$5 Billion+ Poured Into Bitcoin ETFs: A Deep Dive Into The Recent Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Deep Dive into the Recent Boom

The cryptocurrency market has witnessed a significant surge in investment, with over $5 billion flowing into Bitcoin exchange-traded funds (ETFs) in recent months. This unprecedented influx of capital marks a pivotal moment for Bitcoin's mainstream adoption and signifies a growing confidence in the digital asset among institutional and retail investors alike. But what's driving this boom, and what does it mean for the future of Bitcoin and the broader crypto market? Let's delve into the details.

The Catalyst for the Bitcoin ETF Boom:

Several factors have converged to propel this recent investment surge into Bitcoin ETFs:

-

SEC Approval: The landmark approval of the first Bitcoin futures ETF in the US in 2021 paved the way for increased institutional participation. While spot Bitcoin ETFs are still awaiting approval, the futures-based ETFs have opened the door for more conservative investors to gain exposure to Bitcoin's price movements. This reduced regulatory uncertainty is a key driver.

-

Inflation Hedge: With persistent inflation across the globe, investors are actively seeking alternative assets to protect their portfolios. Bitcoin, often touted as a "digital gold," is increasingly viewed as a hedge against inflation and economic uncertainty. This perception is fueling demand.

-

Increased Institutional Adoption: Large financial institutions are gradually increasing their Bitcoin holdings. This institutional interest lends credibility and legitimacy to the asset class, encouraging further investment from other players.

-

Technological Advancements: Ongoing developments within the Bitcoin network, such as the Lightning Network, are improving scalability and transaction speeds. These advancements address some of the previous concerns surrounding Bitcoin's usability as a daily transactional currency.

A Closer Look at the Numbers:

While precise figures fluctuate daily, the combined assets under management (AUM) of Bitcoin ETFs have undeniably crossed the $5 billion mark. This represents a significant increase from previous years and reflects the growing maturity of the cryptocurrency investment landscape. Specific ETF performance varies, however, highlighting the need for thorough due diligence before investing.

What Does This Mean for the Future?

The massive influx of capital into Bitcoin ETFs suggests several potential outcomes:

-

Increased Price Volatility: The increased liquidity brought about by ETF investment can lead to both increased price appreciation and heightened volatility. Investors should be prepared for potential market swings.

-

Further Regulatory Scrutiny: The growing mainstream adoption of Bitcoin through ETFs will likely attract increased regulatory attention. This could lead to both opportunities and challenges for the crypto market.

-

Wider Adoption of Crypto: The success of Bitcoin ETFs could encourage the development and adoption of ETFs for other cryptocurrencies, further diversifying the market.

Risks to Consider:

Investing in Bitcoin ETFs, like any investment, carries inherent risks. These include:

- Market Volatility: The price of Bitcoin is notoriously volatile, and investors can experience significant losses.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, creating potential risks.

- Security Risks: While exchanges employ robust security measures, the risk of hacks and theft always remains.

Conclusion:

The surge of investment into Bitcoin ETFs represents a significant milestone for the cryptocurrency industry. While the future remains uncertain, the current trend suggests increasing mainstream acceptance and a growing confidence in Bitcoin's long-term potential. However, potential investors should carefully weigh the risks and rewards before committing capital. Thorough research and understanding of the market are crucial. Consult a financial advisor before making any investment decisions.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Bitcoin Price, Crypto Market, SEC Approval, Institutional Investment, Bitcoin Volatility, Digital Gold, Inflation Hedge, AUM, Assets Under Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: A Deep Dive Into The Recent Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Shanghai Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025

Post Shanghai Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025 -

Balis Tourism Overhaul Stricter Guidelines To Combat Bad Tourist Behavior

May 20, 2025

Balis Tourism Overhaul Stricter Guidelines To Combat Bad Tourist Behavior

May 20, 2025 -

Watch The Powerful Wwi Drama A Streaming Premiere With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch The Powerful Wwi Drama A Streaming Premiere With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Post Pectra Upgrade Ethereum Attracts 200 Million In Investments

