Bitcoin ETF Investments Surge Past $5 Billion: A Look At The Driving Forces

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: A Look at the Driving Forces

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have just crossed a monumental threshold, surpassing $5 billion in total investments. This unprecedented surge signals a significant shift in investor sentiment and opens a crucial discussion about the future of Bitcoin and its integration into mainstream finance. But what's driving this dramatic increase? Let's delve into the key factors fueling this investment boom.

The Rise of Institutional Adoption: One of the most significant factors contributing to the surge in Bitcoin ETF investments is the growing acceptance of Bitcoin by institutional investors. Hedge funds, pension funds, and other large financial players are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential hedge against inflation and a diversification tool. This institutional interest lends legitimacy and stability to the asset class, encouraging further investment. [Link to a relevant article on institutional Bitcoin adoption]

Regulatory Clarity and Approvals: The regulatory landscape surrounding Bitcoin ETFs is slowly evolving, with several countries showing increasing openness towards their approval. While the US has been relatively slow to grant approvals for spot Bitcoin ETFs, the mere possibility of approval is enough to fuel significant speculation and investment. The recent flurry of filings for spot Bitcoin ETFs indicates a growing expectation of eventual regulatory green light. This regulatory uncertainty, paradoxically, also drives investment as investors speculate on future price movements. [Link to a relevant article on Bitcoin ETF regulatory developments]

Gradual Mainstream Acceptance: Bitcoin is no longer a niche asset. Its growing acceptance by major payment processors, retailers, and financial institutions is slowly but surely integrating it into the mainstream financial system. This increasing visibility and accessibility are crucial factors driving wider adoption and investment in Bitcoin ETFs, making them a more attractive and less intimidating investment option for everyday investors.

<h3>What does this mean for the future?</h3>

The $5 billion milestone is not just a number; it’s a powerful indicator of a broader trend. The increasing acceptance of Bitcoin as a legitimate asset class, coupled with the potential for regulatory clarity, suggests that we're entering a new era for cryptocurrency investments.

- Increased Volatility: While the influx of institutional money brings stability, it's important to acknowledge that Bitcoin remains a volatile asset. Investors should be prepared for price fluctuations.

- Growing Competition: The success of Bitcoin ETFs is likely to attract more competitors to the market, potentially leading to a wider range of investment choices for investors.

- Further Innovation: The increased investment in Bitcoin ETFs will likely spur innovation in the cryptocurrency space, leading to the development of new products and services.

Investing in Bitcoin ETFs: Before you rush into investing, remember to conduct thorough research and understand the associated risks. Consult with a financial advisor to determine if Bitcoin ETFs are a suitable investment for your portfolio. Remember that past performance is not indicative of future results.

Conclusion: The surge in Bitcoin ETF investments past $5 billion represents a significant milestone for the cryptocurrency market. This remarkable growth is driven by a confluence of factors, including increased institutional adoption, evolving regulatory landscapes, and greater mainstream acceptance. While the future remains uncertain, this milestone highlights Bitcoin's increasing integration into the traditional financial system and its potential for continued growth. This is a story that deserves continued monitoring and analysis. Stay tuned for further developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: A Look At The Driving Forces. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

