5 Ways The Trump Tax Cuts May Limit Your Healthcare

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

5 Ways the Trump Tax Cuts May Have Limited Your Healthcare Access

The 2017 Tax Cuts and Jobs Act, a landmark piece of legislation under the Trump administration, significantly reshaped the American tax code. While touted for boosting economic growth, the act’s impact extended far beyond tax brackets, subtly impacting healthcare access for many Americans. This article explores five key ways the tax cuts may have inadvertently limited healthcare options and affordability.

H2: 1. Weakening the Affordable Care Act (ACA)

The Trump tax cuts significantly weakened the Affordable Care Act (ACA), also known as Obamacare, by eliminating the individual mandate penalty. This penalty, designed to encourage individuals to obtain health insurance, was a crucial component in maintaining the ACA's risk pools and affordability. Its removal led to a decrease in the number of insured individuals, raising premiums for those who remained enrolled and potentially limiting access to comprehensive coverage. [Link to a reputable source discussing the impact of the individual mandate repeal on ACA premiums]. This ultimately impacted the affordability and availability of healthcare, particularly for lower-income individuals and families.

H2: 2. Reduced Funding for Public Health Programs

While not directly stated, the tax cuts indirectly impacted funding for vital public health programs. The substantial tax cuts resulted in a significant reduction in federal revenue. This revenue shortfall, coupled with increasing budgetary pressures in other areas, meant less funding for critical public health initiatives, including disease prevention and control programs, mental health services, and community health centers. These cuts potentially affected preventative care and access to affordable healthcare for vulnerable populations. [Link to a reputable source on federal spending cuts following the tax cuts].

H3: The Ripple Effect on Preventative Care:

Reduced funding for preventative care programs means fewer resources for crucial initiatives like screenings for cancer, diabetes, and heart disease. Early detection is vital for successful treatment, and limitations in access to preventative services could lead to more expensive and complex treatments later.

H2: 3. Increased Medical Debt Burden

The tax cuts, by prioritizing corporate tax reductions, arguably prioritized short-term economic gains over long-term healthcare affordability. This lack of focus on healthcare affordability has potentially increased the burden of medical debt for many Americans. High healthcare costs, coupled with stagnant wages for many, have contributed to a growing crisis of medical debt, impacting individuals' financial stability and overall well-being. [Link to a reputable study on medical debt in the US].

H2: 4. State Budget Shortfalls and Healthcare Cuts

Many states relied on increased federal funding to support their Medicaid programs and other healthcare initiatives. The reduced federal revenue generated by the tax cuts forced several states to make difficult choices, often resulting in cuts to state-funded healthcare programs. These cuts impacted access to vital services, impacting vulnerable populations disproportionately.

H2: 5. Limited Investment in Healthcare Infrastructure

The focus on tax cuts may have diverted resources away from investments in healthcare infrastructure, including research, development, and the expansion of healthcare facilities in underserved communities. This lack of investment has potentially limited access to cutting-edge treatments and technologies, exacerbating existing healthcare disparities.

H2: Conclusion: A Complex Interplay of Factors

The impact of the 2017 tax cuts on healthcare is complex and multifaceted. While the cuts did not directly target healthcare programs, their indirect effects on federal and state budgets, the ACA, and overall healthcare affordability have had a significant, and potentially detrimental, impact on many Americans' access to quality and affordable healthcare. Further research and analysis are necessary to fully understand the long-term consequences of these changes. Understanding these potential consequences is crucial for advocating for policies that prioritize both economic growth and healthcare accessibility for all Americans.

Call to Action: Stay informed about healthcare policy and advocate for legislation that promotes affordable and accessible healthcare for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 5 Ways The Trump Tax Cuts May Limit Your Healthcare. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

