Bitcoin ETF Investments Surge Past $5 Billion: Analyzing The Market Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: Analyzing the Market Shift

The world of finance is buzzing. Bitcoin exchange-traded fund (ETF) investments have officially exploded past the $5 billion mark, signaling a monumental shift in investor sentiment and a significant endorsement of Bitcoin's place in mainstream finance. This surge represents a dramatic increase in institutional and individual investment, prompting analysts to dissect the driving forces behind this remarkable growth and predict future market trends. Let's dive into the details.

What Fueled This Record-Breaking Investment?

Several key factors have contributed to this unprecedented influx of capital into Bitcoin ETFs:

-

Regulatory Approvals: The recent approval of Bitcoin futures ETFs in the US played a pivotal role. This opened the door for a wider range of investors, particularly institutional investors who previously faced regulatory hurdles, to gain exposure to Bitcoin. The increased accessibility significantly boosted investor confidence.

-

Growing Institutional Adoption: Large financial institutions are increasingly recognizing Bitcoin as a viable asset class. Their participation not only adds legitimacy to the market but also injects substantial capital, fueling the price appreciation and attracting further investment.

-

Inflation Hedge: With persistent inflation concerns globally, Bitcoin is viewed by many as a potential hedge against inflation, a safe haven asset similar to gold. This perception has attracted investors seeking to protect their portfolios from eroding purchasing power.

-

Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network improving transaction speeds and reducing costs, contribute to its growing appeal and long-term potential.

Analyzing the Market Shift: What Does it Mean?

This $5 billion milestone marks a significant turning point for Bitcoin's integration into traditional finance. The increased accessibility and institutional adoption are driving factors in its mainstream acceptance. However, it's crucial to acknowledge potential risks:

-

Volatility Remains: Bitcoin is known for its volatility. While ETF investments offer a degree of diversification and management, the inherent price fluctuations remain a considerable risk for investors.

-

Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Future regulatory changes could impact the Bitcoin ETF market significantly.

-

Market Manipulation: Concerns about potential market manipulation, particularly in the cryptocurrency market, remain a valid consideration.

The Future of Bitcoin ETFs:

The future looks bright for Bitcoin ETFs. With continued regulatory clarity and increasing institutional interest, we can expect further growth. However, investors should remain cautious, conduct thorough research, and understand the inherent risks before investing.

Where to Learn More:

For more in-depth analysis and resources on Bitcoin ETFs and the cryptocurrency market, consider exploring reputable financial news websites such as and . Remember to always consult a financial advisor before making any investment decisions.

Call to Action: Stay informed about the evolving cryptocurrency market and its impact on the global economy. Understanding the trends and potential risks is crucial for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: Analyzing The Market Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bali Seeks International Help To Improve Tourist Behavior And Safety

May 20, 2025

Bali Seeks International Help To Improve Tourist Behavior And Safety

May 20, 2025 -

The Last Of Us Season 2 Diverges Exploring The Evolution Of Joel And Ellies Dynamic

May 20, 2025

The Last Of Us Season 2 Diverges Exploring The Evolution Of Joel And Ellies Dynamic

May 20, 2025 -

Unity And Peace Key Themes Of Pope Leos Inauguration Mass

May 20, 2025

Unity And Peace Key Themes Of Pope Leos Inauguration Mass

May 20, 2025 -

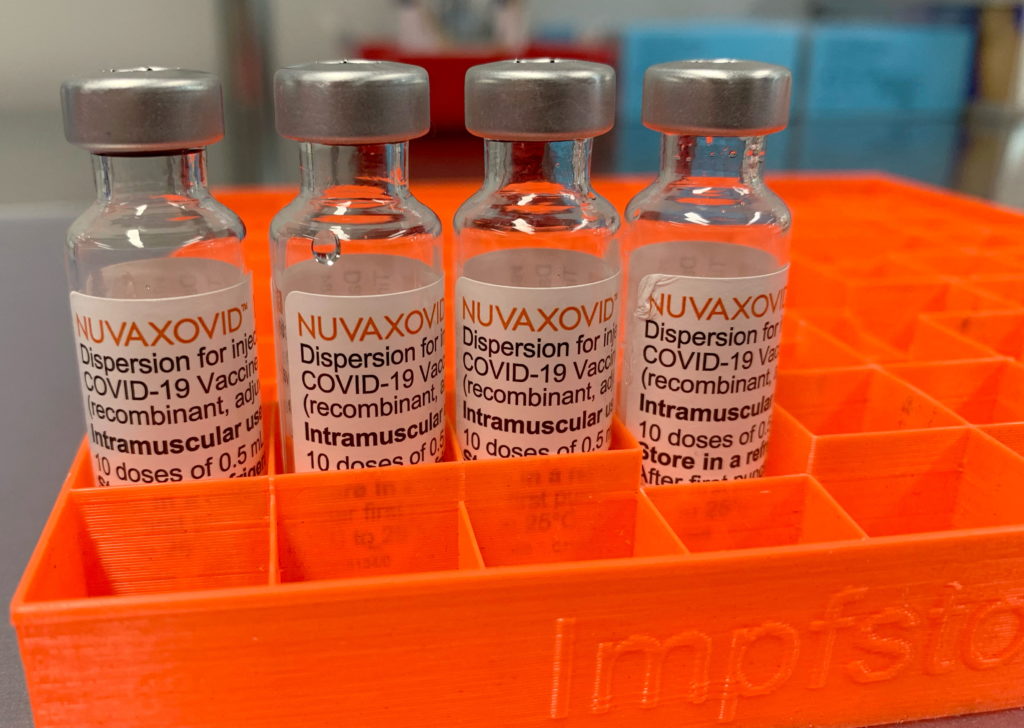

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Limitations

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Limitations

May 20, 2025 -

Major Solar Flare Warning Nasa Predicts Potential Power Outages

May 20, 2025

Major Solar Flare Warning Nasa Predicts Potential Power Outages

May 20, 2025