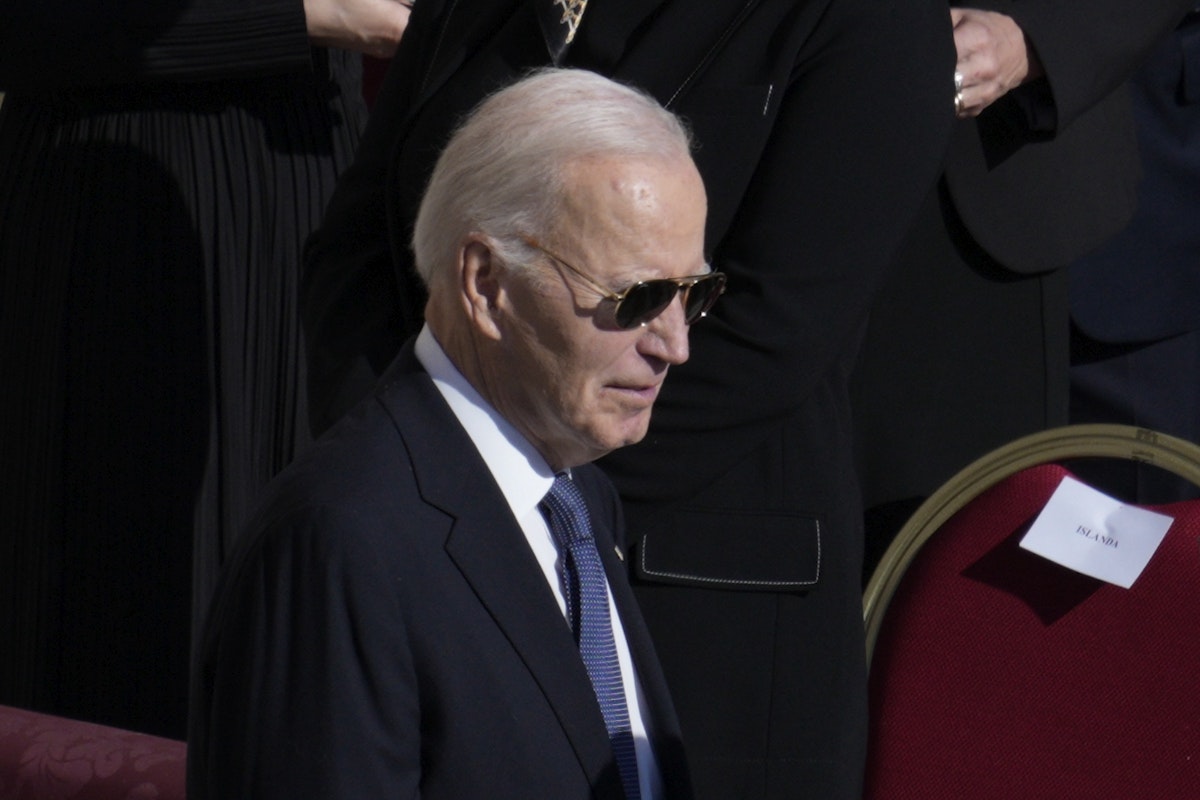

Biden Health Concerns Staffers Report Worsening Condition

May 14, 2025

Biden Health Concerns Staffers Report Worsening Condition

May 14, 2025