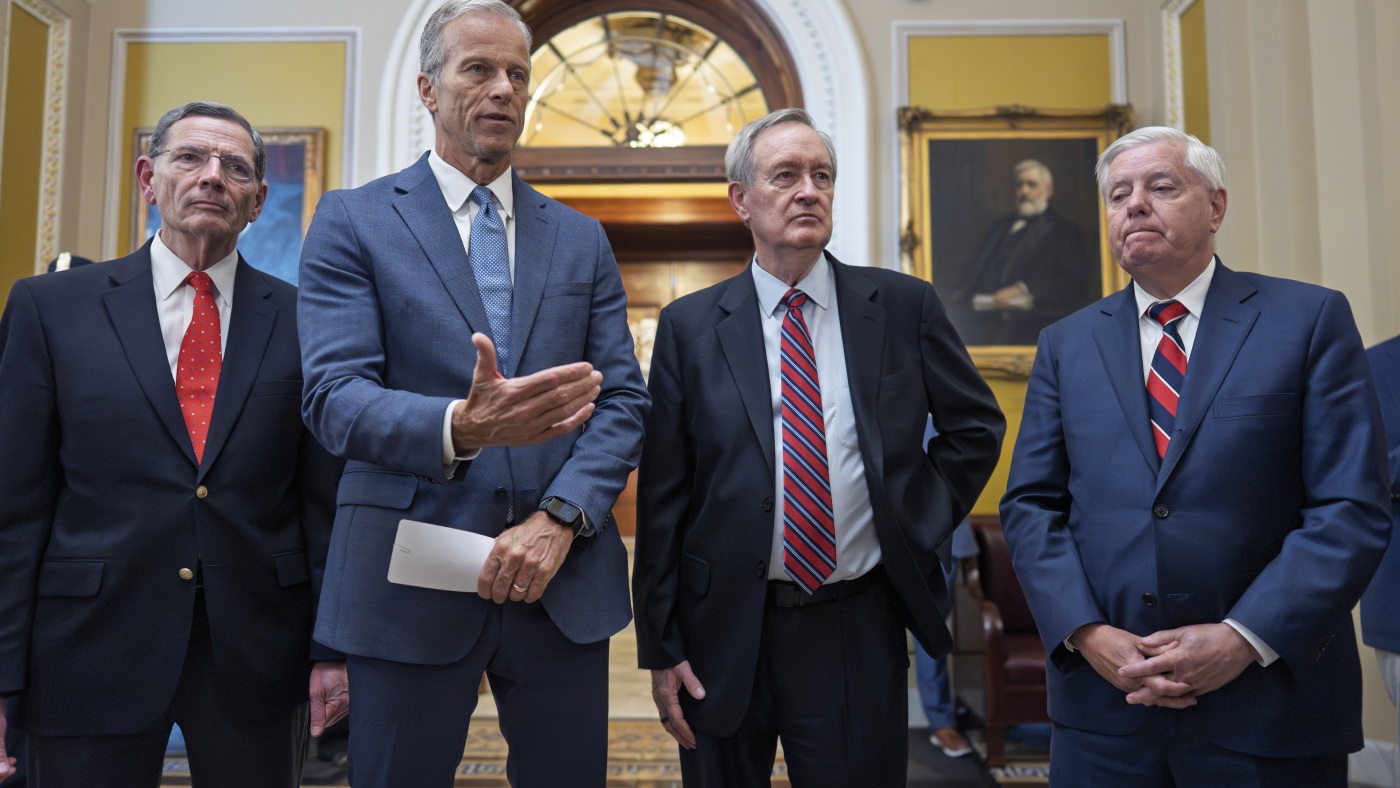

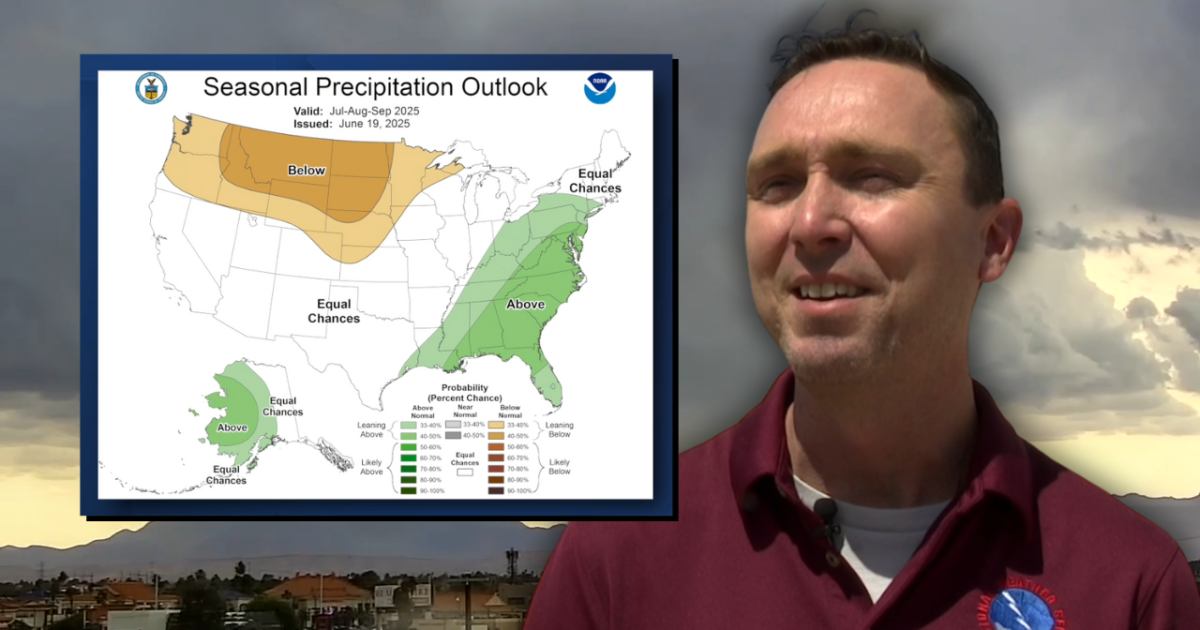

Southern Nevada Monsoon Season 2024 Forecast And Expert Predictions

Jul 03, 2025

Southern Nevada Monsoon Season 2024 Forecast And Expert Predictions

Jul 03, 2025 -

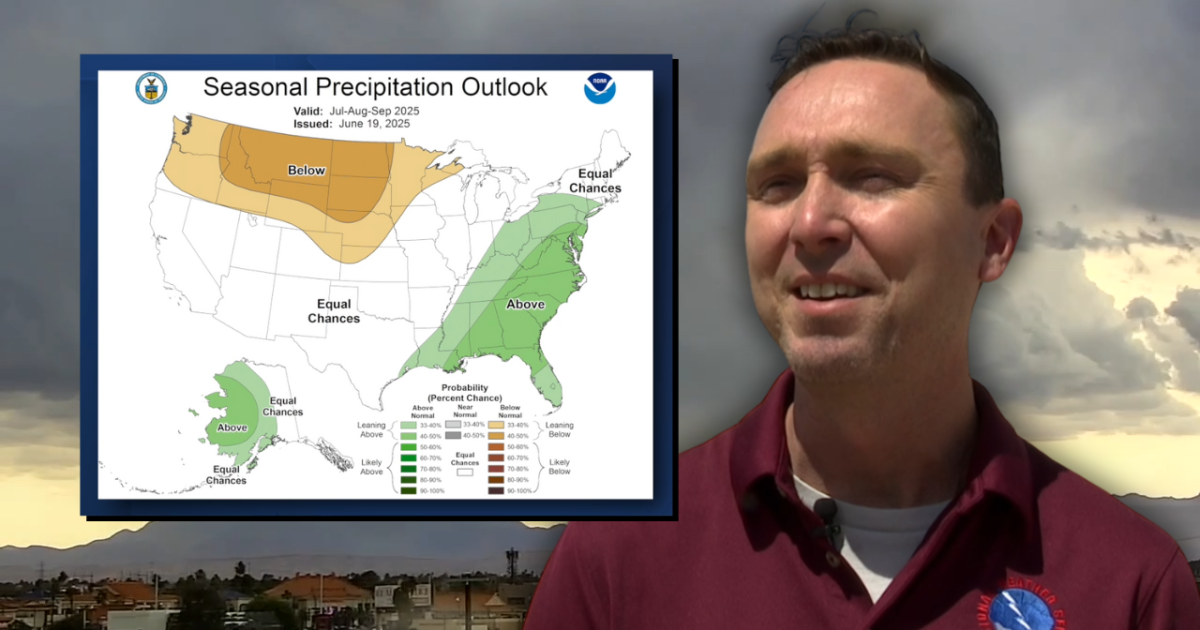

Bournemouths Untold Stories The Titanic Connection

Jul 03, 2025

Bournemouths Untold Stories The Titanic Connection

Jul 03, 2025 -

Tragic Ferry Accident Near Bali Four Fatalities Scores Missing In Indonesian Waters

Jul 03, 2025

Tragic Ferry Accident Near Bali Four Fatalities Scores Missing In Indonesian Waters

Jul 03, 2025 -

Southern Nevada Monsoon Outlook Assessing The Chances Of Significant Rainfall

Jul 03, 2025

Southern Nevada Monsoon Outlook Assessing The Chances Of Significant Rainfall

Jul 03, 2025 -

Exclusive New Images From The Hershey Biopic Starring Finn Wittrock And Alexandra Daddario

Jul 03, 2025

Exclusive New Images From The Hershey Biopic Starring Finn Wittrock And Alexandra Daddario

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025