Bitcoin ETF Investments Surpass $5 Billion: Analyzing The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surpass $5 Billion: Analyzing the Market Trend

Bitcoin exchange-traded funds (ETFs) have officially crossed a monumental threshold, surpassing a staggering $5 billion in total investments. This landmark achievement signifies a pivotal moment for Bitcoin's integration into mainstream finance and underscores the growing institutional interest in the world's largest cryptocurrency. But what does this surge in investment truly mean for the future of Bitcoin and the broader cryptocurrency market? Let's delve into the details.

The Meteoric Rise of Bitcoin ETFs:

The journey to $5 billion wasn't overnight. The launch of the first Bitcoin futures ETF in the US in 2021 marked a significant turning point, paving the way for more sophisticated investment vehicles. However, the recent surge is largely attributed to several key factors:

- Increased Regulatory Clarity: While regulatory hurdles remain, the increasing acceptance and clearer guidelines from authorities like the SEC (Securities and Exchange Commission) in the US have boosted investor confidence. This clearer regulatory landscape reduces uncertainty and encourages larger institutional investments.

- Institutional Adoption: Hedge funds, pension funds, and other major financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a hedge against inflation and a diversifying asset.

- Growing Retail Investor Interest: Despite the volatility inherent in cryptocurrencies, retail investors continue to show a keen interest in Bitcoin, viewing it as a potentially lucrative long-term investment. The accessibility offered by ETFs further fuels this trend.

- Improved ETF Products: The ETF market itself has evolved, offering investors a wider range of products with varying risk profiles and investment strategies. This diversification caters to a broader spectrum of investor needs and risk tolerances.

What This Means for the Future:

The surpassing of the $5 billion mark is not just a symbolic victory; it's a strong indicator of the maturing Bitcoin market. This milestone suggests several potential future trends:

- Increased Price Volatility (Short-Term): While long-term prospects remain positive for many, a sudden influx of investment can lead to short-term price fluctuations as the market adjusts.

- Further Institutional Adoption: This success will likely attract even more institutional investors, further legitimizing Bitcoin within the traditional finance world.

- More Innovative ETF Products: We can anticipate a surge in the development of new and innovative Bitcoin ETFs, potentially including those focused on specific strategies or sectors.

- Greater Market Liquidity: The increased investment volume in Bitcoin ETFs will likely contribute to improved market liquidity, making it easier for investors to buy and sell Bitcoin.

Risks and Considerations:

It's crucial to remember that investing in Bitcoin, regardless of the vehicle, carries inherent risks. Volatility remains a significant factor, and the cryptocurrency market is subject to regulatory changes and technological advancements that can impact its value. Potential investors should conduct thorough research and understand the associated risks before investing.

Conclusion:

The $5 billion milestone in Bitcoin ETF investments marks a significant turning point. While uncertainty always remains in the volatile world of cryptocurrencies, the trend points towards increased mainstream acceptance and institutional adoption of Bitcoin. This development holds significant implications for the future of digital assets and their integration into the global financial system. Further monitoring of this market trend will be crucial for investors and market analysts alike. Stay tuned for future updates and analysis as this exciting space continues to evolve.

Related Articles:

- [Link to an article about Bitcoin regulation]

- [Link to an article about institutional investment in crypto]

- [Link to an article about the future of cryptocurrencies]

Disclaimer: This article provides general information and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surpass $5 Billion: Analyzing The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Master Of Ceremony Warbonds Helldivers 2s May 15th Drop Revealed

May 20, 2025

Master Of Ceremony Warbonds Helldivers 2s May 15th Drop Revealed

May 20, 2025 -

Tras Conversacion Con Xabi Alonso Cercano El Fichaje Para El Real Madrid

May 20, 2025

Tras Conversacion Con Xabi Alonso Cercano El Fichaje Para El Real Madrid

May 20, 2025 -

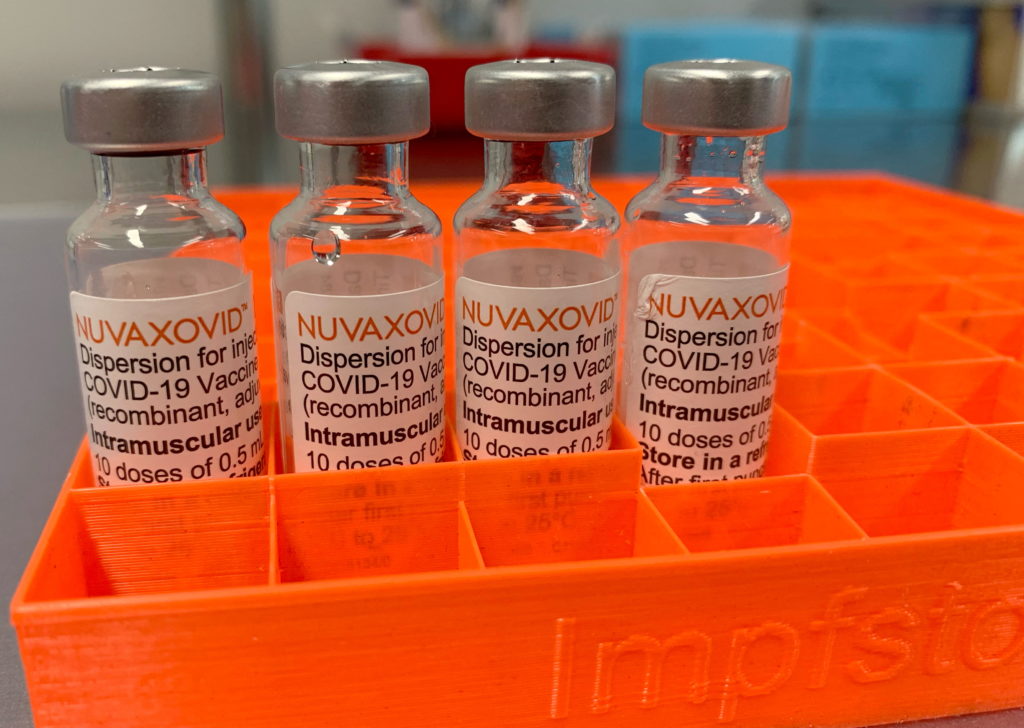

Fda Approval For Novavax Covid 19 Vaccine Comes With Strict Conditions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Strict Conditions

May 20, 2025 -

Curbing Bad Tourist Behavior Bali Implements New Regulations

May 20, 2025

Curbing Bad Tourist Behavior Bali Implements New Regulations

May 20, 2025 -

2025s Most Intense Solar Flare Impacts Radio Networks In Europe Asia And The Middle East Video

May 20, 2025

2025s Most Intense Solar Flare Impacts Radio Networks In Europe Asia And The Middle East Video

May 20, 2025