Will Clean Energy Tax Policies Drive Or Detract From US Economic Prosperity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Policies Drive or Detract from US Economic Prosperity?

The Biden administration's ambitious clean energy agenda, fueled by significant tax policies, has ignited a fierce debate: will these initiatives boost or hinder US economic prosperity? The answer, as with most complex economic questions, isn't simple and depends heavily on perspective and the timeframe considered. While proponents highlight job creation and long-term sustainability, critics raise concerns about potential short-term costs and competitiveness.

The Promise of Green Jobs and Innovation:

Proponents argue that investing in clean energy through tax credits, incentives, and deductions stimulates economic growth. The Inflation Reduction Act (IRA), for example, allocates billions to renewable energy projects, electric vehicle (EV) manufacturing, and energy efficiency upgrades. This massive investment is projected to create hundreds of thousands of high-paying jobs in manufacturing, installation, maintenance, and research & development. These aren't just low-skill jobs; the clean energy sector demands skilled technicians, engineers, and scientists, driving innovation and technological advancements.

Furthermore, the transition to clean energy fosters innovation across various sectors. Companies are developing cutting-edge technologies in solar, wind, battery storage, and smart grids, creating new markets and attracting both domestic and foreign investment. This increased competition can lead to lower energy prices in the long run, benefiting consumers and businesses alike.

Concerns about Economic Costs and Global Competitiveness:

Opponents, however, express concerns about the economic burden of these policies. The substantial government spending required raises questions about the potential impact on the national debt and inflation. Some argue that the tax incentives disproportionately benefit specific industries or regions, creating winners and losers within the economy. There are also worries about the potential for increased energy costs in the short term, impacting businesses and households.

Another critical concern revolves around global competitiveness. If the US aggressively pursues clean energy policies while other nations lag, there's a risk of losing manufacturing jobs to countries with less stringent environmental regulations. This could lead to a decline in US manufacturing output and a trade deficit.

A Balanced Perspective: Navigating the Challenges and Opportunities:

The debate isn't about whether to embrace clean energy; it's about how to do it effectively. A balanced approach requires careful consideration of several factors:

- Phased Implementation: Gradual implementation allows the economy to adjust, minimizing disruptions and mitigating potential negative impacts.

- Targeted Incentives: Focusing incentives on technologies with the highest potential for growth and job creation maximizes the economic return on investment.

- Infrastructure Development: Investing in necessary infrastructure, such as transmission lines and charging stations, is crucial to support the widespread adoption of renewable energy.

- Worker Retraining Programs: Providing retraining opportunities for workers displaced from fossil fuel industries is vital to ensure a just transition to a clean energy economy.

- International Cooperation: Collaborating with other nations to establish global standards and avoid a "race to the bottom" in environmental regulations is essential.

Conclusion:

The economic impact of clean energy tax policies is complex and multifaceted. While the potential for job creation, innovation, and long-term economic benefits is significant, navigating the challenges of short-term costs, global competitiveness, and equitable implementation is crucial. A well-designed and strategically implemented policy framework can maximize the economic advantages while minimizing the risks, ensuring that clean energy initiatives contribute positively to US economic prosperity. Further research and data analysis will be crucial in evaluating the success of these policies and adapting them to achieve the desired outcomes. The ongoing debate underscores the need for informed public discourse and evidence-based policymaking to guide the nation's transition to a sustainable energy future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Policies Drive Or Detract From US Economic Prosperity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

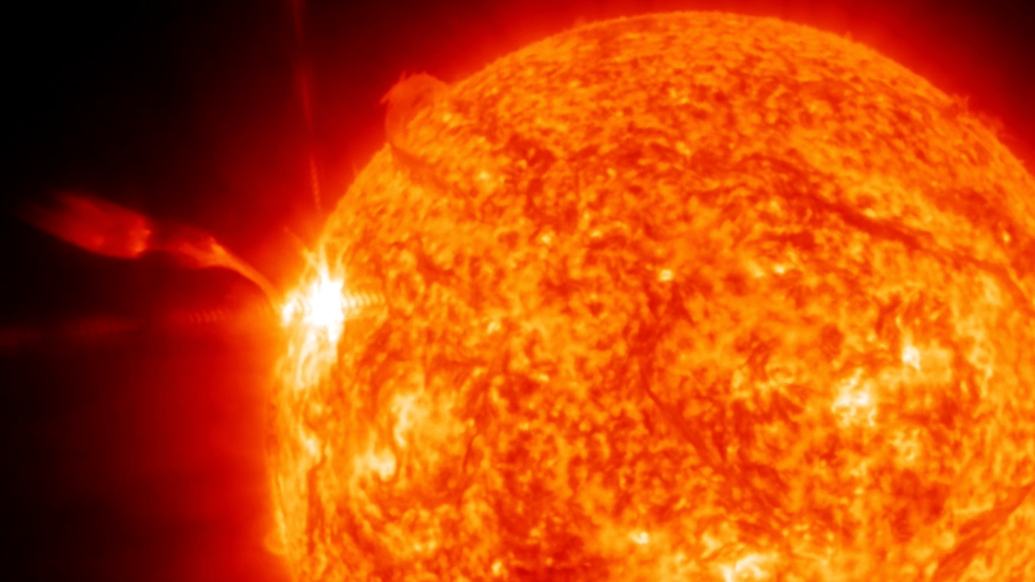

Sun Erupts Strongest Solar Flare Of 2025 Impacts Global Communications

May 19, 2025

Sun Erupts Strongest Solar Flare Of 2025 Impacts Global Communications

May 19, 2025 -

May 16 2025 Maryland Lottery Mega Millions And Pick 3 Winning Numbers

May 19, 2025

May 16 2025 Maryland Lottery Mega Millions And Pick 3 Winning Numbers

May 19, 2025 -

Pope Leo Calls For World Peace And Unity In Inaugural Address

May 19, 2025

Pope Leo Calls For World Peace And Unity In Inaugural Address

May 19, 2025 -

Sun Team Notebook Roster Analysis Starting Lineup Predictions And Season Outlook

May 19, 2025

Sun Team Notebook Roster Analysis Starting Lineup Predictions And Season Outlook

May 19, 2025 -

Is Star Wars Battlefronts Return A Sign Of Things To Come

May 19, 2025

Is Star Wars Battlefronts Return A Sign Of Things To Come

May 19, 2025