Will Clean Energy Tax Policies Boost Or Hinder US Economic Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Policies Boost or Hinder US Economic Growth? A Complex Equation

The Biden administration's ambitious climate agenda, heavily reliant on clean energy tax policies, has ignited a fierce debate: will these policies stimulate or stifle US economic growth? The answer, as with most complex economic questions, isn't a simple yes or no. It's a nuanced equation involving job creation, technological innovation, and the potential for short-term economic adjustments.

The Argument for Economic Growth:

Proponents argue that investing in clean energy technologies represents a significant economic opportunity. The transition to renewable energy sources like solar and wind power is expected to generate substantial job growth. The International Renewable Energy Agency (IRENA) estimates that the renewable energy sector could support nearly 42 million jobs globally by 2030. This job creation isn't limited to manufacturing and installation; it extends to research and development, finance, and supporting industries.

Furthermore, tax credits and incentives designed to boost clean energy adoption can stimulate technological innovation. Competition for government funding and the promise of lucrative returns can accelerate the development of more efficient and cost-effective renewable energy technologies. This innovation, in turn, can lead to increased productivity and economic growth across various sectors. The rapid decline in the cost of solar energy in recent years serves as a powerful example of this effect.

The Concerns About Economic Hinderance:

Critics, however, express concerns about the potential for short-term economic disruption. The transition away from fossil fuels, a cornerstone of the US economy for decades, could lead to job losses in the traditional energy sector. While proponents highlight the creation of new jobs in renewables, critics argue that these job gains might not fully offset job losses in other sectors, at least in the short term. This transition could also lead to increased energy costs for consumers and businesses, potentially impacting inflation and economic growth.

Moreover, the cost of implementing these policies is a significant factor. Government spending on subsidies and tax credits represents a financial burden that could potentially crowd out other forms of investment or lead to increased national debt. The effectiveness of these policies in achieving their stated environmental goals also remains a subject of ongoing debate.

Finding a Balance: Navigating the Transition:

The key to maximizing the economic benefits of clean energy tax policies lies in careful planning and execution. A well-designed policy framework should prioritize:

- Targeted investments in workforce retraining and education: This will help workers in the fossil fuel industry transition to jobs in the renewable energy sector, minimizing job displacement.

- Investing in infrastructure: Modernizing the grid and developing the necessary infrastructure to support renewable energy sources is crucial for their successful integration into the economy.

- Promoting technological innovation: Continued investment in research and development will ensure that the US remains at the forefront of clean energy technology.

- A phased approach: A gradual transition to clean energy will allow for a smoother adjustment for businesses and workers, minimizing economic disruption.

Conclusion:

The impact of clean energy tax policies on US economic growth is ultimately a complex question with no easy answers. While the potential for job creation and technological innovation is significant, careful management of the transition is essential to mitigate potential negative economic consequences. A balanced approach that prioritizes workforce retraining, infrastructure development, and technological innovation will be key to unlocking the economic benefits of a clean energy future while minimizing disruption. Further research and data analysis will be critical to fully understanding the long-term economic effects of these policies. The ongoing debate necessitates a continuous evaluation and adjustment of policy to optimize economic growth and environmental sustainability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Policies Boost Or Hinder US Economic Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

