Analysis: Nio's 21% Year-on-Year Revenue Increase In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

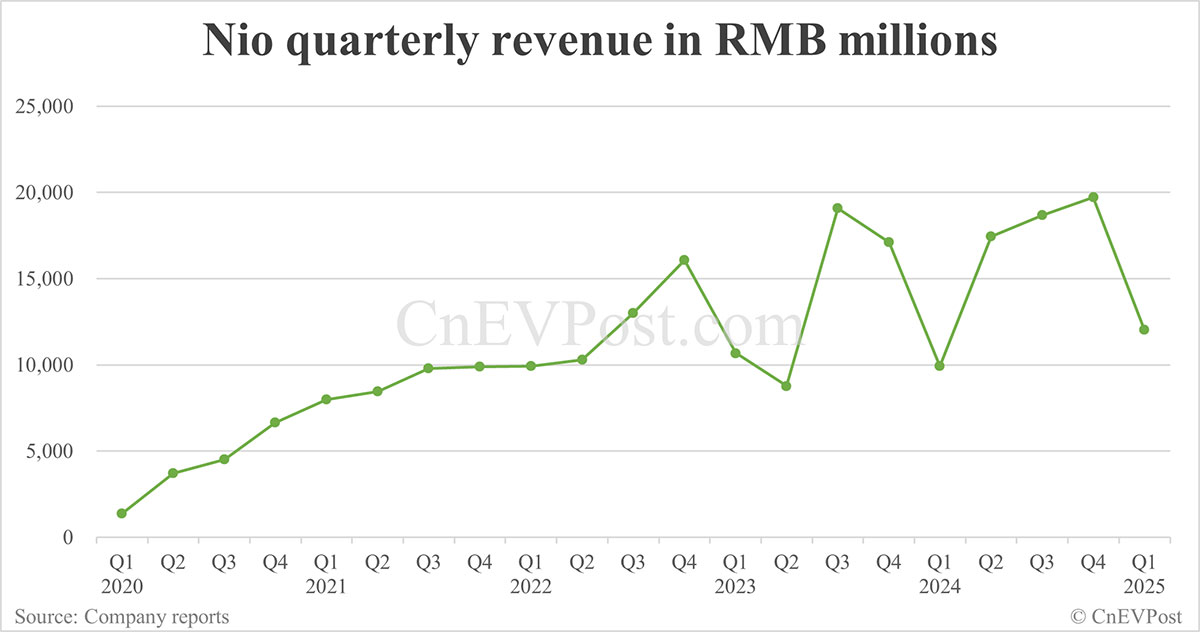

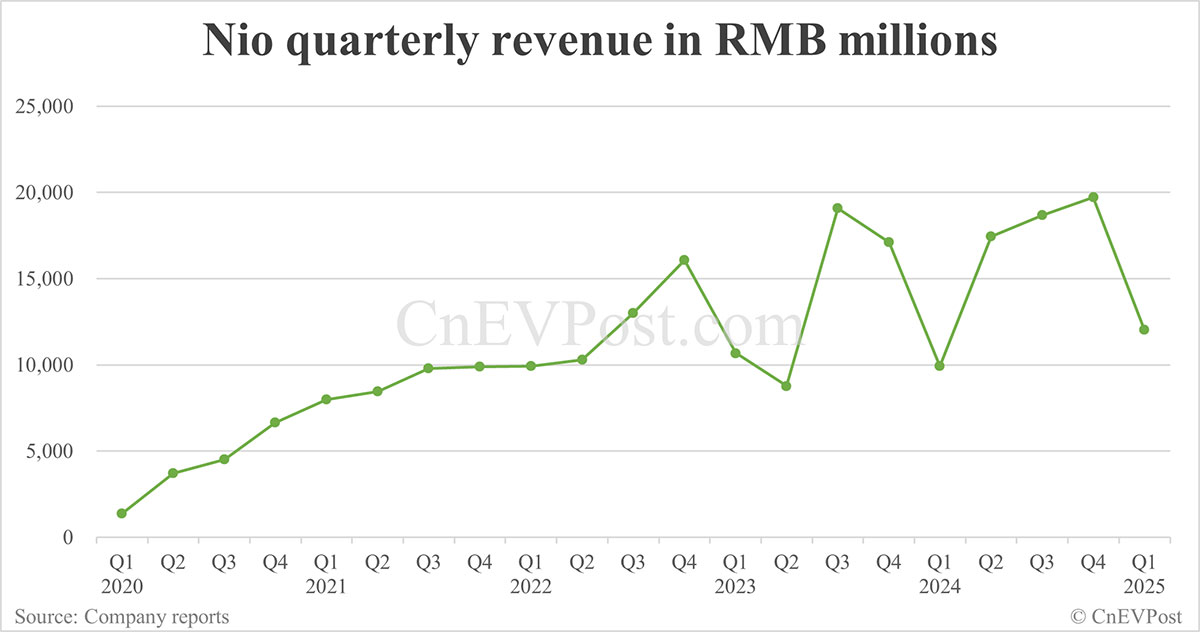

Analysis: Nio's 21% Year-on-Year Revenue Increase in Q1 2024 – A Sign of Continued Growth?

