Will Intel Deliver In 2025? A Look At The Investment Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Intel Deliver in 2025? A Look at the Investment Outlook

Intel, a titan of the semiconductor industry, faces a pivotal moment. After years of struggling to compete with rivals like TSMC and Samsung in the cutting-edge process node race, the company is betting heavily on its IDM 2.0 strategy and a massive investment in new fabrication plants. But will these efforts translate into a successful turnaround by 2025? This in-depth analysis explores the investment outlook for Intel and the key factors that will determine its success.

Intel's Ambitious Comeback Plan:

Intel's IDM 2.0 strategy represents a significant shift. This model combines internal manufacturing (IDM) with external collaborations, aiming to leverage both internal expertise and external capacity to bring innovative products to market faster. This involves:

- Massive Capital Expenditure: Intel is pouring billions of dollars into expanding its manufacturing capacity, building new fabs in Arizona, Ohio, and possibly elsewhere. This is a crucial investment to regain its manufacturing leadership.

- Focus on Advanced Nodes: The company is aggressively pursuing advancements in its process technology, aiming to compete with the leading-edge nodes offered by TSMC and Samsung. Success here is paramount to winning back market share in high-performance computing.

- Expanding its Product Portfolio: Beyond CPUs, Intel is diversifying into other areas like GPUs, networking chips, and specialized AI accelerators. This broader portfolio reduces reliance on a single product segment and opens up new revenue streams.

Challenges Facing Intel's 2025 Goals:

Despite the ambitious plans, several challenges could hinder Intel's progress:

- Competition: The semiconductor industry is fiercely competitive. TSMC and Samsung hold a significant lead in advanced process nodes, and catching up will require substantial time and resources. Furthermore, emerging players pose additional challenges.

- Yield Rates and Production Ramp-up: Building new fabs and achieving high yield rates are complex and time-consuming processes. Any delays in ramping up production could impact Intel's financial performance and its ability to meet market demand.

- Geopolitical Risks: The global semiconductor industry is increasingly impacted by geopolitical factors, including trade wars and potential supply chain disruptions. These uncertainties could affect Intel's investment plans and overall success.

The Investment Landscape:

So, is Intel a good investment for 2025? The answer is nuanced. While the company's turnaround strategy is ambitious and potentially rewarding, significant risks remain. Investors should consider:

- Long-Term Perspective: Intel's turnaround won't happen overnight. Investors need a long-term perspective, as significant returns are unlikely to be seen immediately.

- Risk Tolerance: The semiconductor industry is volatile. Investors need a high risk tolerance given the competitive landscape and potential production challenges.

- Diversification: A well-diversified portfolio is crucial to mitigate risks associated with investing in a single company, especially one undergoing a major transformation.

Conclusion:

Intel's future in 2025 hinges on the successful execution of its IDM 2.0 strategy. While the company's investment in new fabs and product diversification is a positive sign, significant challenges remain. Investors need to carefully weigh the potential rewards against the inherent risks before committing their capital. Further analysis of Intel's quarterly earnings reports and industry trends will be crucial in refining the investment outlook as 2025 approaches. Stay tuned for further updates on Intel's progress and the evolving competitive landscape. Do your own thorough research before making any investment decisions.

Related Articles:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Intel Deliver In 2025? A Look At The Investment Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jac Caglianone Ronny Mauricio And Other Key Waiver Wire Pickups For Fantasy Baseball

Jun 11, 2025

Jac Caglianone Ronny Mauricio And Other Key Waiver Wire Pickups For Fantasy Baseball

Jun 11, 2025 -

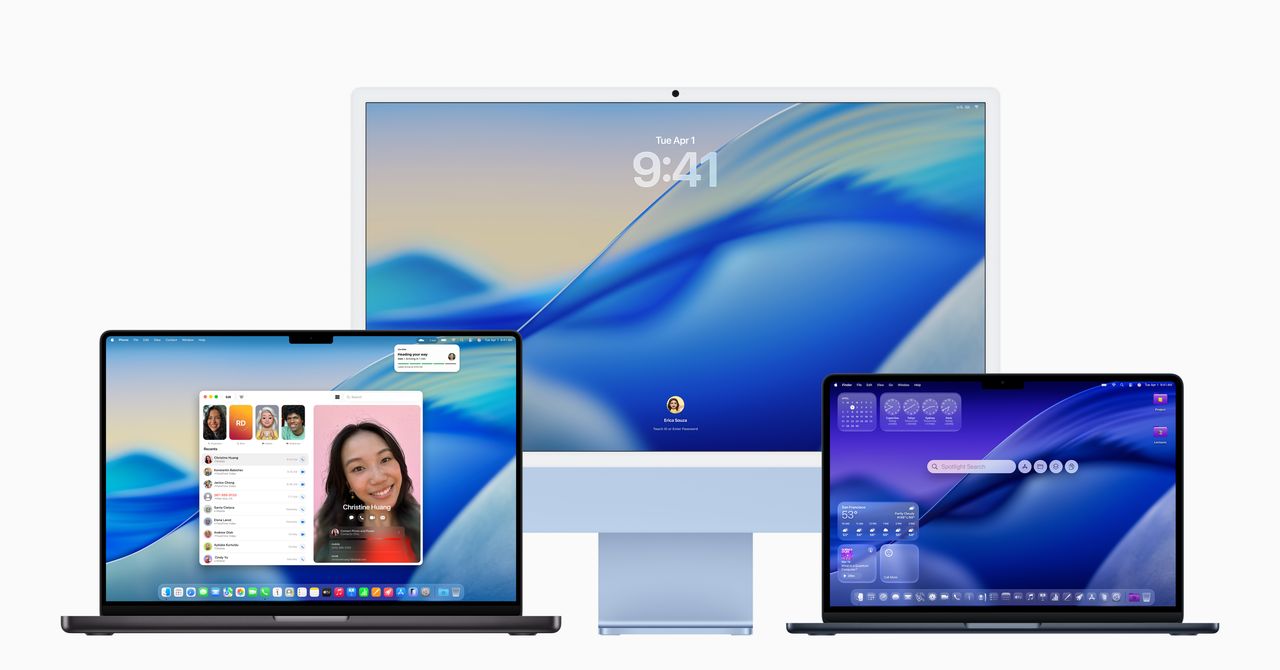

The End Of Intel Macs A New Era For Apple Silicon

Jun 11, 2025

The End Of Intel Macs A New Era For Apple Silicon

Jun 11, 2025 -

Packers Minicamp Surprise Bo Meltons Unexpected Position Switch

Jun 11, 2025

Packers Minicamp Surprise Bo Meltons Unexpected Position Switch

Jun 11, 2025 -

Elon Musk And Scott Bessant White House Altercation Details Emerge

Jun 11, 2025

Elon Musk And Scott Bessant White House Altercation Details Emerge

Jun 11, 2025 -

Investing In Intel Will 2025 Bring The Comeback Investors Want

Jun 11, 2025

Investing In Intel Will 2025 Bring The Comeback Investors Want

Jun 11, 2025