Will Clean Energy Tax Policy Decide America's Economic Destiny?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Policy Decide America's Economic Destiny?

The future of the American economy is inextricably linked to its energy future. As the world grapples with climate change and the urgent need for decarbonization, the tax policies surrounding clean energy are no longer a niche political debate; they are a defining factor in America's economic destiny. The choices made today will shape industries, jobs, and global competitiveness for decades to come.

The Stakes are High: Economic Growth vs. Environmental Responsibility

The tension is palpable. Proponents of robust clean energy tax incentives argue that investing in renewables like solar, wind, and geothermal is not just environmentally responsible but also economically advantageous. They point to the potential for millions of high-paying jobs in manufacturing, installation, and maintenance, alongside a burgeoning green technology sector. Furthermore, a shift towards cleaner energy sources can reduce reliance on volatile fossil fuel markets, enhancing energy security and national resilience. The Inflation Reduction Act (IRA), for example, offers substantial tax credits for clean energy investments, aiming to stimulate this growth.

However, critics raise concerns about the economic burden of transitioning away from established fossil fuel industries. They argue that aggressive tax policies favoring renewables could lead to job losses in the traditional energy sector and potentially increase energy prices for consumers in the short term. The debate often centers on the speed and scale of the transition, with disagreements about the optimal balance between environmental goals and economic stability.

Analyzing the Impact of Key Tax Policies

Several key tax policies are at the heart of this debate:

-

Tax Credits for Renewable Energy: The IRA's generous tax credits for solar, wind, and other renewable energy sources are a prime example of incentivizing clean energy adoption. These credits aim to make renewable energy more competitive with fossil fuels, driving investment and innovation. However, their long-term effectiveness and potential for unintended consequences require careful monitoring.

-

Carbon Tax vs. Cap-and-Trade: The discussion around carbon pricing mechanisms—either a carbon tax or a cap-and-trade system—remains contentious. A carbon tax directly levies a fee on carbon emissions, incentivizing businesses to reduce their carbon footprint. Cap-and-trade systems, on the other hand, set a limit on emissions and allow companies to buy and sell emission permits. Both approaches have potential economic impacts, influencing production costs and potentially leading to higher prices for carbon-intensive goods.

-

Investment Tax Credits for Green Technologies: Beyond renewable energy generation, tax incentives are also crucial for fostering innovation in other green technologies, such as energy storage, carbon capture, and energy-efficient building materials. These investments are essential for creating a truly sustainable energy future.

Navigating the Path Forward: A Balanced Approach is Crucial

The path towards a clean energy future requires a carefully calibrated approach that balances environmental goals with economic realities. A rushed transition could disrupt industries and lead to unintended economic consequences. Conversely, a slow and hesitant approach risks jeopardizing America's ability to compete in the global green economy.

The need for a comprehensive analysis is undeniable. Independent research institutions and government agencies must continue to monitor the impact of these policies, providing data-driven insights to inform future decision-making. Transparency and open dialogue are crucial to building public consensus and ensuring a just and equitable transition. The future of American prosperity hinges on getting this balance right. Ignoring the intertwined nature of economic and environmental policy will have far-reaching consequences.

Call to Action: Stay informed about the evolving clean energy landscape and engage in constructive discussions about the economic implications of different policy choices. Your voice matters in shaping America's energy future and its economic destiny.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Policy Decide America's Economic Destiny?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tomorrows Matchup Ohio State Battles For Knoxville Regional Victory

May 19, 2025

Tomorrows Matchup Ohio State Battles For Knoxville Regional Victory

May 19, 2025 -

Orioles O Neill Suffers Setback Cowser Nears Return

May 19, 2025

Orioles O Neill Suffers Setback Cowser Nears Return

May 19, 2025 -

Marsh Markram Power Srh To 206 Lsg Faces Must Win Situation

May 19, 2025

Marsh Markram Power Srh To 206 Lsg Faces Must Win Situation

May 19, 2025 -

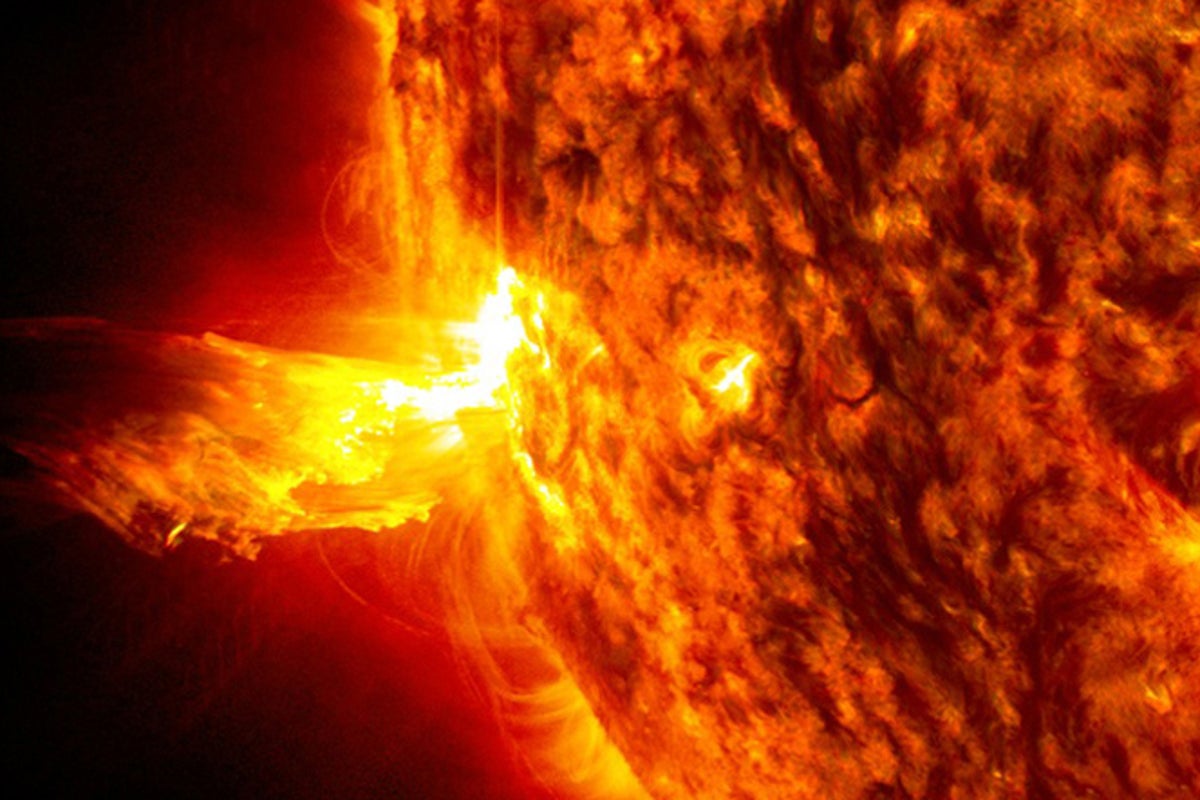

Are We Prepared Nasa Forecasts Major Solar Flares Possible Power Outages

May 19, 2025

Are We Prepared Nasa Forecasts Major Solar Flares Possible Power Outages

May 19, 2025 -

Ncaa Softball Knoxville Regional Final Tennessee Vs Ohio State Where To Watch

May 19, 2025

Ncaa Softball Knoxville Regional Final Tennessee Vs Ohio State Where To Watch

May 19, 2025