Is Hims & Hers (HIMS) Stock A Risky Investment? A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Risky Investment? A Detailed Analysis

Hims & Hers Health, Inc. (HIMS) has captured significant attention since its IPO, offering telehealth services for a range of health concerns, primarily focused on men's and women's health. But is investing in HIMS stock a smart move, or is it a risky gamble? This detailed analysis explores the potential upsides and downsides, helping you make an informed decision.

The Allure of Telehealth and the HIMS Business Model:

The telehealth market is booming, driven by increasing consumer demand for convenient and accessible healthcare. HIMS leverages this trend by offering online consultations, prescriptions, and at-home treatment options for conditions like hair loss, sexual health concerns, and skincare issues. This direct-to-consumer (DTC) model, bypassing traditional healthcare pathways, has contributed to its rapid growth. Their subscription-based model further ensures recurring revenue streams, a major attraction for investors.

Reasons Why HIMS Stock Might Be Risky:

While the growth potential is undeniable, several factors contribute to the risk associated with investing in HIMS:

- High Competition: The telehealth market is increasingly competitive. Established players and new entrants constantly vie for market share, potentially squeezing HIMS' profit margins.

- Regulatory Uncertainty: The healthcare industry is heavily regulated. Changes in regulations, particularly concerning telehealth practices and prescription drug distribution, could significantly impact HIMS' operations and profitability.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. Reduced marketing effectiveness or increased advertising costs could negatively affect growth.

- Profitability Concerns: While HIMS is growing rapidly, it's yet to achieve consistent profitability. Sustaining growth while navigating expenses and increasing competition presents a significant challenge.

- Market Volatility: The stock market itself is inherently volatile. HIMS, as a relatively young company, is more susceptible to market fluctuations than established blue-chip stocks.

Reasons Why HIMS Stock Might Be a Good Investment:

Despite the risks, HIMS presents compelling arguments for potential investors:

- Large and Growing Market: The telehealth market is vast and expanding rapidly, offering substantial growth opportunities for HIMS.

- Recurring Revenue: The subscription-based model ensures predictable and recurring revenue streams, providing stability compared to one-time sales models.

- Brand Recognition: HIMS has built a strong brand identity and recognition, particularly among younger demographics.

- Innovation Potential: The company continues to innovate and expand its product and service offerings, catering to evolving consumer needs.

- Potential for Acquisitions: Its strong market position could make it an attractive acquisition target for larger healthcare companies.

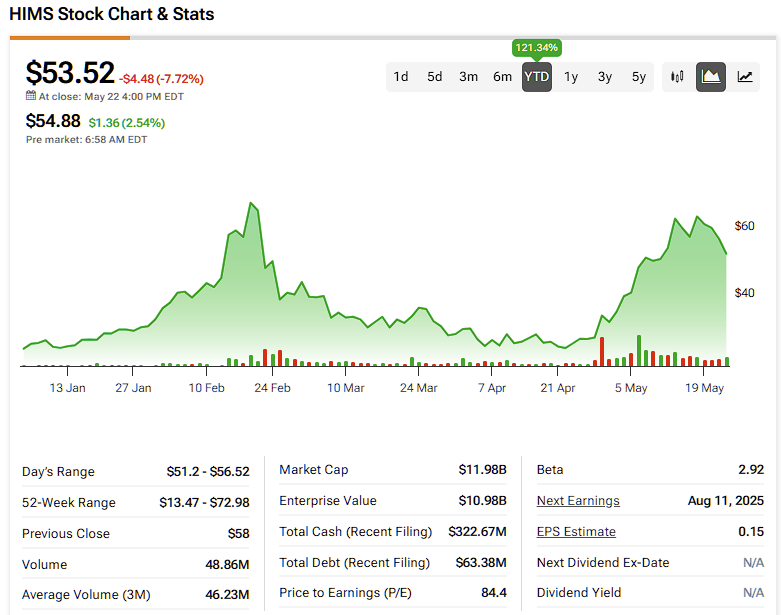

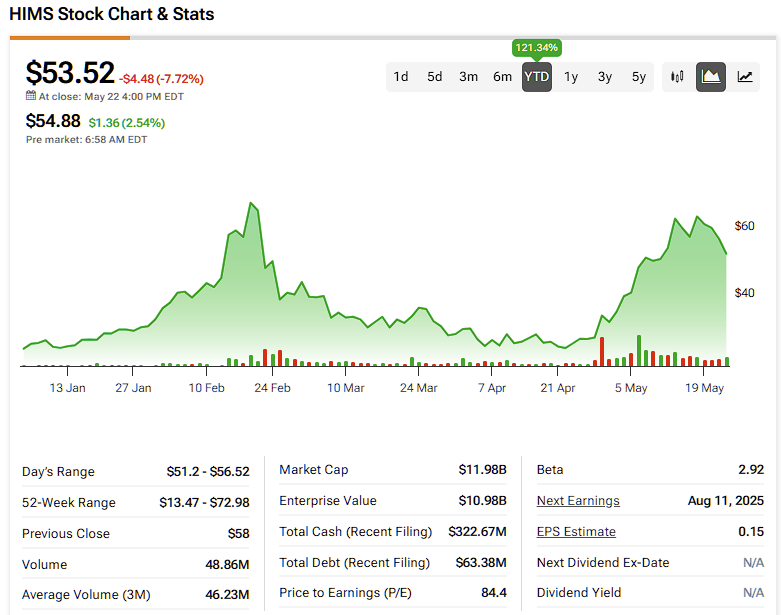

Financial Performance & Key Metrics:

Analyzing HIMS' financial statements, including revenue growth, customer acquisition costs, and operating margins, is crucial for assessing its financial health and future prospects. Regularly reviewing these key performance indicators (KPIs) provides valuable insights into the company's performance and long-term sustainability. Refer to their quarterly and annual reports for detailed financial data. (Link to HIMS investor relations page would be placed here.)

Conclusion: Weighing the Risks and Rewards

Investing in HIMS stock involves significant risk. However, the potential rewards in the rapidly growing telehealth market are equally substantial. Before investing, conduct thorough due diligence, carefully consider your risk tolerance, and diversify your portfolio. Consult with a qualified financial advisor to determine if HIMS aligns with your investment goals and risk profile. Remember, past performance is not indicative of future results. The information provided here is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Risky Investment? A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Evaluating Hims And Hers Health Hims A Prudent Investors Guide

Jun 04, 2025

Evaluating Hims And Hers Health Hims A Prudent Investors Guide

Jun 04, 2025 -

Rapid Growth Popular Hot Chicken Chain Acquired 155 Locations Slated For 2024

Jun 04, 2025

Rapid Growth Popular Hot Chicken Chain Acquired 155 Locations Slated For 2024

Jun 04, 2025 -

Decoding Taylor Jenkins Reids Success Insights For Aspiring Authors

Jun 04, 2025

Decoding Taylor Jenkins Reids Success Insights For Aspiring Authors

Jun 04, 2025 -

Did Scott Walkers Actions Damage His Political Prospects With Trump

Jun 04, 2025

Did Scott Walkers Actions Damage His Political Prospects With Trump

Jun 04, 2025 -

The Ukrainian Drone Campaign A Precedent For Future Asymmetric Warfare

Jun 04, 2025

The Ukrainian Drone Campaign A Precedent For Future Asymmetric Warfare

Jun 04, 2025