Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Private Equity Giant Roark Capital Acquires Arby's Rival: A Major Shakeup in the Quick-Service Restaurant Industry

The quick-service restaurant (QSR) industry is buzzing with news of a major acquisition. Roark Capital, the private equity firm already behind Subway's recent turnaround, has announced its purchase of Inspire Brands, the parent company of Arby's, Buffalo Wild Wings, and several other popular restaurant chains. This deal signifies a significant consolidation of power within the fast-casual and fast-food sectors, prompting speculation about the future direction of these beloved brands.

Roark Capital's Growing Restaurant Empire: This acquisition significantly expands Roark Capital's already impressive portfolio of restaurant brands. The firm's previous acquisition of Subway, a global giant in the sandwich industry, signaled its ambition to reshape the fast-food landscape. Now, with the addition of Inspire Brands, Roark controls a diverse range of popular dining options, catering to a wide variety of consumer tastes and preferences. This strategic move solidifies their position as a major player, potentially influencing industry trends for years to come.

What Does This Mean for Arby's and Other Inspire Brands? While the details of the acquisition are still unfolding, industry analysts predict several potential outcomes. Increased investment in marketing and technology could be on the horizon for Arby's and other Inspire Brands chains. This could translate into improved customer experiences, new menu innovations, and a stronger competitive edge in a fiercely contested market. The potential for streamlining operations across the various brands within the Inspire portfolio could also lead to greater efficiency and profitability.

Consolidation and Competition in the QSR Sector: This acquisition highlights a broader trend of consolidation within the quick-service restaurant industry. Larger private equity firms are increasingly acquiring smaller chains, seeking to create larger, more diversified portfolios. This trend raises questions about the future of smaller, independent restaurants and the potential impact on competition and consumer choice.

Key Takeaways:

- Roark Capital's dominance: This acquisition further solidifies Roark Capital's position as a major force in the QSR industry.

- Future of Inspire Brands: Expect potential improvements in marketing, technology, and operational efficiency across Arby's and other Inspire Brands.

- Industry Consolidation: This deal reflects a broader trend of consolidation within the quick-service restaurant sector.

- Impact on Consumers: While the long-term effects remain to be seen, consumers can anticipate potential changes in menu offerings, pricing, and overall dining experiences.

Looking Ahead: The full impact of Roark Capital's acquisition of Inspire Brands will unfold over time. However, one thing is certain: this deal marks a significant shift in the landscape of the quick-service restaurant industry, setting the stage for exciting – and potentially disruptive – changes in the years to come. We will continue to monitor the situation and provide updates as more information becomes available. Stay tuned for further analysis and insights into this developing story.

Related Articles:

- [Link to an article about Subway's recent turnaround]

- [Link to an article about the competitive landscape of the QSR industry]

- [Link to an article about private equity investment in the restaurant sector]

Keywords: Roark Capital, Inspire Brands, Arby's, Buffalo Wild Wings, Subway, Private Equity, QSR, Quick-Service Restaurant, Restaurant Acquisition, Industry Consolidation, Fast Food, Fast Casual, Mergers and Acquisitions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Tense Exchange With Scott Walker A Political Earthquake

Jun 04, 2025

Trumps Tense Exchange With Scott Walker A Political Earthquake

Jun 04, 2025 -

Renewed Assault Ukraine Claims Latest Attack On Crimean Bridge Via Underwater Drone

Jun 04, 2025

Renewed Assault Ukraine Claims Latest Attack On Crimean Bridge Via Underwater Drone

Jun 04, 2025 -

Political Fallout The Gops Struggle To Defend Trumps Controversial Bill

Jun 04, 2025

Political Fallout The Gops Struggle To Defend Trumps Controversial Bill

Jun 04, 2025 -

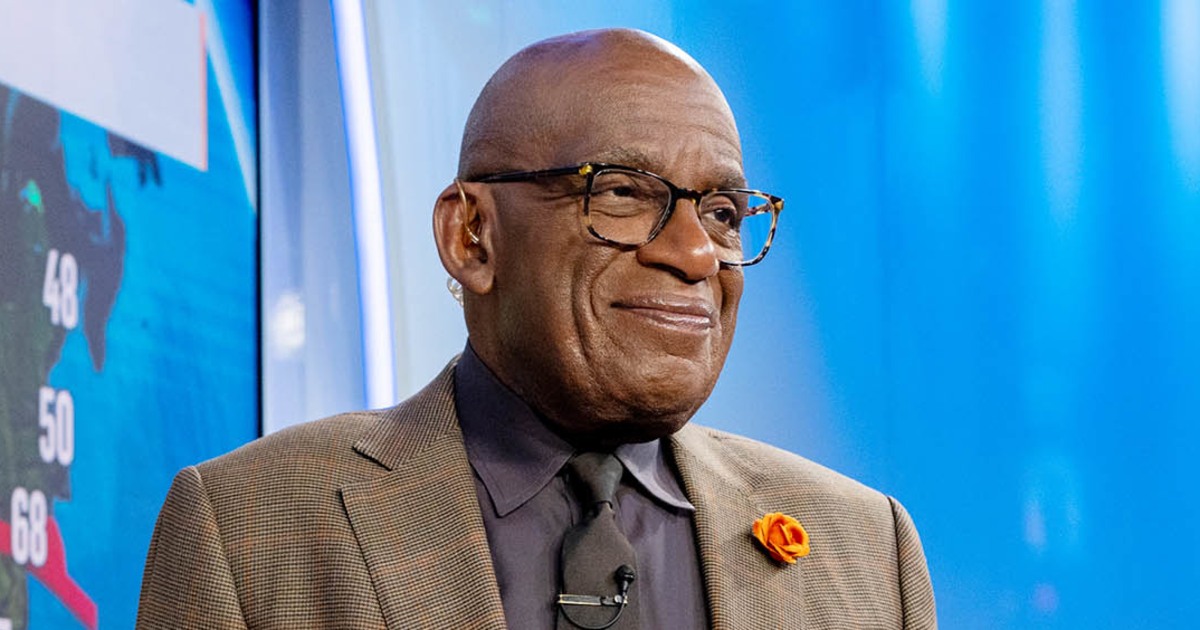

Al Rokers Lasting Weight Loss Insights And Inspiration After 20 Years

Jun 04, 2025

Al Rokers Lasting Weight Loss Insights And Inspiration After 20 Years

Jun 04, 2025 -

Hims And Hers Hims Understanding The Volatility In The Health Tech Stock Market

Jun 04, 2025

Hims And Hers Hims Understanding The Volatility In The Health Tech Stock Market

Jun 04, 2025