Nio, the Chinese electric vehicle (EV) manufacturer, reported a robust 21% year-on-year increase in revenue for the first quarter of 2024. This significant jump to [Insert Actual Revenue Figure Here] signals continued growth despite persistent challenges in the global automotive market and the competitive EV landscape. However, a deeper dive into the numbers reveals a more nuanced picture of Nio's performance and future prospects.

Strong Sales Figures, But Challenges Remain

The 21% revenue increase is undoubtedly positive news for Nio investors. This growth can be largely attributed to [Insert Key Reasons for Revenue Increase, e.g., strong demand for new models, successful marketing campaigns, expansion into new markets]. The company delivered [Insert Number] vehicles in Q1 2024, exceeding expectations and demonstrating a growing market share in China's competitive EV sector. This success is a testament to Nio's strategic focus on innovation, particularly in areas such as battery technology and autonomous driving capabilities.

However, the company also faces significant headwinds. Increased competition from established automakers like Tesla and burgeoning domestic rivals continues to pressure margins. Furthermore, the ongoing global chip shortage and supply chain disruptions remain potential threats to production and delivery timelines. Nio's ability to navigate these challenges will be crucial for sustaining its impressive growth trajectory.

Dissecting the Q1 2024 Results:

- Revenue Growth: The 21% year-on-year increase is impressive, but investors should consider the underlying factors driving this growth. Was it solely due to increased sales volume, or did pricing strategies also contribute? A closer look at the average selling price (ASP) is necessary for a complete understanding.

- Profitability: While revenue is up, Nio's profitability remains a key area of focus. Analyzing the gross and net profit margins will reveal whether the revenue increase translates into improved financial health. [Insert details on profit margins if available].

- Market Share: Nio's market share within the Chinese EV market is a critical indicator of its long-term success. Analyzing the company's market position relative to competitors like BYD and XPeng will provide valuable insights. [Insert market share data if available]

- Future Outlook: Nio's guidance for the remainder of 2024 will be crucial. The company's projections for vehicle deliveries, revenue growth, and profitability will provide valuable insights into its future prospects. [Insert any forward-looking statements made by Nio].

Nio's Strategic Initiatives for Future Growth:

Nio's success is not solely reliant on strong Q1 results. The company is actively pursuing several strategic initiatives to fuel future growth, including:

- Expansion into New Markets: Nio's international expansion plans will play a significant role in its future success. The company's progress in entering new markets and gaining traction will be closely watched by investors.

- Technological Innovation: Continuous advancements in battery technology, autonomous driving capabilities, and other innovative features are crucial for maintaining a competitive edge.

- Strengthening the Ecosystem: Nio's battery swap technology and its expanding ecosystem of services are key differentiators. Further development and expansion in this area will be essential for attracting and retaining customers.

Conclusion:

Nio's 21% year-on-year revenue increase in Q1 2024 is undeniably a positive development. However, a comprehensive analysis requires a deeper examination of profitability, market share, and the company's strategic initiatives. The ongoing challenges in the EV market necessitate a cautious yet optimistic outlook. The coming quarters will be critical in determining whether this strong start translates into sustained, long-term growth. Investors should monitor Nio's progress closely as the company navigates the complexities of the competitive EV landscape.

Keywords: Nio, electric vehicle, EV, revenue, Q1 2024, China, automotive, market share, profitability, growth, technology, battery, autonomous driving, competition, Tesla, BYD, XPeng, supply chain, financial results, stock market, investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Year-on-Year Revenue Increase In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Century Stand Powers England To 108 Run Win Over West Indies

Jun 04, 2025

Century Stand Powers England To 108 Run Win Over West Indies

Jun 04, 2025 -

Green Growth In Brazil Finance Ministers Climate Change Vision

Jun 04, 2025

Green Growth In Brazil Finance Ministers Climate Change Vision

Jun 04, 2025 -

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025 -

Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand

Jun 04, 2025

Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand

Jun 04, 2025 -

Live Cricket England Women Vs West Indies Women Second Odi

Jun 04, 2025

Live Cricket England Women Vs West Indies Women Second Odi

Jun 04, 2025