Will Tariffs Derail NIO's Q1 Growth Despite Strong Deliveries?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Tariffs Derail NIO's Q1 Growth Despite Strong Deliveries?

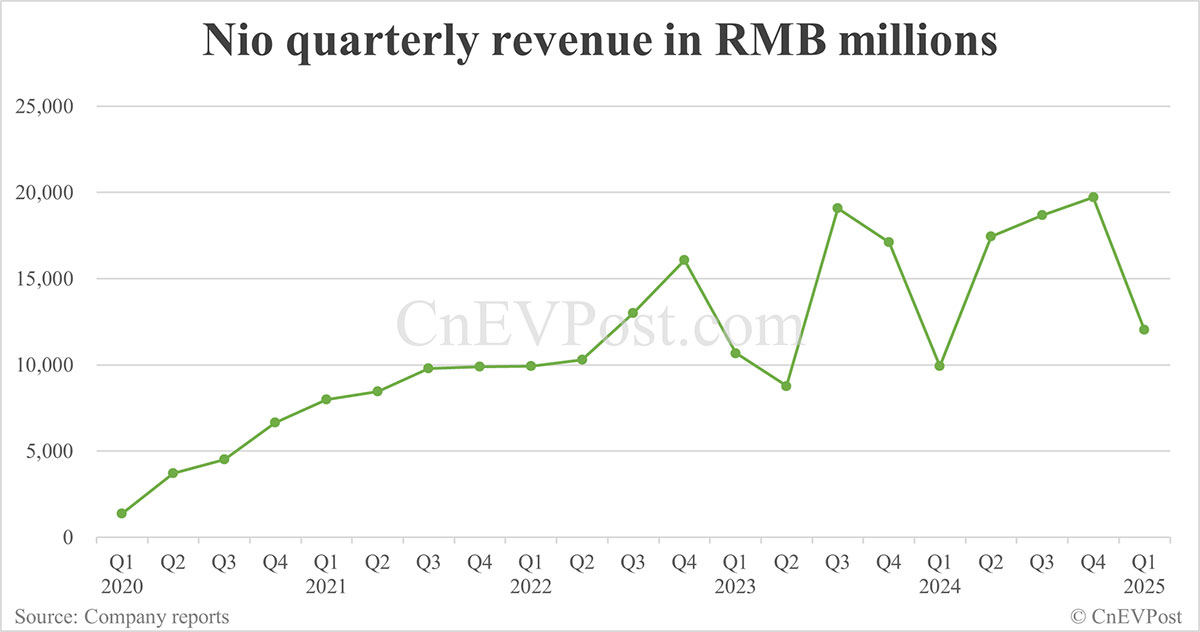

Chinese electric vehicle (EV) maker NIO reported strong vehicle deliveries in Q1 2024, exceeding expectations. However, the looming shadow of US tariffs on Chinese-made goods casts a significant doubt over whether this impressive performance will translate into robust financial growth. The question on everyone's mind: will increased import costs derail NIO's momentum?

NIO's Q1 delivery figures showcased impressive growth, solidifying its position as a major player in the global EV market. This positive trend, however, faces a potential headwind in the form of escalating trade tensions between the US and China. The impact of these tariffs could significantly affect NIO's profitability, even with the strong sales figures.

The Tariff Tightrope: A Balancing Act for NIO

The US government's imposition of tariffs on various Chinese goods, including potentially EV components, directly impacts NIO's cost structure. These increased import costs could squeeze profit margins, potentially offsetting the benefits of strong vehicle sales. The company's ability to navigate this challenging environment will be crucial for maintaining its growth trajectory. This situation highlights the complex interplay between global trade policy and the success of even the most innovative companies.

NIO's Strategies to Mitigate Tariff Impacts

NIO isn't sitting idly by. The company is likely exploring several strategies to mitigate the negative effects of tariffs. These might include:

- Price Adjustments: Increasing vehicle prices to absorb some of the added tariff costs. This, however, carries the risk of impacting consumer demand, especially in a competitive market.

- Supply Chain Diversification: Shifting some of its manufacturing or sourcing to regions outside of China to reduce reliance on tariff-affected goods. This is a long-term strategy requiring significant investment and logistical adjustments.

- Cost Optimization: Implementing internal cost-cutting measures to offset the increased import costs. This could involve streamlining operations and improving efficiency across the supply chain.

- Focus on Domestic Market: Concentrating efforts on expanding its presence and market share within China, where tariffs are less of a concern. This approach leverages the growing domestic EV market in China.

The Bigger Picture: Global EV Market Dynamics

The challenges faced by NIO underscore the broader complexities of the global EV market. The industry is characterized by intense competition, rapid technological advancements, and fluctuating geopolitical landscapes. Companies like NIO need to demonstrate resilience and adaptability to thrive in this dynamic environment. The success of NIO's strategies to counter the tariff impacts will be a key indicator of its long-term competitiveness.

Looking Ahead: Q1 Earnings and Beyond

NIO's Q1 2024 earnings report will provide crucial insights into the actual impact of tariffs on its financial performance. Investors and analysts will be closely scrutinizing the company's financial statements for any signs of margin compression or other negative consequences. The report will undoubtedly shape market sentiment and influence NIO's stock price. The coming months will be critical in determining whether NIO can successfully navigate the challenges presented by tariffs and maintain its upward trajectory.

Further Reading:

This situation highlights the importance of diversifying supply chains and the ongoing challenges faced by companies operating in a globalized economy. The impact of tariffs on NIO's Q1 growth remains to be seen, but the company's response will be a critical factor in its future success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Tariffs Derail NIO's Q1 Growth Despite Strong Deliveries?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Wvu Athletes Controversial Pitt Logo Act Twitter Reaction

Jun 04, 2025

Former Wvu Athletes Controversial Pitt Logo Act Twitter Reaction

Jun 04, 2025 -

Bulgaria And The Euro A Closer Look At The Upcoming Accession

Jun 04, 2025

Bulgaria And The Euro A Closer Look At The Upcoming Accession

Jun 04, 2025 -

Nio Revenue Growth Q1 2024 Figures Show 21 Year On Year Increase

Jun 04, 2025

Nio Revenue Growth Q1 2024 Figures Show 21 Year On Year Increase

Jun 04, 2025 -

England Women Triumph Over West Indies 108 Run Win On The Back Of Jones And Beaumont Hundreds

Jun 04, 2025

England Women Triumph Over West Indies 108 Run Win On The Back Of Jones And Beaumont Hundreds

Jun 04, 2025 -

Social Media Firestorm Wvu Player And The Pitt Logo Controversy

Jun 04, 2025

Social Media Firestorm Wvu Player And The Pitt Logo Controversy

Jun 04, 2025