Billions Flow Into Bitcoin ETFs: A Wave Of Institutional Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Wave of Institutional Investment

The cryptocurrency market is experiencing a seismic shift as billions of dollars pour into Bitcoin exchange-traded funds (ETFs). This surge in institutional investment signifies a growing acceptance of Bitcoin as a legitimate asset class, marking a pivotal moment in the digital asset's history. The approval of the first Bitcoin futures ETF in the US in October 2021 paved the way for this significant influx of capital, and recent approvals of spot Bitcoin ETFs are further accelerating the trend.

This isn't just a fleeting trend; it's a clear indication of institutional confidence in Bitcoin's long-term potential. But what's driving this massive investment, and what does it mean for the future of Bitcoin and the broader cryptocurrency market? Let's delve deeper.

The Institutional Embrace of Bitcoin ETFs

Several factors contribute to this wave of institutional investment in Bitcoin ETFs:

-

Increased Regulatory Clarity: The gradual but steady increase in regulatory clarity around cryptocurrencies, particularly in major markets like the US, has significantly boosted investor confidence. The SEC's approval process, while rigorous, provides a degree of legitimacy that attracts institutional investors seeking regulated investment vehicles.

-

Accessibility and Diversification: ETFs offer a convenient and regulated way for institutional investors to gain exposure to Bitcoin without the complexities and risks associated with directly holding the cryptocurrency. This accessibility makes Bitcoin a more manageable addition to diversified investment portfolios.

-

Demand from Institutional Investors: Large financial institutions, pension funds, and hedge funds are increasingly seeking alternative investment options to diversify their portfolios and hedge against inflation. Bitcoin, with its decentralized nature and limited supply, is seen as an attractive hedge against traditional market volatility.

The Impact of Spot Bitcoin ETF Approvals

The recent approvals of spot Bitcoin ETFs represent a watershed moment. Unlike futures-based ETFs, spot ETFs directly track the price of Bitcoin, offering a more direct and potentially lucrative investment opportunity. This increased direct exposure is further fueling the institutional investment boom. The impact is already being felt, with billions flowing into these new funds within days of their launch.

What Does This Mean for the Future?

The influx of billions into Bitcoin ETFs has several potential implications:

-

Price Volatility: While the increased institutional investment brings stability, it's important to acknowledge that Bitcoin's price remains volatile. Significant inflows can lead to short-term price increases, while large outflows could trigger corrections.

-

Mainstream Adoption: This wave of investment signals a significant step towards the mainstream adoption of Bitcoin. As more institutional investors enter the market, it increases Bitcoin's legitimacy and visibility, potentially encouraging further retail investment.

-

Market Maturity: The growing institutional participation in the Bitcoin market contributes to its overall maturity. This can lead to more sophisticated trading strategies, improved liquidity, and greater price stability over the long term.

Looking Ahead:

The future of Bitcoin remains uncertain, but the current trend of billions flowing into Bitcoin ETFs paints a picture of increasing institutional acceptance and long-term potential. While volatility is inherent, the growing regulatory clarity, accessibility through ETFs, and the demand from institutional investors strongly suggest that Bitcoin's role in the global financial landscape is only going to grow stronger. Further regulatory approvals and the development of innovative products within the crypto space will continue to shape this dynamic market. Stay informed and keep an eye on the evolving regulatory landscape for the latest updates.

Related Articles:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you should conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Wave Of Institutional Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

