Clean Energy Taxes: Economic Impacts And The Path Forward For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Taxes: Economic Impacts and the Path Forward for America

America's transition to clean energy is accelerating, driven by climate concerns and technological advancements. But this shift is not without its economic complexities, particularly concerning the role of taxation. Understanding the economic impacts of clean energy taxes – both positive and negative – is crucial to charting a successful path forward. This article delves into the current landscape, exploring the potential benefits and drawbacks, and outlining a strategy for maximizing economic growth while achieving environmental goals.

The Dual-Edged Sword of Clean Energy Taxes

Taxes play a pivotal role in shaping economic behavior. When it comes to clean energy, taxes can be used as both carrots and sticks.

-

Carbon Taxes: These levy a fee on the carbon content of fossil fuels, incentivizing businesses and consumers to switch to cleaner alternatives. While proponents highlight the potential for reduced emissions and revenue generation for green initiatives (like the ), critics cite concerns about increased energy prices and potential harm to specific industries. The economic impact depends heavily on how the revenue is reinvested – a poorly designed carbon tax could stifle economic growth, while a well-designed one could spur innovation and job creation.

-

Subsidies and Tax Credits for Renewables: Conversely, tax credits and subsidies for renewable energy sources like solar, wind, and geothermal aim to make them more competitive with fossil fuels. The for solar, for example, has significantly boosted the solar industry, creating jobs and lowering costs. However, questions remain about the long-term sustainability of these subsidies and their potential to distort the market.

Economic Impacts: A Balanced Perspective

The economic impacts of clean energy taxes are multifaceted:

-

Job Creation: The clean energy sector is a significant job creator. Investing in renewable energy infrastructure, manufacturing, and research leads to the development of new industries and high-skilled jobs. A study by the highlights the substantial employment potential of renewable energy technologies.

-

Economic Growth: While initial investments may be substantial, the long-term economic benefits of clean energy are compelling. Reduced reliance on volatile fossil fuel markets, increased energy independence, and the development of new technologies can contribute to sustained economic growth.

-

Cost Considerations: The transition to clean energy will undoubtedly involve costs. However, the economic costs of inaction on climate change – including extreme weather events, resource scarcity, and public health issues – are far greater in the long run. A cost-benefit analysis should carefully weigh these long-term consequences.

-

Regional Disparities: The economic impacts of clean energy policies aren't evenly distributed. Regions heavily reliant on fossil fuels may face economic challenges during the transition. Therefore, targeted support and retraining programs are crucial to mitigate potential job losses and ensure a just transition for all workers.

The Path Forward: A Strategy for Success

To maximize the economic benefits and minimize the downsides of clean energy taxes, America needs a comprehensive strategy:

-

Revenue Recycling: Revenue generated from carbon taxes should be strategically reinvested in clean energy research, development, and deployment, as well as programs that support affected communities.

-

Phased Implementation: A gradual implementation of clean energy policies allows businesses and consumers time to adapt, reducing economic disruptions.

-

Targeted Support for Vulnerable Communities: Investing in retraining programs and infrastructure development in regions dependent on fossil fuels ensures a just and equitable transition.

-

Technological Innovation: Continued investment in research and development is crucial for driving down the costs of clean energy technologies and making them more competitive.

Conclusion:

Clean energy taxes are a critical tool in America's transition to a sustainable future. By carefully considering the economic impacts and implementing well-designed policies, the nation can achieve significant economic growth while mitigating the risks of climate change. A balanced approach that combines sensible taxation with targeted investments and support for vulnerable communities is key to navigating this crucial transition successfully. The future of America's economy and its environment depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Taxes: Economic Impacts And The Path Forward For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Santa Rosa Church Police Report Details Teens Desecration

