Will Social Security Survive? Examining The Future Of Retirement Benefits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Social Security Survive? Examining the Future of Retirement Benefits

The future of Social Security is a topic sparking considerable debate and anxiety among Americans nearing retirement and those planning for their golden years. With the program facing increasing financial strain, the question on everyone's mind is: will Social Security survive? This article delves into the challenges facing the Social Security system and explores potential solutions to ensure its long-term viability.

The Looming Crisis: Understanding the Funding Gap

Social Security, a cornerstone of the American retirement system, faces a significant funding shortfall. The number of retirees is growing rapidly, while the worker-to-retiree ratio is declining. This demographic shift, coupled with increased life expectancy, puts immense pressure on the system's ability to meet its obligations. The Social Security Administration (SSA) projects that the trust funds supporting the program will be depleted within the next 10 to 15 years, leading to benefit cuts unless Congress takes action.

Key Factors Contributing to the Crisis:

- Aging Population: The increasing number of Baby Boomers entering retirement age significantly increases the demand for benefits.

- Declining Birth Rates: Lower birth rates mean fewer workers contributing to the system to support a growing retired population.

- Increased Life Expectancy: People are living longer, resulting in longer periods of receiving benefits.

- Economic Fluctuations: Recessions and economic downturns impact tax revenue, further straining the system's finances.

Potential Solutions: A Difficult Balancing Act

Addressing the Social Security crisis requires a multi-faceted approach, and finding solutions that satisfy all stakeholders is a considerable challenge. Several options are currently under consideration:

-

Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could help reduce the strain on the system. However, this could disproportionately impact lower-income workers who often have shorter life expectancies and less savings.

-

Increasing the Social Security Tax Rate: A modest increase in the Social Security tax rate could generate additional revenue. However, this may impact workers' take-home pay, potentially hindering economic growth.

-

Raising the Taxable Earnings Base: Currently, Social Security taxes are only applied to earnings up to a certain limit. Raising this limit could significantly increase revenue. Critics argue this could disproportionately affect higher-income earners.

-

Benefit Reductions: While a politically unpopular option, reducing benefits for higher earners or implementing means-testing could help alleviate the shortfall.

-

Investing Social Security Trust Funds: Diversifying the trust fund's investments beyond government bonds could generate higher returns. However, this carries inherent risks and requires careful consideration.

What Does the Future Hold?

The future of Social Security remains uncertain. The long-term solvency of the program depends heavily on the actions Congress takes in the coming years. Delaying action will only exacerbate the problem, potentially leading to more drastic cuts in the future. Staying informed about proposed legislation and engaging in the political process are crucial steps in safeguarding the retirement benefits of future generations.

Call to Action: Learn more about Social Security reform by visiting the official Social Security Administration website: . Understanding the issues is the first step towards ensuring a secure retirement for yourself and others. Contact your elected officials to express your concerns and advocate for responsible solutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Social Security Survive? Examining The Future Of Retirement Benefits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Why A Head Start Matters The 2028 Democratic Presidential Hopefuls

Aug 16, 2025

Why A Head Start Matters The 2028 Democratic Presidential Hopefuls

Aug 16, 2025 -

From Rto To 5 Day Workweek Robinhood Ceos Admission And New Office Mandate

Aug 16, 2025

From Rto To 5 Day Workweek Robinhood Ceos Admission And New Office Mandate

Aug 16, 2025 -

General Hospitals Finola Hughes Honest Look Back At Staying Alive Performance

Aug 16, 2025

General Hospitals Finola Hughes Honest Look Back At Staying Alive Performance

Aug 16, 2025 -

Fewer Tourists Less Revenue Is The Las Vegas Strip Heading For A Downturn

Aug 16, 2025

Fewer Tourists Less Revenue Is The Las Vegas Strip Heading For A Downturn

Aug 16, 2025 -

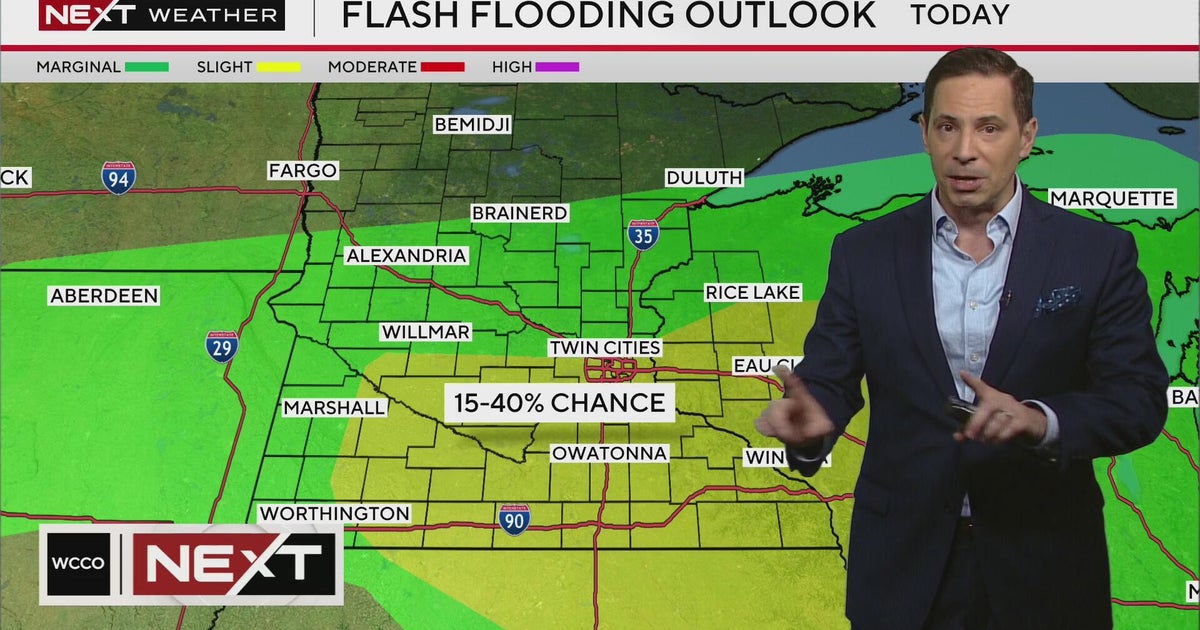

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025

Mega Millions Winning Numbers Friday August 15 2025

Mega Millions Winning Numbers Friday August 15 2025

August 15 2025 Mega Millions Lottery Results

August 15 2025 Mega Millions Lottery Results

International Outcry Advocacy Groups Denounce Israels West Bank Settlement Expansion

International Outcry Advocacy Groups Denounce Israels West Bank Settlement Expansion