Will Tariffs Derail NIO's Q1 2024 Earnings Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Tariffs Derail NIO's Q1 2024 Earnings Growth?

NIO, a prominent player in the burgeoning electric vehicle (EV) market, is gearing up to release its Q1 2024 earnings. However, looming trade tensions and the potential impact of tariffs are casting a shadow over investor expectations. The question on everyone's mind: will these economic headwinds derail NIO's anticipated growth?

The Chinese EV maker has consistently impressed investors with its innovative technology and stylish vehicles. But the global economic landscape is anything but predictable, and rising tariffs could significantly impact NIO's bottom line. This article delves into the potential effects of tariffs on NIO's performance and explores the strategies the company might employ to mitigate these risks.

The Tariff Threat: A Looming Challenge

The ongoing trade disputes between major global economies have created an unpredictable environment for businesses operating internationally. NIO, with a significant portion of its supply chain and export markets outside of China, is particularly vulnerable to fluctuating tariff rates. Increased tariffs on imported components or finished vehicles could directly impact production costs and pricing strategies, potentially squeezing profit margins.

Furthermore, the impact extends beyond direct costs. Increased tariffs can lead to:

- Reduced consumer demand: Higher prices due to tariffs may discourage consumers from purchasing NIO vehicles, especially in price-sensitive markets.

- Supply chain disruptions: Tariffs could disrupt NIO's supply chain, leading to delays in production and potentially impacting delivery timelines.

- Increased competition: Competitors less affected by tariffs may gain a competitive advantage, further impacting NIO's market share.

NIO's Potential Mitigation Strategies

NIO is not a passive player in this challenging environment. The company is likely exploring several strategies to navigate the potential impact of tariffs:

- Diversification of supply chains: Shifting sourcing of components to countries with favorable trade agreements could help reduce reliance on tariff-affected regions.

- Price adjustments: While not ideal, carefully calibrated price adjustments might help maintain profitability despite increased costs. However, this needs to be balanced against the impact on consumer demand.

- Focus on domestic market: Strengthening its position within the Chinese domestic market could lessen the reliance on export markets subject to tariffs.

- Lobbying efforts: Engaging in political advocacy to influence trade policy could potentially lead to more favorable tariff arrangements.

Analyst Predictions and Investor Sentiment

Analyst sentiment towards NIO remains mixed. Some analysts remain bullish, citing the company's strong technological advancements and growing market share in China. Others express caution, highlighting the potential negative impact of tariffs and geopolitical uncertainties. Investor sentiment is likely to be highly sensitive to the Q1 2024 earnings report, particularly regarding the company's commentary on tariff-related challenges and its strategies for mitigating the risks.

Looking Ahead: What to Expect in Q1 2024

NIO's Q1 2024 earnings report will be a crucial indicator of the company's resilience in the face of escalating trade tensions. Investors will be closely scrutinizing the company's financial performance, its commentary on the tariff situation, and its plans to navigate this challenging landscape. The report could significantly impact NIO's stock price and investor confidence. Keep an eye on major financial news outlets for updates following the release.

Further Reading:

Disclaimer: This article provides general information and commentary and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Tariffs Derail NIO's Q1 2024 Earnings Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Actress Sydney Sweeney And The Unexpected Bathwater Sales Trend

Jun 03, 2025

Actress Sydney Sweeney And The Unexpected Bathwater Sales Trend

Jun 03, 2025 -

Police Capture Fugitive Wanted For Capital Murder In North Texas

Jun 03, 2025

Police Capture Fugitive Wanted For Capital Murder In North Texas

Jun 03, 2025 -

Wtf Podcasts Final Episode Marc Maron Announces End

Jun 03, 2025

Wtf Podcasts Final Episode Marc Maron Announces End

Jun 03, 2025 -

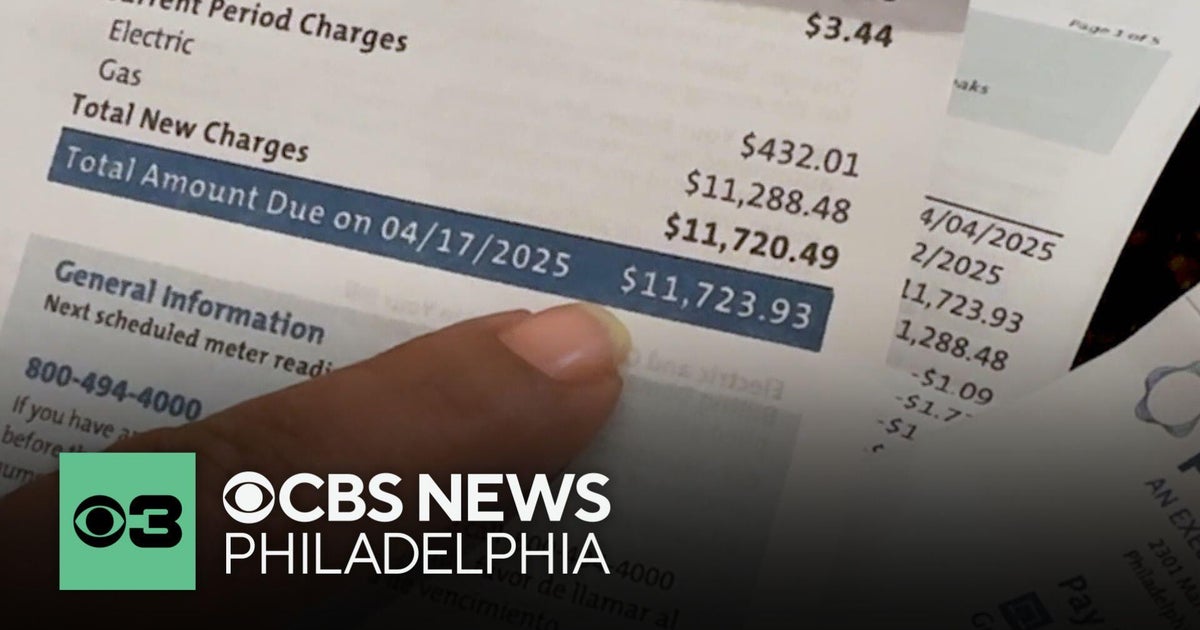

Peco Billing Error Results In 12 000 Bill For Pennsylvania Customer

Jun 03, 2025

Peco Billing Error Results In 12 000 Bill For Pennsylvania Customer

Jun 03, 2025 -

Is Miley Cyrus Reconciled With Billy Cyrus Source Weighs In

Jun 03, 2025

Is Miley Cyrus Reconciled With Billy Cyrus Source Weighs In

Jun 03, 2025