May 20, 2025

Post Pectra Upgrade Ethereum Attracts 200 Million In Investments

May 20, 2025 -

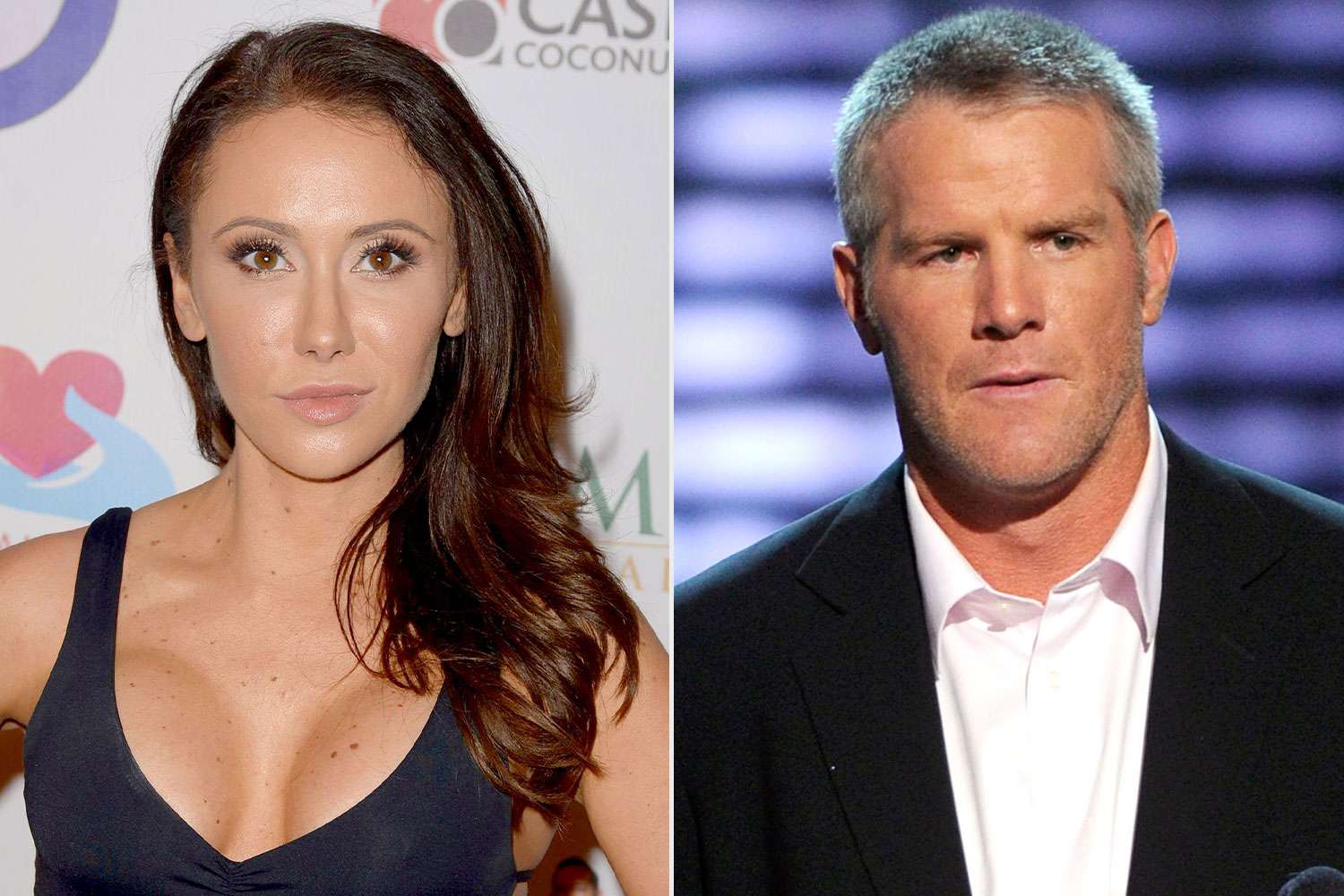

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Lack Of Respect

May 20, 2025

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Lack Of Respect

May 20, 2025