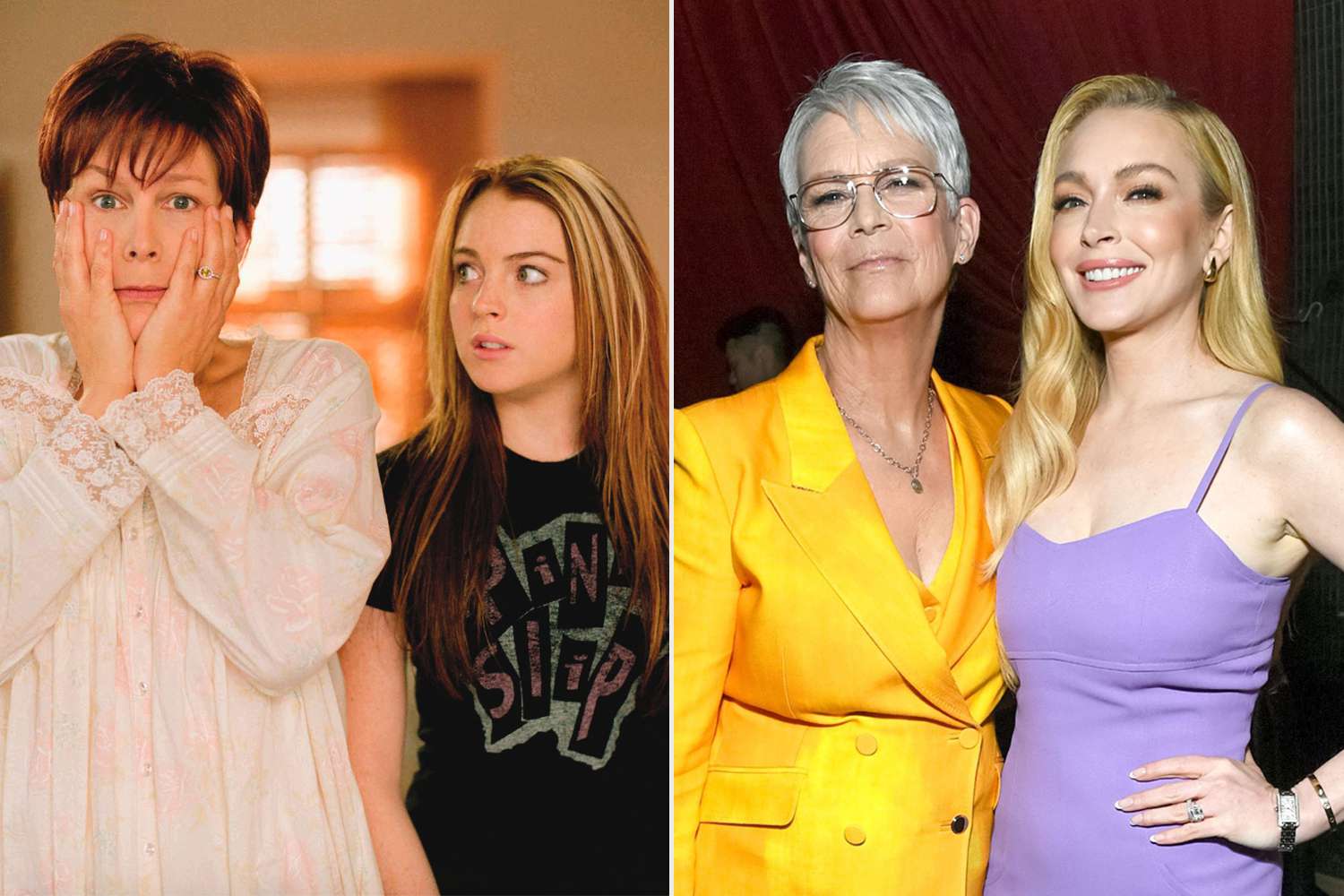

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 21, 2025

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 21, 2025 -

Jamie Lee Curtis And Lindsay Lohans Honest Friendship

May 21, 2025

Jamie Lee Curtis And Lindsay Lohans Honest Friendship

May 21, 2025 -

Big Budget Rayman Game In Development At Ubisoft Milan Hiring Now

May 21, 2025

Big Budget Rayman Game In Development At Ubisoft Milan Hiring Now

May 21, 2025 -

Tom Aspinall Fight Delay Is Jon Jones Retiring From Ufc

May 21, 2025

Tom Aspinall Fight Delay Is Jon Jones Retiring From Ufc

May 21, 2025 -

Stock Market Today Analyzing The S And P 500s 6 Day Rally And Moodys Impact

May 21, 2025

Stock Market Today Analyzing The S And P 500s 6 Day Rally And Moodys Impact

May 21, 2025