Will Intel Rebound In 2025? Assessing The Investment Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Intel Rebound in 2025? Assessing the Investment Risks

Intel, a once-dominant force in the semiconductor industry, has faced significant challenges in recent years. The company's struggles have left investors questioning its future and prompting serious consideration of the investment risks involved. But could 2025 bring a resurgence for the tech giant? Let's delve into the potential for an Intel rebound and the crucial factors investors need to consider.

Intel's Recent Struggles: A Market Share Squeeze

For years, Intel held a near-monopoly in the x86 CPU market. However, the rise of competitors like AMD, coupled with delays in its own advanced process node technologies (like 7nm and 10nm), significantly eroded its market share. This led to decreased revenue, impacting investor confidence and share prices. The company's attempts to regain its footing, including massive investments in new fabrication plants (fabs) and a renewed focus on research and development, haven't yet yielded the expected results.

The Path to Rebound: Key Factors to Watch

Intel's potential rebound in 2025 hinges on several crucial factors:

-

Successful Implementation of New Technologies: Intel's ambitious plans for its next-generation process nodes (like 3nm and beyond) are paramount. Success here would significantly enhance its manufacturing capabilities, allowing it to compete more effectively with rivals like TSMC and Samsung. Any delays or setbacks could further hinder its progress.

-

Market Demand for CPUs and Related Technologies: The overall demand for CPUs and other semiconductor products will play a vital role. A strong global market coupled with increased demand for high-performance computing (HPC) and artificial intelligence (AI) would benefit Intel significantly. Conversely, a downturn in the global economy could stifle growth.

-

Competitive Landscape: The relentless competition from AMD, which has consistently gained market share, remains a significant challenge. Intel needs to not only improve its own technology but also effectively counter AMD's aggressive marketing and product strategies. The continued innovation from other players in the market also adds to the complexity.

-

Execution of its Foundry Business: Intel's foray into the foundry business (manufacturing chips for other companies) is a crucial aspect of its long-term strategy. Securing high-profile clients and demonstrating manufacturing excellence will be essential to its success in this increasingly competitive arena. This is a key differentiator from its primary competitor, TSMC.

-

Financial Health and Investment Strategies: Intel's financial health and ability to attract further investment will be critical. Maintaining a strong balance sheet and efficiently managing its substantial capital expenditures will be vital for navigating the challenges ahead.

Assessing the Investment Risks: A Cautious Approach

Investing in Intel in 2025 carries inherent risks. While the potential for a rebound exists, several factors could derail its progress. Investors should carefully consider:

-

Technological Uncertainty: The success of Intel's new technologies is not guaranteed. Delays or unforeseen technical challenges could negatively impact its competitiveness.

-

Market Volatility: The semiconductor industry is notoriously volatile, subject to fluctuating demand and economic downturns.

-

Competitive Pressure: The intense competition from established players and emerging competitors continues to pose a significant threat.

Conclusion: A High-Risk, High-Reward Proposition?

Intel's potential rebound in 2025 is not a certainty. While the company is taking steps to address its challenges, significant risks remain. Investors should conduct thorough due diligence, carefully evaluating the company's progress in implementing its strategic initiatives and considering the broader market dynamics before making any investment decisions. This requires careful monitoring of Intel's financial reports, technology announcements, and the overall performance of the semiconductor industry. It's a high-risk, high-reward proposition demanding a well-informed and cautious approach. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Intel Rebound In 2025? Assessing The Investment Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Navigating Senior Year Amidst The Ashes The La Wildfires Toll

Jun 10, 2025

Navigating Senior Year Amidst The Ashes The La Wildfires Toll

Jun 10, 2025 -

Harry Potter Adaptation Casting Update Includes Crucial Weasley And Malfoy Family Members

Jun 10, 2025

Harry Potter Adaptation Casting Update Includes Crucial Weasley And Malfoy Family Members

Jun 10, 2025 -

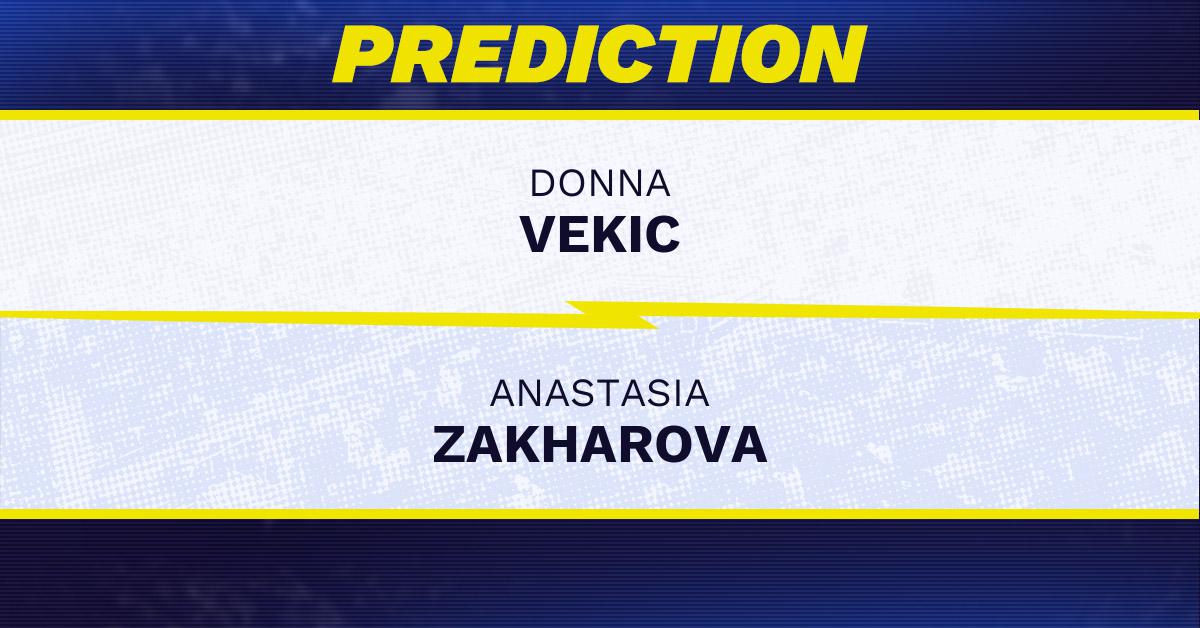

Wta London 2025 Vekic Zakharova Head To Head Predictions And Best Bets

Jun 10, 2025

Wta London 2025 Vekic Zakharova Head To Head Predictions And Best Bets

Jun 10, 2025 -

Liechtenstein Vs Scotland Bbc Sport How To Watch Listen And Follow The Game

Jun 10, 2025

Liechtenstein Vs Scotland Bbc Sport How To Watch Listen And Follow The Game

Jun 10, 2025 -

Exclusive Wyatt Russell On Reimagining John Walker For Avengers Doomsday

Jun 10, 2025

Exclusive Wyatt Russell On Reimagining John Walker For Avengers Doomsday

Jun 10, 2025