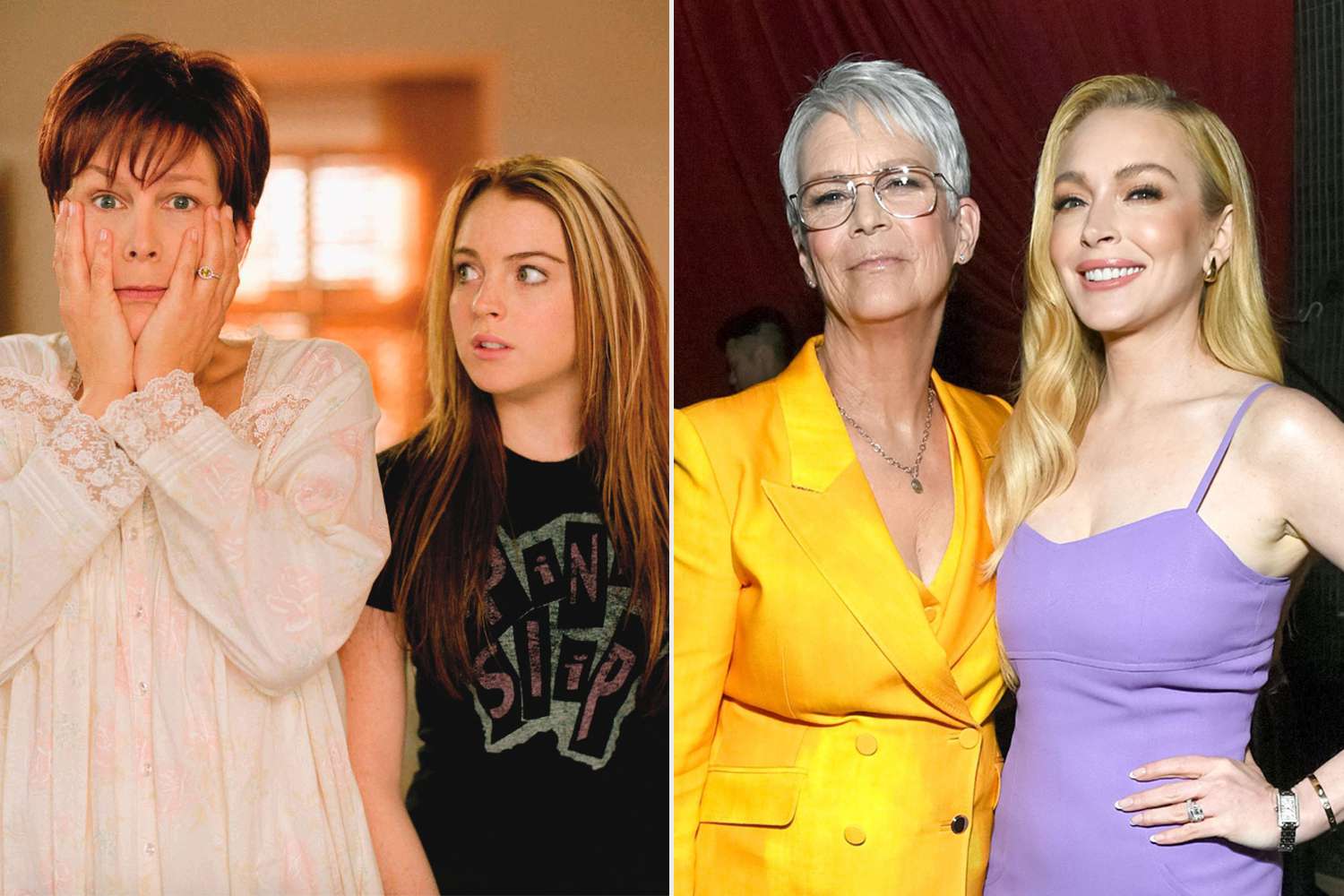

The Unexpected Friendship Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025

The Unexpected Friendship Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025 -

Jon Jones Ufc Withheld Crucial Information About Tom Aspinall

May 20, 2025

Jon Jones Ufc Withheld Crucial Information About Tom Aspinall

May 20, 2025 -

Jamie Lee Curtis Shares The Story Of Her Continued Friendship With Lindsay Lohan After Freaky Friday Exclusive

May 20, 2025

Jamie Lee Curtis Shares The Story Of Her Continued Friendship With Lindsay Lohan After Freaky Friday Exclusive

May 20, 2025 -

Live Score Updates Lsg Vs Srh Ipl 2025 On Field Confrontation And Post Match Fallout

May 20, 2025

Live Score Updates Lsg Vs Srh Ipl 2025 On Field Confrontation And Post Match Fallout

May 20, 2025 -

Mortgage Rate Increase Economic Data Fuels Higher Borrowing Costs

May 20, 2025

Mortgage Rate Increase Economic Data Fuels Higher Borrowing Costs

May 20, 2025