America's Energy Future: How Tax Policies Will Decide The Outcome

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

America's Energy Future: How Tax Policies Will Decide the Outcome

America stands at a crossroads in its energy future. The transition to cleaner energy sources is underway, but the speed and success of this transformation hinge heavily on the nation's tax policies. The choices made today will determine not only the environmental landscape of tomorrow but also the economic prosperity and national security of the United States. This article explores the crucial role of tax policy in shaping America's energy destiny.

The Current Energy Landscape: A Complex Picture

The United States boasts a diverse energy portfolio, encompassing fossil fuels (oil, natural gas, coal), nuclear power, and renewable sources (solar, wind, hydro). However, the dominance of fossil fuels remains a significant challenge in achieving climate goals. The International Energy Agency (IEA) [link to IEA website] highlights the urgent need for a global shift towards cleaner energy, and the US, as a major emitter, plays a pivotal role.

Tax Incentives Driving the Transition (or Hindering It)

Tax policies are powerful tools capable of accelerating or decelerating the energy transition. Currently, various tax incentives exist:

- Production Tax Credits (PTC) and Investment Tax Credits (ITC): These credits incentivize the development and deployment of renewable energy technologies like solar and wind power. The extension and expansion of these credits are crucial for maintaining momentum in the renewable energy sector.

- Tax deductions for energy efficiency improvements: These encourage homeowners and businesses to invest in energy-saving measures, reducing overall energy consumption and carbon emissions.

- Fossil fuel subsidies: Conversely, continued subsidies for fossil fuels counteract efforts to transition to cleaner energy. Phasing out these subsidies is a crucial step towards a sustainable energy future. Reports from organizations like the OECD [link to OECD website] consistently highlight the environmental and economic inefficiencies of such subsidies.

The Impact of Different Tax Policies:

Several proposed tax policies could significantly influence America's energy trajectory:

- Carbon tax: A carbon tax, placing a price on carbon emissions, would incentivize businesses and individuals to reduce their carbon footprint. The revenue generated could fund further investments in clean energy technologies or be returned to taxpayers as a dividend. However, concerns about the potential impact on low-income households require careful consideration.

- Clean energy standards: Mandating a certain percentage of electricity generation from renewable sources would drive investment and innovation in the renewable energy sector. This approach, while potentially effective, could also face challenges in terms of implementation and cost.

- Investing in grid modernization: A robust and modernized electricity grid is essential for integrating intermittent renewable energy sources like solar and wind. Tax incentives for grid upgrades are vital for ensuring the reliable and efficient delivery of clean energy.

Beyond Tax Incentives: A Holistic Approach

While tax policies are essential, a holistic approach is needed to ensure a successful energy transition. This includes:

- Technological innovation: Continued research and development are crucial for improving the efficiency and affordability of renewable energy technologies.

- Infrastructure development: Investment in transmission lines, storage solutions, and charging infrastructure is necessary to support the widespread adoption of renewable energy.

- Public awareness and education: Educating the public about the benefits of clean energy and the importance of climate action is crucial for building support for the transition.

Conclusion: A Critical Decision Point

America's energy future is not predetermined. The tax policies enacted in the coming years will play a decisive role in shaping the nation's energy landscape and its contribution to global climate goals. A strategic and forward-thinking approach that prioritizes clean energy, phases out fossil fuel subsidies, and invests in grid modernization is vital for ensuring a sustainable and prosperous future for generations to come. The decisions made today will reverberate for decades to come, making informed policy choices of paramount importance. What path will America choose?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on America's Energy Future: How Tax Policies Will Decide The Outcome. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ubisoft Milans Rayman Team Hiring Now

