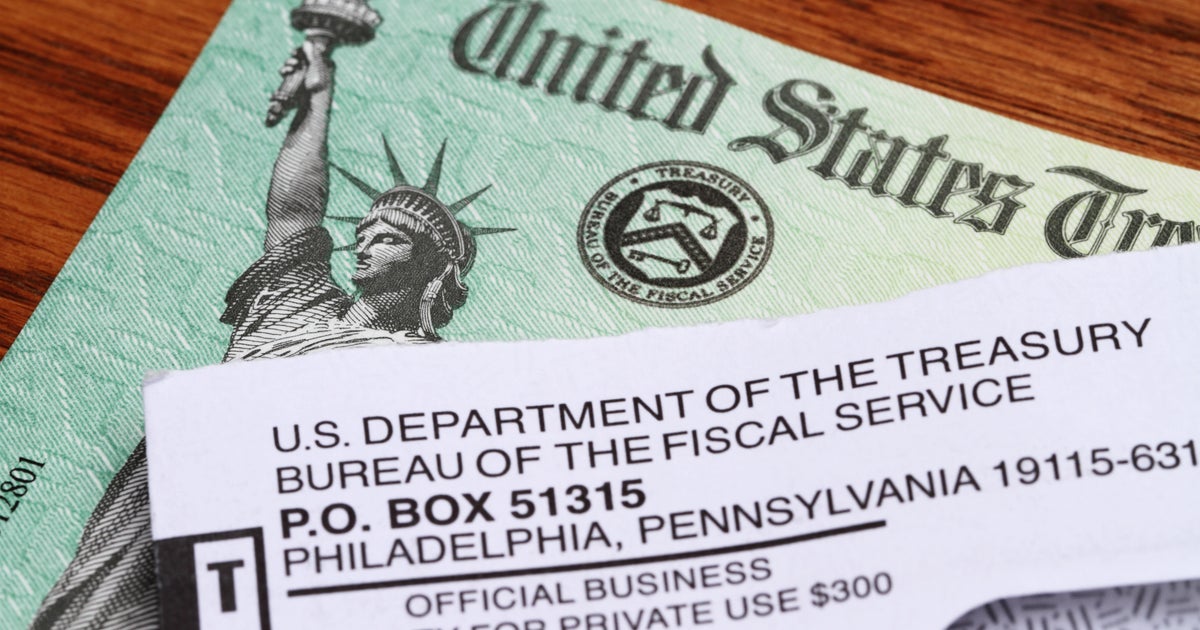

Will The Inflation Reduction Act Change My Social Security Taxes?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will the Inflation Reduction Act Change My Social Security Taxes?

The Inflation Reduction Act (IRA), signed into law in August 2022, brought sweeping changes to healthcare, climate initiatives, and the tax code. But did it affect your Social Security taxes? The short answer is: not directly. However, the indirect effects are worth understanding. This article will clarify what the IRA does and doesn't change regarding your Social Security contributions.

What the Inflation Reduction Act Doesn't Change About Social Security Taxes

The IRA made no alterations to the established Social Security tax rates or the earnings base subject to taxation. This means:

- Tax Rate Remains the Same: For 2024, the Social Security tax rate remains at 6.2% for employees, matched by a 6.2% contribution from employers. Self-employed individuals pay both portions, totaling 12.4%. These rates haven't changed due to the IRA.

- Taxable Earnings Base Unaltered: The maximum amount of earnings subject to Social Security tax also remains unchanged by the IRA. This amount is adjusted annually for inflation by the Social Security Administration (SSA). You can find the current maximum taxable earnings on the SSA website.

Essentially, the IRA didn't touch the core mechanics of how Social Security taxes are calculated or collected.

Indirect Impacts of the IRA on Social Security Recipients

While the IRA doesn't directly impact Social Security taxes, its provisions have indirect consequences, primarily affecting the overall economic landscape that influences Social Security's financial health:

- Prescription Drug Costs: The IRA's reforms to lower prescription drug prices could indirectly benefit seniors relying on Social Security, freeing up funds for other needs. Reduced healthcare costs ease financial burdens and potentially reduce strain on the Social Security system in the long run.

- Medicare Savings: Similar to prescription drug costs, reductions in Medicare expenses through the IRA could indirectly benefit Social Security beneficiaries who are also eligible for Medicare. More disposable income means less financial strain, which can lessen the demand for Social Security benefits.

- Inflationary Pressures: The IRA aims to curb inflation through various means. Success in controlling inflation would positively impact the purchasing power of Social Security benefits, making them stretch further. High inflation erodes the value of fixed incomes like Social Security.

These are long-term, indirect effects. They don't represent immediate changes to your Social Security taxes, but rather the broader economic implications of the legislation.

Staying Informed About Social Security

The Social Security Administration's official website () remains the best resource for up-to-date information on Social Security taxes, benefits, and eligibility. Regularly checking their website ensures you have the most accurate and current information. It's crucial to understand your own financial situation and how changes in legislation might impact your retirement planning. Consider consulting a financial advisor for personalized guidance.

In conclusion, while the Inflation Reduction Act didn't directly change your Social Security taxes, its indirect effects on healthcare costs and inflation could positively impact your overall financial well-being and the long-term stability of the Social Security system. Stay informed and plan accordingly for a secure retirement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will The Inflation Reduction Act Change My Social Security Taxes?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

All In 2025 Jim Ross Confirmed As Commentator

Jul 07, 2025

All In 2025 Jim Ross Confirmed As Commentator

Jul 07, 2025 -

Ea Sports College Football 26 New Team Ratings And Game Mode Updates

Jul 07, 2025

Ea Sports College Football 26 New Team Ratings And Game Mode Updates

Jul 07, 2025 -

Wimbledon Tennis The Ultimate Guide For British Fans

Jul 07, 2025

Wimbledon Tennis The Ultimate Guide For British Fans

Jul 07, 2025 -

Did Jaws Harm Or Help Marine Conservation Assessing The Films Impact

Jul 07, 2025

Did Jaws Harm Or Help Marine Conservation Assessing The Films Impact

Jul 07, 2025 -

Twitch Streamers Tone Brand Launches In Target A New Era In Personal Care

Jul 07, 2025

Twitch Streamers Tone Brand Launches In Target A New Era In Personal Care

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025