Will Clean Energy Tax Incentives Drive Economic Prosperity In America?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Incentives Drive Economic Prosperity in America?

America is at a crossroads. The push for a greener future is colliding with economic realities, and the question on everyone's mind is: can clean energy tax incentives truly drive economic prosperity? The recent surge in government investment in renewable energy sources, spurred by the Inflation Reduction Act (IRA), has ignited a passionate debate. This article delves into the potential economic impacts, exploring both the promising upsides and the potential downsides.

The Allure of Green Growth:

The IRA's hefty tax credits and incentives for renewable energy projects—solar, wind, geothermal, and more—are designed to stimulate a massive expansion of the clean energy sector. Proponents argue this will create a plethora of high-paying jobs, from manufacturing and installation to research and development. This influx of jobs, they claim, will revitalize local economies, particularly in communities traditionally reliant on fossil fuels.

- Job Creation: The clean energy sector is already a significant employer, but the IRA aims to supercharge its growth. Estimates vary, but many analysts predict hundreds of thousands of new jobs across the country. This includes roles in manufacturing solar panels, building wind turbines, and developing advanced energy storage solutions.

- Technological Innovation: Government investment often fuels innovation. The substantial tax incentives incentivize research and development, potentially leading to breakthroughs in renewable energy technologies, making them even more efficient and cost-competitive. This could propel American leadership in the global green technology market.

- Infrastructure Development: The transition to clean energy requires significant upgrades to our national grid and energy infrastructure. This translates into construction jobs, boosting economic activity and improving the overall resilience of our energy systems.

Challenges and Concerns:

While the potential benefits are significant, it's crucial to acknowledge the challenges.

- Supply Chain Issues: The rapid expansion of the clean energy sector may strain existing supply chains, potentially leading to price increases and delays in project completion. Securing reliable and sustainable supply chains for critical raw materials is paramount.

- Regional Disparities: The economic benefits may not be evenly distributed. Some regions may be better positioned to capitalize on the incentives than others, potentially exacerbating existing economic inequalities. Targeted policies are needed to ensure equitable access to the opportunities created by the IRA.

- Transition Costs: Shifting away from fossil fuels necessitates investments in new infrastructure and workforce retraining. These transition costs need careful management to avoid disrupting existing industries and causing economic hardship for workers in the fossil fuel sector.

The International Landscape:

America's push for clean energy is happening against a backdrop of global competition. Other countries are also heavily investing in renewable energy, creating a global race to dominate the burgeoning green technology market. Maintaining a competitive edge will require continuous innovation and strategic policymaking.

Conclusion: A Path to Prosperity?

The success of the clean energy tax incentives in driving economic prosperity hinges on several factors: effective policy implementation, strategic investment, and addressing the potential challenges proactively. While the potential for job creation, technological advancement, and infrastructure development is undeniable, careful planning and equitable distribution of benefits are crucial to ensure the transition to a clean energy economy benefits all Americans. Only time will tell whether these incentives will deliver on their ambitious promise, but the potential for a cleaner and more prosperous future is undeniably significant. Further research and ongoing monitoring of the IRA's impact will be essential in understanding its long-term economic consequences. Stay informed and engage in the conversation – the future of American economic prosperity may depend on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Incentives Drive Economic Prosperity In America?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mens Lacrosse Ncaa Tournament Quarterfinals Full Tv Schedule And Game Times

