Will Clean Energy Tax Policies Boost Or Hurt The US Economy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Policies Boost or Hurt the US Economy? A Complex Question with Significant Implications

The debate surrounding clean energy tax policies and their economic impact on the United States is heating up. Are these policies a catalyst for growth and innovation, or a drag on the economy, potentially harming jobs and hindering competitiveness? The answer, unfortunately, isn't straightforward. It's a complex issue with both proponents and opponents presenting compelling arguments. This article delves into the intricacies of this debate, exploring the potential benefits and drawbacks of incentivizing clean energy through tax policies.

The Argument for Economic Boost: Jobs, Innovation, and Global Competitiveness

Supporters of clean energy tax policies, such as the Investment Tax Credit (ITC) for solar and wind energy, argue that these incentives are crucial for driving economic growth. The core argument centers around several key points:

-

Job Creation: The clean energy sector is a significant job creator. Tax credits stimulate investment in renewable energy infrastructure, leading to the creation of manufacturing, installation, and maintenance jobs. A recent study by the National Renewable Energy Laboratory (NREL) [link to NREL study if available] highlights the substantial employment potential within the sector.

-

Technological Innovation: Government support fosters innovation. Tax incentives encourage research and development in renewable energy technologies, leading to breakthroughs in efficiency and cost reduction. This innovation spills over into related industries, creating a ripple effect of economic growth.

-

Global Competitiveness: As the world transitions to a cleaner energy future, countries that invest heavily in renewable energy technologies gain a competitive advantage. By incentivizing clean energy through tax policies, the US can maintain its position as a global leader in technological innovation and attract foreign investment.

-

Reduced Healthcare Costs: The shift to cleaner energy sources can lead to a reduction in healthcare costs associated with air pollution-related illnesses, offering a significant long-term economic benefit.

The Counterarguments: Potential Costs and Economic Disruptions

Critics of these policies raise concerns about potential negative economic consequences:

-

Increased Energy Costs: Some argue that the transition to clean energy will inevitably lead to higher energy costs for consumers and businesses, potentially impacting economic competitiveness. However, proponents counter this by pointing to decreasing costs of renewable energy technologies and the long-term savings associated with reduced reliance on fossil fuels.

-

Job Displacement in Traditional Industries: The shift away from fossil fuels could lead to job losses in the coal, oil, and gas industries. However, proponents argue that job creation in the clean energy sector will outweigh job losses in traditional industries, especially with effective retraining and reskilling programs.

-

Taxpayer Burden: The cost of tax incentives for clean energy is ultimately borne by taxpayers. Critics argue that these incentives could be better allocated to other areas of the economy. However, proponents highlight the long-term economic benefits and the potential for reduced healthcare and environmental cleanup costs.

-

Market Distortion: Some argue that government intervention through tax policies distorts the free market, potentially hindering efficient resource allocation.

Conclusion: A Balanced Approach is Key

The economic impact of clean energy tax policies is a complex issue with no easy answers. While there are potential downsides, the potential for job creation, technological innovation, and enhanced global competitiveness is significant. A balanced approach is crucial, ensuring that policies are carefully designed to maximize benefits while minimizing potential negative consequences. This includes investing in workforce retraining, supporting communities affected by the transition, and fostering a robust and competitive clean energy market. Further research and ongoing monitoring are essential to fully understand the long-term economic implications of these policies. The future of the US economy may well depend on navigating this complex landscape successfully.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Policies Boost Or Hurt The US Economy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

League Of Legends 2025 Hall Of Famer Revealed By Riot Price Concerns For Skin

May 21, 2025

League Of Legends 2025 Hall Of Famer Revealed By Riot Price Concerns For Skin

May 21, 2025 -

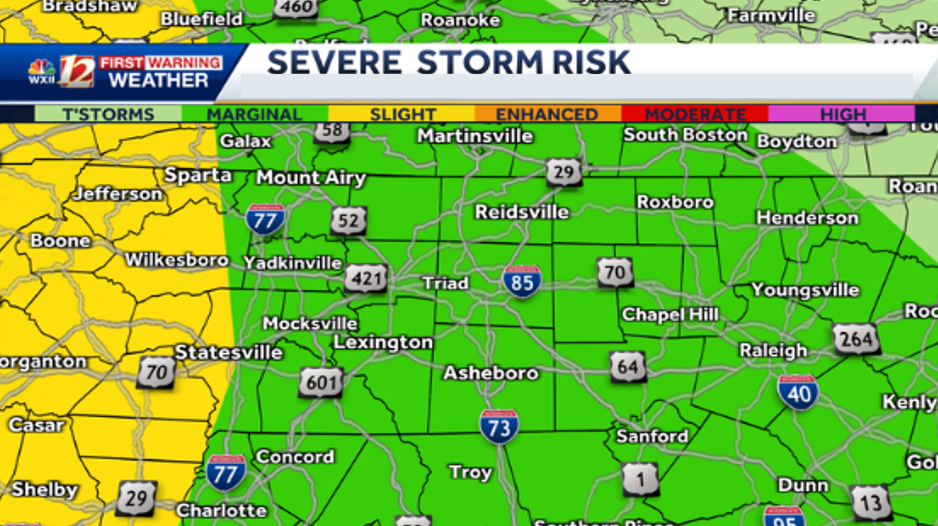

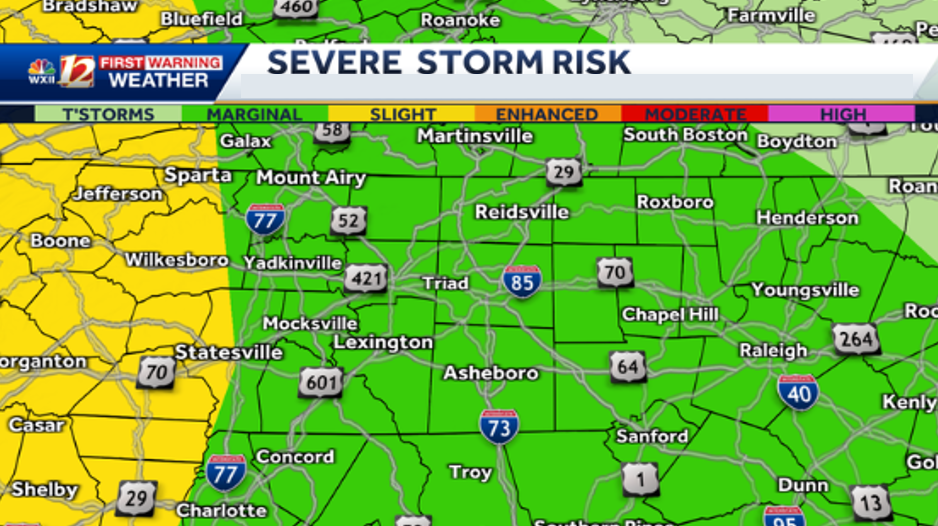

Overnight Storms Bring Severe Weather Risk To North Carolina Stay Alert

May 21, 2025

Overnight Storms Bring Severe Weather Risk To North Carolina Stay Alert

May 21, 2025 -

Death Toll Rises As Tornadoes Pummel Midwest And South

May 21, 2025

Death Toll Rises As Tornadoes Pummel Midwest And South

May 21, 2025 -

Rain And Severe Storms Expected Overnight Across North Carolina

May 21, 2025

Rain And Severe Storms Expected Overnight Across North Carolina

May 21, 2025 -

A J Perez Discusses The Fallout Threats Untold And Brett Favres Legacy

May 21, 2025

A J Perez Discusses The Fallout Threats Untold And Brett Favres Legacy

May 21, 2025