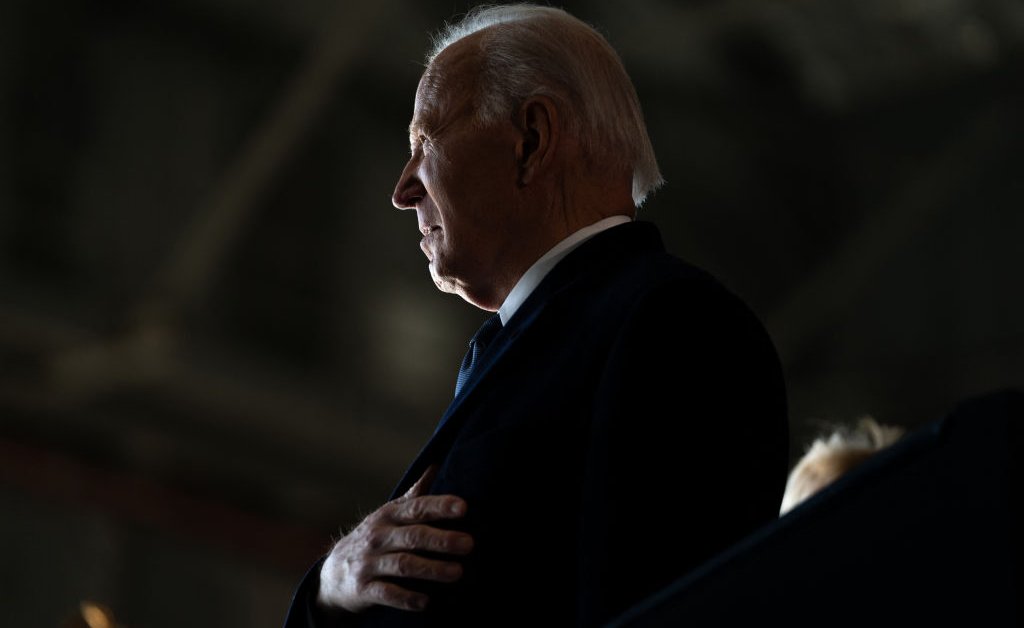

Bidens Cancer Diagnosis Messages Of Hope And Support From World Leaders

May 21, 2025

Bidens Cancer Diagnosis Messages Of Hope And Support From World Leaders

May 21, 2025 -

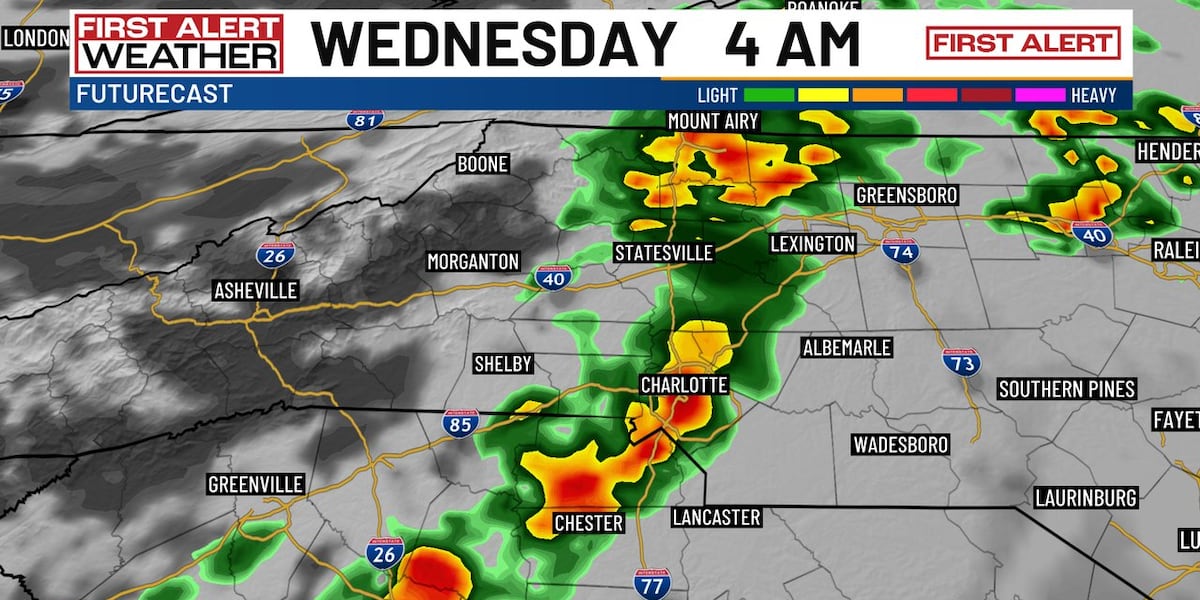

Charlotte Brace For Overnight Storms Cooldown On The Way

May 21, 2025

Charlotte Brace For Overnight Storms Cooldown On The Way

May 21, 2025 -

Untold Brett Favre A J Perez Details Intimidation And The Espn Series Future

May 21, 2025

Untold Brett Favre A J Perez Details Intimidation And The Espn Series Future

May 21, 2025 -

Trump Era Policy Restored Supreme Court Backs Deportation Of Venezuelan Migrants

May 21, 2025

Trump Era Policy Restored Supreme Court Backs Deportation Of Venezuelan Migrants

May 21, 2025 -

Ellen De Generes Social Media Comeback A Powerful Message After Grief

May 21, 2025

Ellen De Generes Social Media Comeback A Powerful Message After Grief

May 21, 2025