Will Intel Stock Rebound In 2025? An Investor's Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Intel Stock Rebound in 2025? An Investor's Analysis

Intel (INTC) has faced a challenging few years, grappling with increased competition and lagging behind in the advanced chip manufacturing race. But with a renewed focus on innovation and aggressive investment in its manufacturing capabilities, many investors are wondering: will Intel stock rebound in 2025? This in-depth analysis explores the potential for an Intel stock resurgence and what factors could influence its performance.

Intel's Recent Struggles and Strategic Shifts

Intel's decline wasn't sudden. For several years, the company struggled to keep pace with rivals like TSMC and Samsung in the race to produce the most advanced chips. This technological gap led to lost market share and impacted profitability. However, Intel has embarked on a significant turnaround strategy, investing billions in new fabrication plants (fabs) and focusing on advanced process technologies like its Intel 7, Intel 4, and beyond. This significant capital expenditure aims to reclaim its manufacturing leadership position.

Factors Suggesting a Potential Rebound in 2025

Several factors point towards a possible Intel stock rebound by 2025:

- Manufacturing Investments: Intel's massive investments in its IDM 2.0 strategy, which emphasizes both design and manufacturing, could significantly boost its competitiveness. New fabs coming online in the coming years are crucial to this strategy. This could lead to increased efficiency and allow Intel to better compete with foundries like TSMC.

- Government Support: The CHIPS and Science Act in the US provides substantial funding for domestic semiconductor manufacturing. Intel is a major beneficiary of this act, receiving significant financial incentives that support its expansion plans and bolster its competitiveness.

- Focus on Innovation: Intel has demonstrated a renewed commitment to innovation, investing heavily in research and development across various chip technologies, including CPUs, GPUs, and specialized AI accelerators. Success in these areas could lead to increased market share and revenue.

- Data Center Growth: The data center market remains a significant growth area, and Intel is a key player. Strong performance in this segment could significantly contribute to Intel's overall financial health and stock price. Their Xeon processors continue to hold a strong position in this market.

- Potential for Diversification: Intel's expansion into new markets beyond traditional CPUs, such as GPUs and networking, could diversify its revenue streams and reduce its reliance on a single product category. This diversification mitigates risk and offers potential for future growth.

Challenges that Could Impede a Rebound

Despite the positive factors, several challenges could hinder Intel's rebound:

- Competition: The semiconductor industry remains incredibly competitive. TSMC and Samsung continue to be formidable rivals with advanced manufacturing capabilities. Maintaining competitiveness requires continuous innovation and significant investment.

- Execution Risk: Successfully implementing Intel's ambitious manufacturing and product roadmap is crucial. Any delays or setbacks could negatively impact the company's financial performance and investor confidence.

- Global Economic Uncertainty: Global economic conditions can significantly influence demand for semiconductors. A global recession or other economic downturn could reduce demand and negatively affect Intel's sales.

Investor Outlook and Conclusion

Whether Intel stock will rebound significantly by 2025 is uncertain. While the company's strategic shifts and investments hold considerable promise, significant challenges remain. Investors should carefully consider the risks and potential rewards before making any investment decisions. Thorough due diligence, including analysis of Intel's financial statements and future guidance, is vital for informed decision-making. Stay updated on Intel's progress in advanced manufacturing and its market share gains to better assess the potential for future growth. Seeking advice from a qualified financial advisor is always recommended before investing in any stock.

Keywords: Intel, INTC, Intel stock, stock market, semiconductor, chip manufacturing, TSMC, Samsung, IDM 2.0, CHIPS and Science Act, investment, stock rebound, investor analysis, technology, data center, GPU, CPU, financial analysis, market share.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Intel Stock Rebound In 2025? An Investor's Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The 2024 Nba Draft A Mock Draft Weighing Team Needs And Best Available Players

Jun 11, 2025

Analyzing The 2024 Nba Draft A Mock Draft Weighing Team Needs And Best Available Players

Jun 11, 2025 -

2025 Nba Draft Prospect Rankings In Depth Scouting Reports And Tier System

Jun 11, 2025

2025 Nba Draft Prospect Rankings In Depth Scouting Reports And Tier System

Jun 11, 2025 -

At Least 10 Killed In Devastating Austrian School Shooting

Jun 11, 2025

At Least 10 Killed In Devastating Austrian School Shooting

Jun 11, 2025 -

Doing Important Stuff David Corenswet In The Final Superman Trailer

Jun 11, 2025

Doing Important Stuff David Corenswet In The Final Superman Trailer

Jun 11, 2025 -

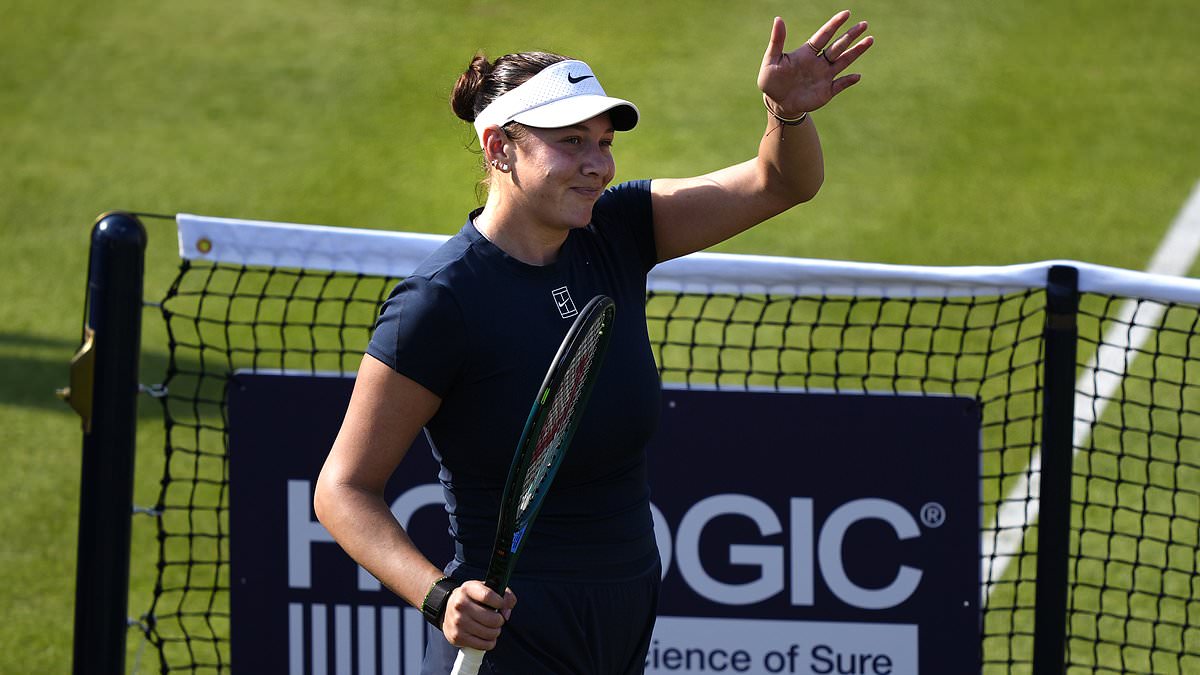

American Tennis Star Faces Backlash After Queens Club Triumphs

Jun 11, 2025

American Tennis Star Faces Backlash After Queens Club Triumphs

Jun 11, 2025