Will Tariffs Derail NIO's Q1 2024 Earnings Despite Delivery Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Tariffs Derail NIO's Q1 2024 Earnings Despite Delivery Growth?

NIO, a prominent player in the burgeoning Chinese electric vehicle (EV) market, is bracing for its Q1 2024 earnings announcement. While the company has reported impressive delivery growth, the looming shadow of US tariffs threatens to significantly impact its financial performance. This raises a critical question: can NIO's strong sales figures withstand the potential economic headwinds created by escalating trade tensions?

The recent surge in EV deliveries for NIO has undoubtedly been a positive sign, demonstrating strong consumer demand and the efficacy of its product lineup. However, the imposition of tariffs on imported Chinese goods, including potential impacts on EV components, casts a significant uncertainty over NIO's bottom line. These tariffs could increase the cost of manufacturing and importing vehicles, potentially squeezing profit margins and impacting overall profitability.

The Impact of Tariffs on NIO's Profitability

The automotive industry is particularly sensitive to tariffs due to its complex supply chains and reliance on global sourcing. For NIO, tariffs could significantly increase the cost of essential components sourced from China, affecting everything from battery cells to electronic systems. This increased cost of goods sold (COGS) directly eats into profitability, potentially leading to lower-than-expected earnings despite robust delivery numbers.

Several factors will influence the severity of the impact:

- The specific tariff rates: The exact rates imposed will directly determine the increase in costs for NIO. Higher rates translate to a more significant impact on profitability.

- NIO's ability to absorb costs: The company's pricing strategies and ability to absorb increased costs without passing them on to consumers will play a crucial role in mitigating the negative effects of tariffs.

- The resilience of consumer demand: If consumer demand remains strong despite potential price increases, NIO might be able to offset some of the negative impact. However, a decrease in demand would further exacerbate the situation.

NIO's Strategies to Mitigate Tariff Impacts

While the threat of tariffs looms large, NIO is not entirely helpless. The company has likely explored several strategies to lessen the blow, including:

- Diversification of supply chains: Shifting sourcing of components away from China to other countries could reduce reliance on tariff-affected goods.

- Negotiations with suppliers: NIO might be engaging in negotiations with its suppliers to share the burden of increased tariffs.

- Price adjustments: Although undesirable, price increases might be necessary to maintain profit margins, but this carries the risk of reduced consumer demand.

- Increased localization efforts: Focusing on producing more components within regions less affected by tariffs, potentially increasing manufacturing in Europe or other strategic locations.

Analyzing the Q1 2024 Earnings Report

NIO's Q1 2024 earnings report will be closely scrutinized by investors and analysts alike. The focus will be on:

- Profit margins: A significant drop in profit margins compared to previous quarters would strongly indicate a negative impact from tariffs.

- Guidance for future quarters: NIO's outlook for the remainder of 2024 will provide valuable insights into its ability to navigate the tariff challenges.

- Details on supply chain strategies: Transparency regarding efforts to mitigate tariff impacts will be crucial in assessing the company's long-term sustainability.

The upcoming earnings announcement is crucial for NIO. While delivery growth paints a positive picture, the lingering threat of tariffs adds a layer of complexity. Investors will need to carefully analyze the financial results and the company's strategies to assess the long-term implications of this significant challenge. The success or failure of NIO in navigating these trade headwinds will be a key indicator of its resilience and future prospects in the competitive global EV market. Stay tuned for updates following the official release of the Q1 2024 earnings report.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Tariffs Derail NIO's Q1 2024 Earnings Despite Delivery Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nios Q1 2024 Earnings Can Strong Deliveries Offset Tariff Worries

Jun 03, 2025

Nios Q1 2024 Earnings Can Strong Deliveries Offset Tariff Worries

Jun 03, 2025 -

Sheinelle Jones Husband Uche Ojeh Laid To Rest Today Show Offers Support

Jun 03, 2025

Sheinelle Jones Husband Uche Ojeh Laid To Rest Today Show Offers Support

Jun 03, 2025 -

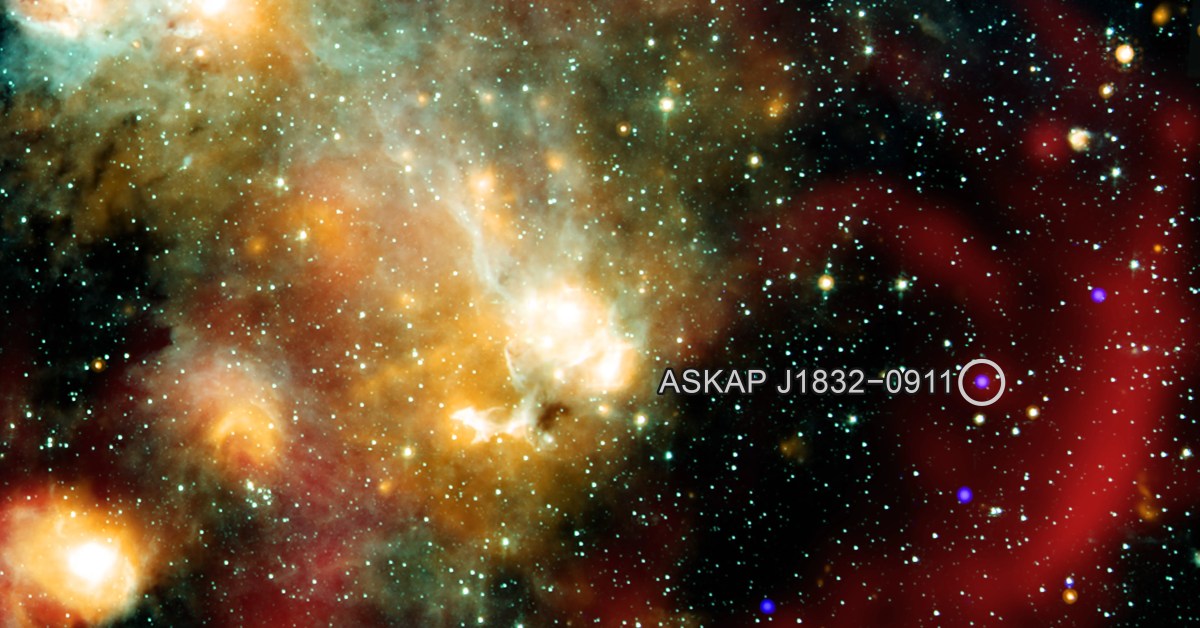

Astronomical Mystery The Case Of The Pulsating Star

Jun 03, 2025

Astronomical Mystery The Case Of The Pulsating Star

Jun 03, 2025 -

Underwater Attack On Crimea Bridge Ukraines Bold Move Against Russia

Jun 03, 2025

Underwater Attack On Crimea Bridge Ukraines Bold Move Against Russia

Jun 03, 2025 -

3 02 Surge For Hims And Hers Hims Stock May 30th Market Performance

Jun 03, 2025

3 02 Surge For Hims And Hers Hims Stock May 30th Market Performance

Jun 03, 2025