Will Clean Energy Tax Policies Boost Or Hamper US Economic Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Policies Boost or Hamper US Economic Growth? A Complex Equation

The Biden administration's ambitious push for clean energy, fueled by significant tax incentives, has sparked a heated debate: will these policies stimulate economic growth or hinder it? The answer, as with most complex economic questions, isn't simple. It depends on a multitude of factors, including implementation, market response, and global economic conditions.

The proponents argue that investing in clean energy technologies creates a virtuous cycle of economic expansion. The argument centers around several key points:

H2: The Case for Growth: Green Jobs and Innovation

-

Job Creation: The transition to renewable energy sources promises a surge in green jobs. From manufacturing solar panels and wind turbines to installing smart grids and developing energy storage solutions, the sector offers a diverse range of employment opportunities. A recent report by the Brookings Institution [link to relevant Brookings report] highlights the potential for millions of new jobs in the clean energy sector. This increased employment translates directly to economic growth through higher wages and increased consumer spending.

-

Technological Innovation: The push for clean energy necessitates significant advancements in technology. This fosters innovation, leading to the development of more efficient and cost-effective solutions. This technological progress can spill over into other sectors, driving productivity gains and overall economic growth. Think of the advancements in battery technology, for instance, impacting not only electric vehicles but also various other industries.

-

Reduced Healthcare Costs: The transition to cleaner energy sources can lead to a reduction in pollution-related illnesses, resulting in lower healthcare costs for individuals and the government. This is a significant indirect benefit to the economy.

H2: The Counterarguments: Transition Costs and Potential Disruptions

Opponents express concerns about the potential negative impacts of these policies:

-

Short-Term Economic Pain: The transition to clean energy requires significant upfront investment. This can lead to short-term economic pain for some industries, particularly those heavily reliant on fossil fuels. Job losses in these sectors are a real concern that needs careful management through retraining programs and investment in new industries.

-

Increased Energy Costs: Depending on implementation, the shift to renewable energy might lead to temporarily higher energy costs for consumers and businesses. This could dampen consumer spending and hinder economic growth if not managed effectively. Careful planning and investment in energy efficiency measures are crucial to mitigate this risk.

-

Global Competitiveness: If the US implements stringent clean energy policies while other countries do not, it could impact the competitiveness of US businesses on the global stage. This potential disadvantage requires careful consideration and strategic policy design.

H2: The Crucial Role of Policy Implementation

The success of clean energy tax policies hinges critically on their effective implementation. This includes:

-

Targeted Incentives: Well-designed tax incentives can attract investment in the right areas, fostering innovation and job growth. However, poorly designed incentives can lead to wasteful spending and unintended consequences.

-

Infrastructure Investment: Significant investment in grid modernization and energy storage is essential to ensure a smooth transition to renewable energy sources. Lack of sufficient infrastructure could hamper the effectiveness of the policies.

-

Worker Retraining Programs: Providing adequate retraining and support for workers displaced from fossil fuel industries is crucial to minimize social and economic disruption during the transition.

H2: Conclusion: A Balanced Approach is Key

The impact of clean energy tax policies on US economic growth is a complex issue with both potential benefits and challenges. While the long-term benefits of a cleaner, more sustainable economy are compelling, careful planning, effective implementation, and a balanced approach are crucial to minimize potential short-term disruptions and maximize the positive economic impact. The ongoing debate requires a nuanced understanding of the various factors at play, promoting a dialogue that considers both the economic and environmental aspects of this crucial transition. Further research and monitoring of the policy's effects will be essential to refine strategies and ensure the most beneficial outcome for the US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Policies Boost Or Hamper US Economic Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Missed Path To Peace Examining Putins Decisions In Ukraine

May 17, 2025

The Missed Path To Peace Examining Putins Decisions In Ukraine

May 17, 2025 -

Watch Liberty Vs Aces Your Free Guide To The 2025 Wnba Season Opener

May 17, 2025

Watch Liberty Vs Aces Your Free Guide To The 2025 Wnba Season Opener

May 17, 2025 -

Manchester United To Upset Chelsea Premier League Predictions And Betting Analysis

May 17, 2025

Manchester United To Upset Chelsea Premier League Predictions And Betting Analysis

May 17, 2025 -

Analyzing Aston Villa Vs Tottenham Key Players Form And Predicted Lineups

May 17, 2025

Analyzing Aston Villa Vs Tottenham Key Players Form And Predicted Lineups

May 17, 2025 -

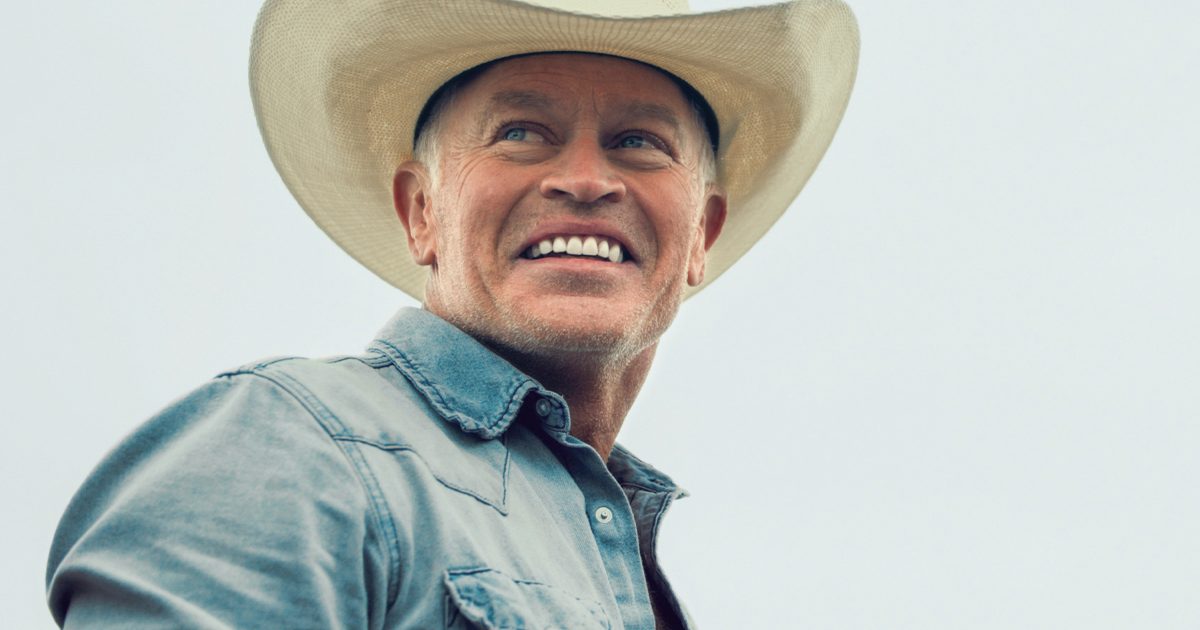

The Last Rodeo George Straits Final Tour A Critics Perspective

May 17, 2025

The Last Rodeo George Straits Final Tour A Critics Perspective

May 17, 2025