Billionaire Buys Fried Chicken Chain: Private Equity's Latest Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buys Fried Chicken Chain: Private Equity's Latest Acquisition Shakes Up the Fast Food Industry

The fast-food world is buzzing after news broke of a major acquisition: renowned billionaire investor, Julian Thorne, has purchased the popular fried chicken chain, "Crispy Bird," in a deal valued at an estimated $2.5 billion. This marks Thorne's latest foray into the private equity realm and sends shockwaves through the competitive landscape. The acquisition raises questions about the future of Crispy Bird and the broader fast-food industry, prompting speculation about potential menu changes, expansion plans, and the overall impact on consumers.

Thorne's Strategic Investment: More Than Just Chicken

Thorne, known for his shrewd investments and bold strategies, isn't just buying a fried chicken chain; he's acquiring a significant market share in a lucrative industry. Crispy Bird, with its loyal customer base and widespread recognition, presents a compelling investment opportunity. Analysts suggest that Thorne's move is part of a broader trend of private equity firms targeting established fast-food brands, recognizing the sector's resilience and potential for growth even amidst economic uncertainty. This isn't Thorne's first rodeo in the food industry; his previous investments in sustainable agriculture and food technology suggest a strategic long-term vision for Crispy Bird that extends beyond simple profit maximization.

What Does This Mean for Crispy Bird and Consumers?

The immediate impact on consumers remains uncertain. While some speculate about potential price increases, Thorne's representatives have emphasized a commitment to maintaining Crispy Bird's core brand identity and popular menu items. However, the possibility of menu innovations, improved sourcing practices, or even expansion into new markets cannot be ruled out.

Potential Changes on the Horizon:

- Menu Innovation: Experts anticipate some level of menu evolution, perhaps incorporating healthier options or limited-time offers to attract a broader customer base.

- Supply Chain Optimization: Thorne's history suggests a focus on sustainable and ethically sourced ingredients, potentially leading to changes in Crispy Bird's supply chain.

- Technological Upgrades: Investment in technology, including digital ordering systems and improved in-store efficiency, is likely.

- Franchise Expansion: The acquisition might pave the way for aggressive expansion of Crispy Bird franchises, particularly in underserved markets.

Private Equity's Appetite for Fast Food: A Growing Trend

Thorne's acquisition of Crispy Bird is not an isolated incident. Private equity firms are increasingly targeting established fast-food brands, drawn by their predictable revenue streams and potential for growth through strategic management and capital investment. This trend highlights the enduring appeal of the fast-food sector, even in the face of changing consumer preferences and economic challenges. We've seen similar acquisitions in recent years, such as [link to a relevant news article about another fast-food acquisition].

The Future of Crispy Bird: A Recipe for Success?

Only time will tell the full impact of this acquisition. While uncertainties remain, Thorne's reputation for strategic investments and successful business models suggests a promising outlook for Crispy Bird. The coming months will reveal whether this acquisition proves to be a recipe for success, reshaping the fast-food landscape in the process. Stay tuned for further updates as the story unfolds.

Keywords: Billionaire, Private Equity, Fried Chicken, Fast Food, Acquisition, Crispy Bird, Julian Thorne, Investment, Franchise, Menu Innovation, Supply Chain, Restaurant Industry, Food Industry, Business News, Financial News.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buys Fried Chicken Chain: Private Equity's Latest Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Hollywood To Texas Roseanne Barrs Resilience After Accident

Jun 04, 2025

From Hollywood To Texas Roseanne Barrs Resilience After Accident

Jun 04, 2025 -

Unlocking Success The Proven Strategies Of A 30 Year Old Tech Billionaire

Jun 04, 2025

Unlocking Success The Proven Strategies Of A 30 Year Old Tech Billionaire

Jun 04, 2025 -

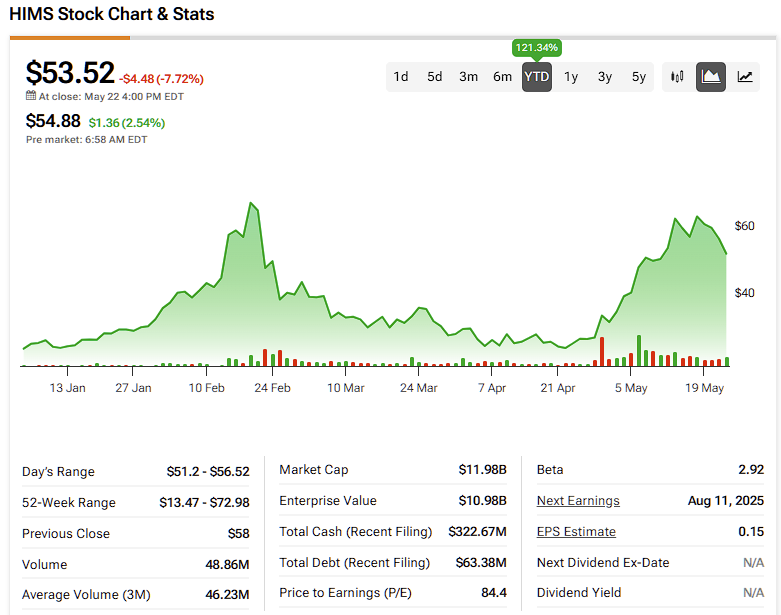

Is Hims And Hers Hims Stock A Risky Investment A Detailed Analysis

Jun 04, 2025

Is Hims And Hers Hims Stock A Risky Investment A Detailed Analysis

Jun 04, 2025 -

Federal Layoff Announcement Met With Opposition From Rep Khanna And Labor Groups

Jun 04, 2025

Federal Layoff Announcement Met With Opposition From Rep Khanna And Labor Groups

Jun 04, 2025 -

Misleading Ballerina Director Clarifies Its Relationship To John Wick

Jun 04, 2025

Misleading Ballerina Director Clarifies Its Relationship To John Wick

Jun 04, 2025