Will Tariff Hikes Derail NIO's Q1 2024 Earnings Despite Delivery Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Tariff Hikes Derail NIO's Q1 2024 Earnings Despite Delivery Growth?

NIO, the Chinese electric vehicle (EV) maker, reported strong vehicle deliveries in Q1 2024, exceeding analyst expectations. However, looming concerns about escalating US tariffs threaten to cast a shadow over the company's financial performance. Will the positive delivery numbers be enough to offset the potential negative impact of increased import costs? Let's delve into the complexities facing NIO and explore the potential ramifications for its Q1 earnings.

NIO's Q1 2024 delivery figures showcased impressive growth, fueled by strong demand for its latest models and an expanding charging infrastructure. This positive momentum is crucial for the company's long-term viability and investor confidence. But the celebration might be premature.

The Tariff Tightrope: A Balancing Act for NIO

The recent escalation of US tariffs on Chinese imports presents a significant hurdle for NIO. These increased tariffs directly impact the cost of importing vehicles and components into the US market, a key region for NIO's international expansion strategy. Higher import costs inevitably translate to higher prices for consumers, potentially dampening demand and impacting profitability.

While NIO has demonstrated resilience in the face of previous challenges, the magnitude of these tariff hikes could prove more substantial. The company may struggle to fully absorb these increased costs without affecting its already competitive pricing strategy. This delicate balancing act between maintaining profitability and market competitiveness will be crucial in determining the ultimate impact on Q1 earnings.

Beyond Tariffs: Other Factors Affecting NIO's Performance

It's important to consider factors beyond tariffs that could influence NIO's Q1 2024 earnings. These include:

- Raw Material Costs: Fluctuations in the prices of crucial raw materials, like lithium and cobalt, continue to pose a challenge for the entire EV industry, impacting NIO's production costs.

- Competition: The EV market is increasingly competitive, with both established and emerging players vying for market share. Intense competition can pressure pricing and profitability.

- Supply Chain Disruptions: Global supply chain issues persist, potentially affecting NIO's production timelines and impacting delivery schedules.

NIO's Strategic Response: Mitigation and Adaptation

NIO isn't standing idly by. The company is likely exploring several strategies to mitigate the impact of the tariff hikes, including:

- Price Adjustments: While potentially unpopular, strategic price adjustments could help offset increased import costs.

- Supply Chain Diversification: Exploring alternative sourcing options for components could reduce reliance on Chinese suppliers and lessen tariff vulnerability.

- Increased Localization: Focusing on local production in target markets like the US could minimize import costs in the long term.

The Q1 2024 Earnings Report: What to Expect

NIO's Q1 2024 earnings report will be closely scrutinized by investors and analysts alike. While the strong delivery numbers offer a positive outlook, the impact of tariff hikes remains a significant uncertainty. Investors will be keenly watching for details on the company's strategies to manage these increased costs and maintain profitability. The report will offer crucial insights into NIO's ability to navigate the complex economic landscape and maintain its growth trajectory.

Will NIO's strong delivery growth outweigh the negative impact of tariff hikes? Only time will tell. Stay tuned for the official Q1 2024 earnings release and subsequent analyst commentary for a clearer picture.

(Note: This article provides analysis based on available information and does not constitute financial advice. Consult with a financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Tariff Hikes Derail NIO's Q1 2024 Earnings Despite Delivery Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Broadway Uproar 500 Artists Denounce Patti Lu Pones Actions Towards Mc Donald And Lewis

Jun 03, 2025

Broadway Uproar 500 Artists Denounce Patti Lu Pones Actions Towards Mc Donald And Lewis

Jun 03, 2025 -

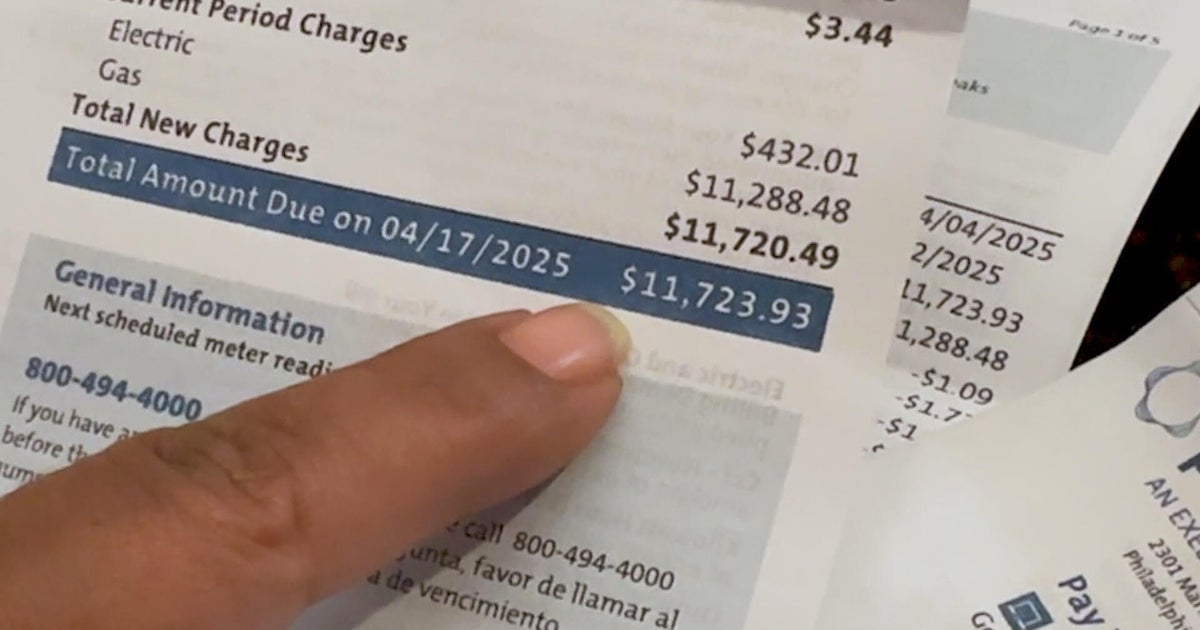

Months Without Bills Then A 12 000 Shock Peco Customers Voice Outrage

Jun 03, 2025

Months Without Bills Then A 12 000 Shock Peco Customers Voice Outrage

Jun 03, 2025 -

China Tariffs Jp Morgans Dimon Delivers Unsweetened Truth About Us Approach

Jun 03, 2025

China Tariffs Jp Morgans Dimon Delivers Unsweetened Truth About Us Approach

Jun 03, 2025 -

Sheinelle Jones Focuses On Family After Husbands Death Source Reveals

Jun 03, 2025

Sheinelle Jones Focuses On Family After Husbands Death Source Reveals

Jun 03, 2025 -

Jp Morgan Chase Ceo Highlights Key Focus For Trump Administration

Jun 03, 2025

Jp Morgan Chase Ceo Highlights Key Focus For Trump Administration

Jun 03, 2025