May 19, 2025

Mens Lacrosse Ncaa Tournament Quarterfinals Full Tv Schedule And Game Times

May 19, 2025 -

Wnba History In The Making Charles Path To All Time Rebounding Record

May 19, 2025

Wnba History In The Making Charles Path To All Time Rebounding Record

May 19, 2025 -

Climate Changes Impact On Fertility And Pregnancy What We Know Now

May 19, 2025

Climate Changes Impact On Fertility And Pregnancy What We Know Now

May 19, 2025 -

Trumps Middle East Tour A Visual Retrospective Of Key Events

May 19, 2025

Trumps Middle East Tour A Visual Retrospective Of Key Events

May 19, 2025 -

Find Out Now Winning Numbers From Sundays Maryland Pick 5 Evening Draw

May 19, 2025

Find Out Now Winning Numbers From Sundays Maryland Pick 5 Evening Draw

May 19, 2025

Latest Posts

-

Spain Cracks Down On Airbnb 65 000 Holiday Rentals Blocked

May 19, 2025

Spain Cracks Down On Airbnb 65 000 Holiday Rentals Blocked

May 19, 2025 -

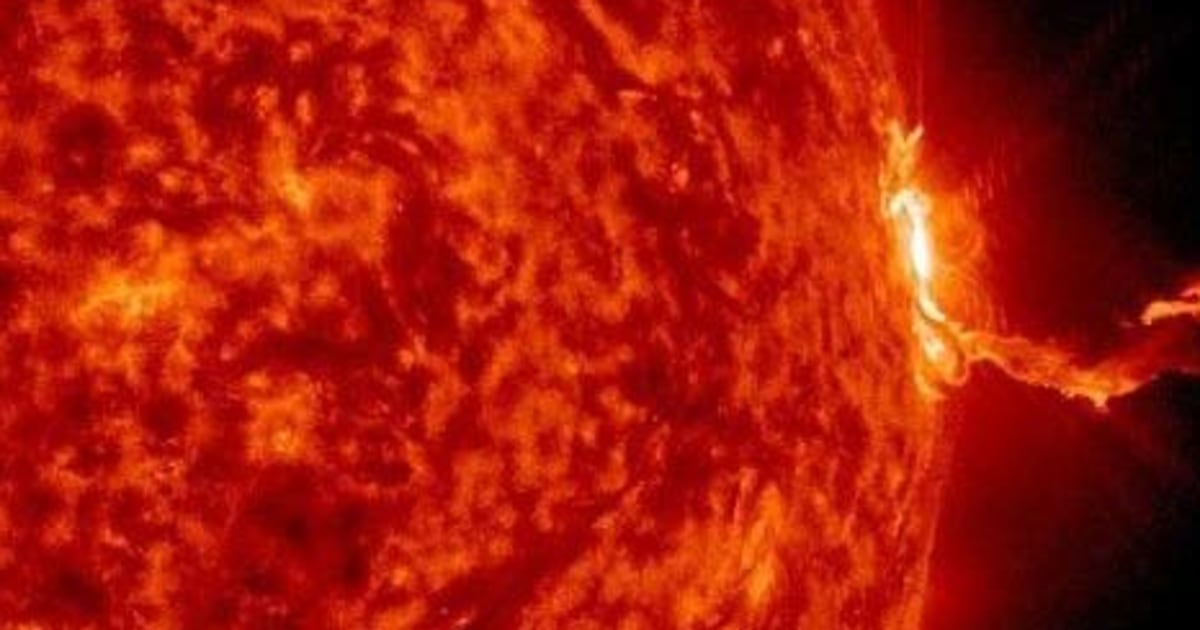

Global Communications Disrupted Massive Solar Storm Impacts Five Continents

May 19, 2025

Global Communications Disrupted Massive Solar Storm Impacts Five Continents

May 19, 2025 -

New Ruling Impacts 65 000 Spanish Holiday Rentals

May 19, 2025

New Ruling Impacts 65 000 Spanish Holiday Rentals

May 19, 2025 -

Major Solar Flare Alert Nasa Predicts Potential Power Grid Failures

May 19, 2025

Major Solar Flare Alert Nasa Predicts Potential Power Grid Failures

May 19, 2025 -

Fashion News Pierpaolo Piccioli Takes The Helm At Balenciaga

May 19, 2025

Fashion News Pierpaolo Piccioli Takes The Helm At Balenciaga

May 19, 2025