May 21, 2025

Santa Rosa Church Police Report Details Teens Desecration

May 21, 2025 -

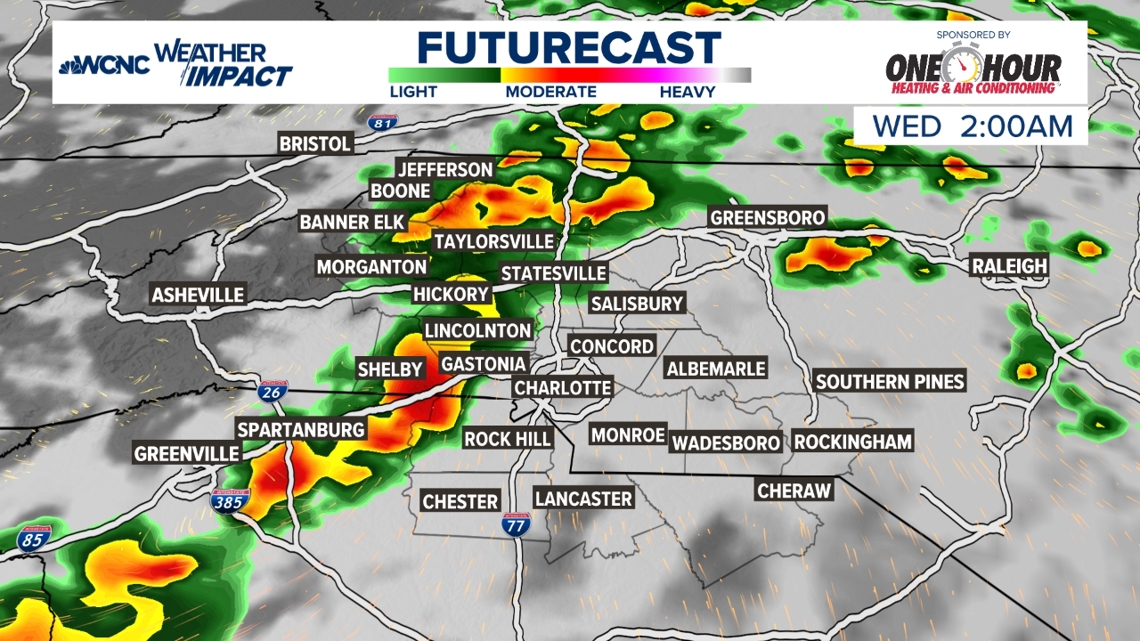

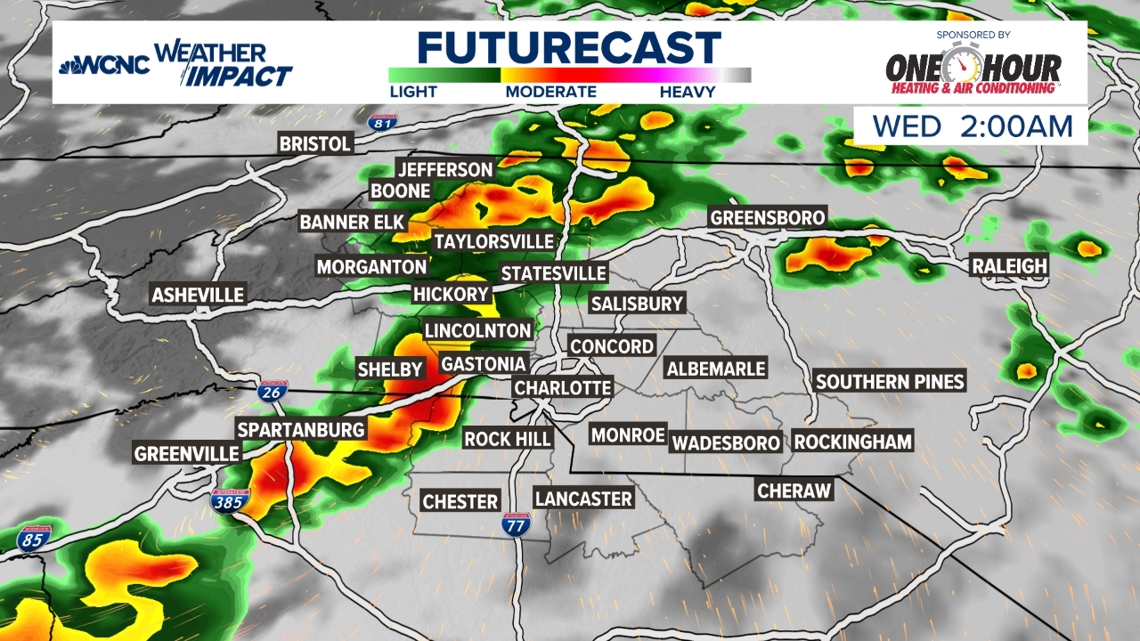

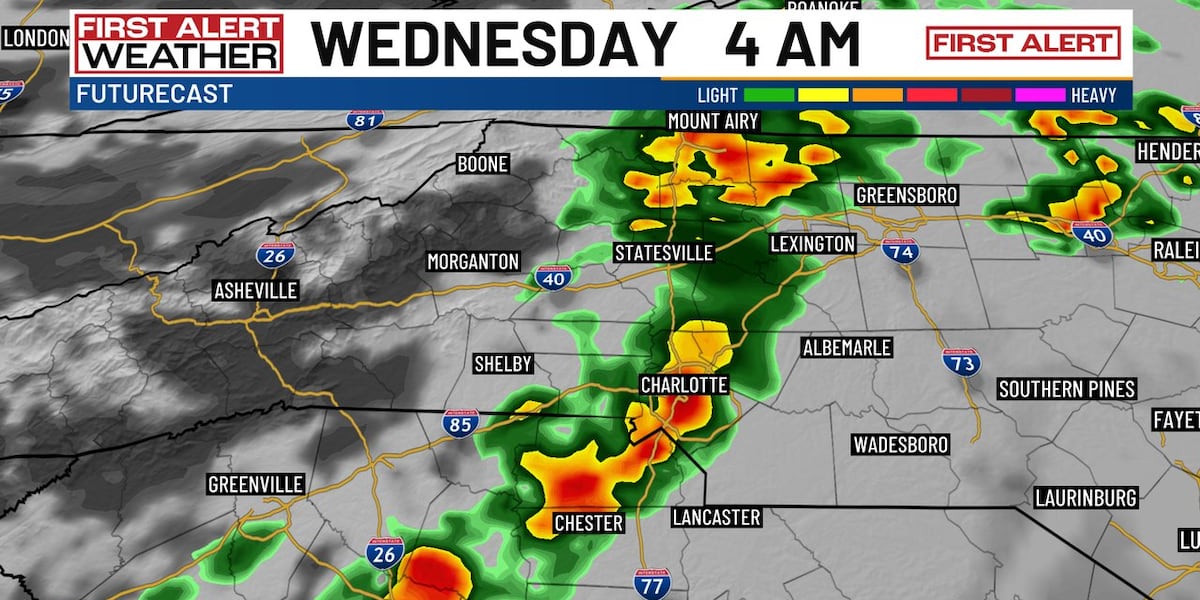

Strong Storm Outlook Low Probability Late Tuesday

May 21, 2025

Strong Storm Outlook Low Probability Late Tuesday

May 21, 2025 -

Very Isolated Risk Of Strong Storms Forecast For Late Tuesday Night

May 21, 2025

Very Isolated Risk Of Strong Storms Forecast For Late Tuesday Night