May 21, 2025

Ubisoft Milans Rayman Team Hiring Now

May 21, 2025 -

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025 -

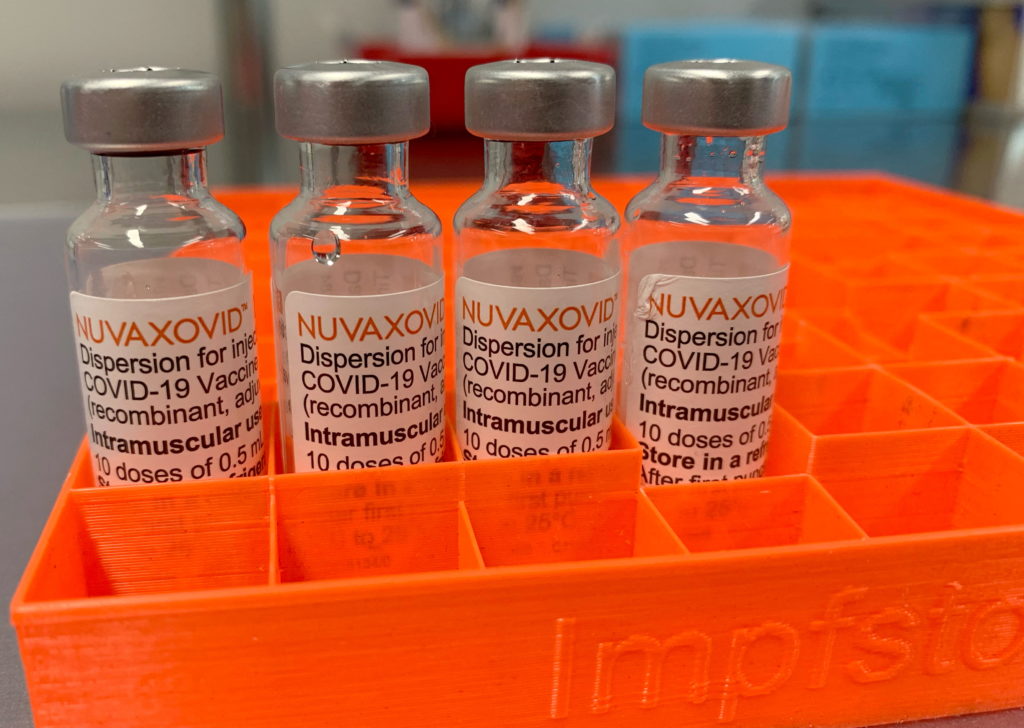

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025 -

Investors Bet Big On Ethereum 200 Million Investment Following Pectra Upgrade

May 21, 2025

Investors Bet Big On Ethereum 200 Million Investment Following Pectra Upgrade

May 21, 2025 -

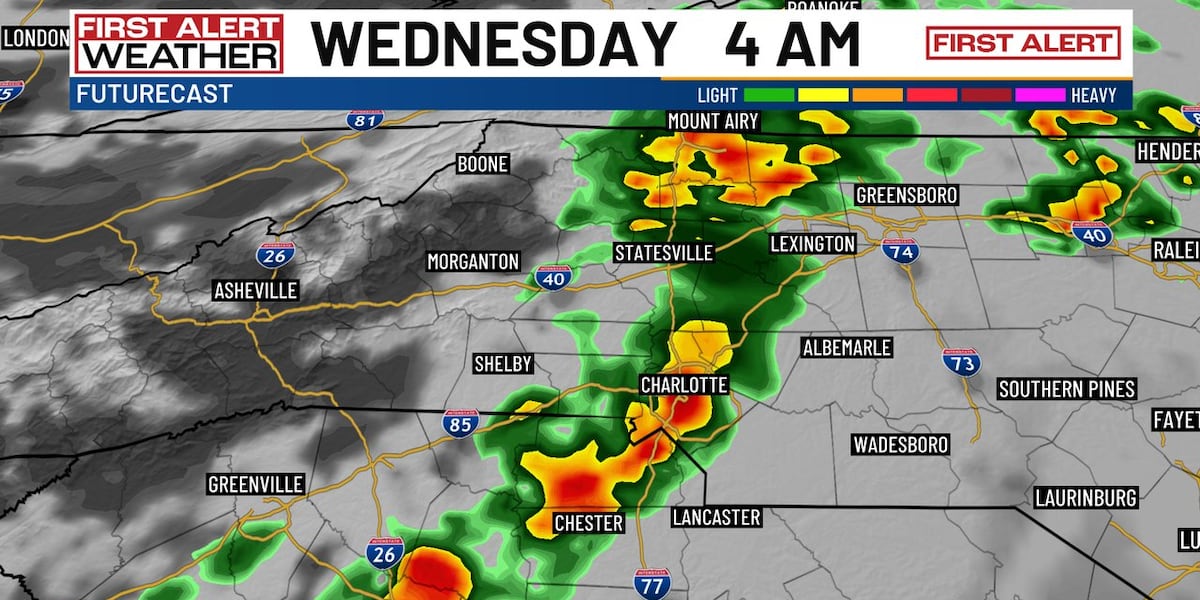

Severe Weather Possible Overnight Storms To Hit Charlotte Before Cooldown

May 21, 2025

Severe Weather Possible Overnight Storms To Hit Charlotte Before Cooldown

May 21, 2025