Will Clean Energy Taxes Boost Or Hurt The American Economy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Taxes Boost or Hurt the American Economy? A Complex Question

The debate surrounding clean energy taxes and their impact on the American economy is far from settled. While proponents argue that incentivizing renewable energy sources will foster economic growth and job creation, critics express concerns about potential costs and negative consequences for specific industries. Understanding the complexities of this issue requires a nuanced examination of both the potential benefits and drawbacks.

The Argument for Clean Energy Taxes: A Boost to the Economy?

Advocates for clean energy taxes, often in the form of carbon taxes or subsidies for renewable energy, point to several potential economic benefits:

-

Job Creation: The burgeoning renewable energy sector offers significant job creation potential. From manufacturing solar panels and wind turbines to installing and maintaining these systems, a transition to clean energy promises a wealth of new employment opportunities, particularly in underserved communities. This job growth isn't limited to manufacturing; it also extends to research, development, and the supporting infrastructure needed for a green economy.

-

Technological Innovation: Clean energy taxes can act as a catalyst for technological innovation. By making renewable energy sources more competitive, these policies incentivize research and development, leading to advancements in efficiency and cost reduction. This ultimately benefits consumers through lower energy prices and a more reliable energy grid.

-

Reduced Healthcare Costs: The transition to clean energy also promises significant public health benefits. Reduced air pollution from fossil fuels leads to lower rates of respiratory illnesses and other health problems, translating into substantial savings in healthcare costs. This positive externality is often overlooked in purely economic analyses.

-

Increased Global Competitiveness: As the global transition to clean energy accelerates, countries that fail to adapt risk falling behind economically. By investing in renewable energy, the US can maintain its competitiveness in the global marketplace and attract foreign investment in green technologies.

The Counterargument: Potential Economic Drawbacks

Opponents of clean energy taxes raise several concerns:

-

Increased Energy Costs: A significant concern is the potential for increased energy costs for consumers and businesses. While the long-term benefits of clean energy may outweigh these costs, the short-term impact could be substantial, especially for low-income households and energy-intensive industries.

-

Job Losses in Fossil Fuel Industries: The transition to clean energy inevitably leads to job losses in the fossil fuel industry. While new jobs will be created in the renewable energy sector, ensuring a just transition for displaced workers is crucial to mitigate negative social and economic consequences. Retraining programs and economic diversification strategies are essential in addressing this challenge.

-

Potential for Tax Increases: The revenue generated from carbon taxes or other clean energy taxes could be used to offset other taxes or fund social programs. However, the potential for increased taxes on consumers remains a significant concern for many.

-

Uncertainty and Market Volatility: The transition to a clean energy economy is inherently uncertain. Fluctuations in the price of renewable energy resources and technological advancements can lead to market volatility, creating challenges for businesses and investors.

Finding a Balance: A Path Forward

The ultimate impact of clean energy taxes on the American economy depends on several factors, including the design of the policies, the pace of the transition, and the implementation of effective mitigation strategies. A well-designed policy framework should focus on:

-

Phased Implementation: A gradual transition to clean energy allows businesses and consumers to adapt to changing conditions, minimizing the negative impacts of increased energy costs.

-

Investment in Workforce Development: Investing in retraining and education programs for workers displaced from the fossil fuel industry is crucial for ensuring a just transition to a green economy.

-

Targeted Support for Vulnerable Communities: Policies should include measures to protect low-income households and vulnerable communities from the potential negative impacts of increased energy costs.

-

Collaboration and Public Engagement: Open dialogue and collaboration among stakeholders are essential for building consensus and ensuring the successful implementation of clean energy policies.