May 21, 2025 -

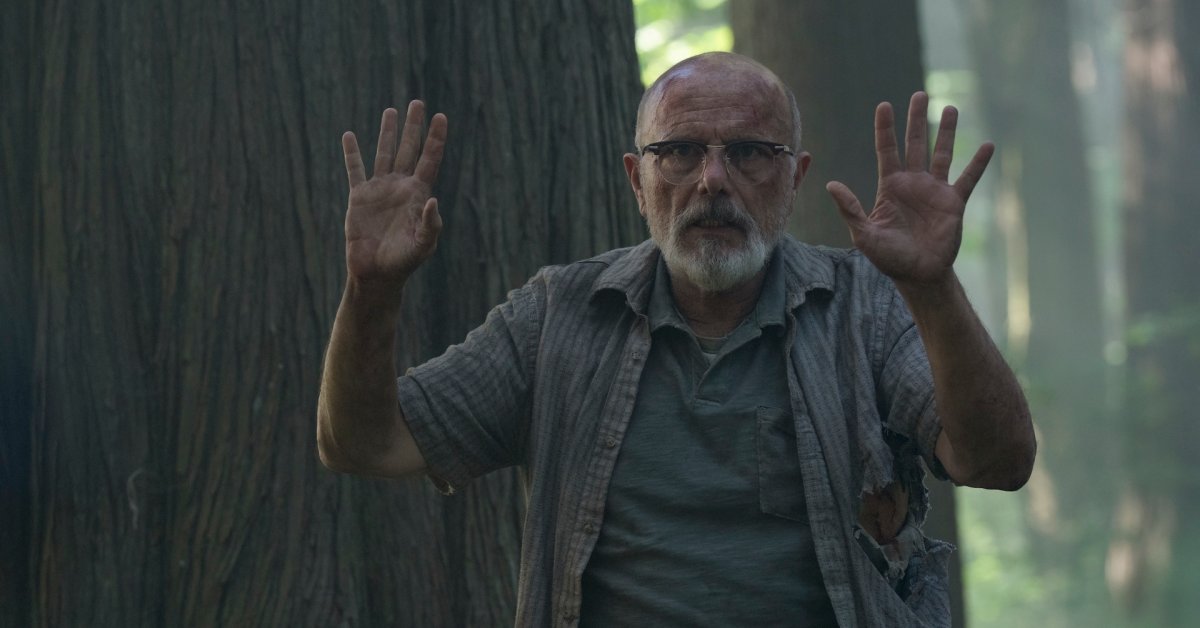

Reimagining The Relationship How The Last Of Us Series Diverges From The Games Narrative Season 2 Focus

May 21, 2025

Reimagining The Relationship How The Last Of Us Series Diverges From The Games Narrative Season 2 Focus

May 21, 2025 -

Charlotte Faces Overnight Storm Threat Cooler Temperatures Expected

May 21, 2025

Charlotte Faces Overnight Storm Threat Cooler Temperatures Expected

May 21, 2025