In conclusion, the question of whether clean energy taxes will boost or hurt the American economy is not a simple yes or no answer. A careful balance must be struck between the long-term economic benefits of a clean energy transition and the potential short-term costs. Careful planning, effective mitigation strategies, and a commitment to a just transition are vital to maximizing the economic benefits and minimizing the negative impacts. Further research and ongoing dialogue are necessary to fully understand and address the complexities of this critical issue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Taxes Boost Or Hurt The American Economy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

O Neills Injury Sets Back Orioles Cowsers Return Nears

May 19, 2025

O Neills Injury Sets Back Orioles Cowsers Return Nears

May 19, 2025 -

Trump In The Middle East Memorable Images From A Presidential Visit

May 19, 2025

Trump In The Middle East Memorable Images From A Presidential Visit

May 19, 2025 -

Climate Crisis The Unseen Threat To Fertility And Healthy Births

May 19, 2025

Climate Crisis The Unseen Threat To Fertility And Healthy Births

May 19, 2025 -

Trump And Putin To Discuss Ukraine Conflict In Monday Phone Call

May 19, 2025

Trump And Putin To Discuss Ukraine Conflict In Monday Phone Call

May 19, 2025 -

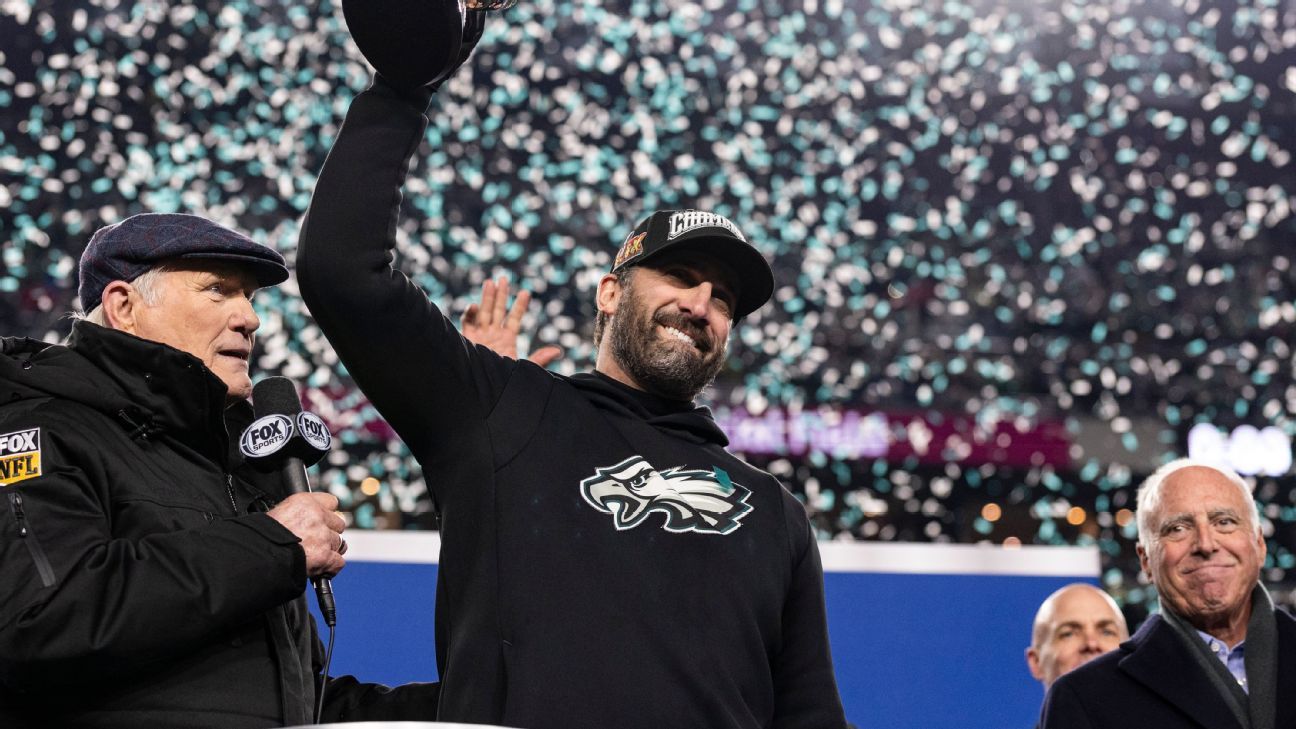

Nick Siriannis Future Secure Philadelphia Eagles Announce Contract Extension

May 19, 2025

Nick Siriannis Future Secure Philadelphia Eagles Announce Contract Extension

May 19, 2025