Will Clean Energy Tax Incentives Drive Economic Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Incentives Drive Economic Growth? A Deep Dive into the Potential

The push for a greener future is gaining momentum globally, fueled by ambitious climate targets and growing public awareness. A key strategy in this transition is the implementation of clean energy tax incentives, designed to accelerate the adoption of renewable technologies and boost economic activity. But will these incentives truly deliver on their promise of driving significant economic growth? The answer, as we'll explore, is complex and multifaceted.

The Allure of Green Investments:

Governments worldwide are deploying a range of tax incentives, including tax credits, deductions, and accelerated depreciation, to make clean energy projects more attractive to investors. These incentives aim to:

- Reduce upfront costs: Making renewable energy sources like solar, wind, and geothermal more competitive with traditional fossil fuels.

- Stimulate innovation: Encouraging research and development in areas such as battery storage, smart grids, and next-generation renewable technologies.

- Create jobs: The clean energy sector is a significant job creator, encompassing manufacturing, installation, maintenance, and research roles. Incentives can accelerate this job growth.

- Attract investment: Tax breaks can make a country or region more attractive to foreign and domestic investment in the clean energy sector.

Economic Growth: More Than Just Green Shoots

The potential economic benefits extend beyond the direct impact on the clean energy industry itself. A successful transition to clean energy can lead to:

- Improved public health: Reduced air pollution from fossil fuels leads to fewer respiratory illnesses and other health problems, saving healthcare costs.

- Increased energy security: Reducing reliance on imported fossil fuels enhances national energy security and reduces vulnerability to price fluctuations.

- Technological advancements: The drive for clean energy innovation often spills over into other sectors, fostering advancements in materials science, engineering, and data analytics.

Challenges and Considerations:

While the potential is significant, several challenges need addressing:

- Effective policy design: Incentives need to be carefully designed to maximize their impact and avoid unintended consequences. Poorly structured incentives can be inefficient or even counterproductive.

- Equity and accessibility: The benefits of clean energy investments must be broadly shared, ensuring that disadvantaged communities aren't left behind. Policies should address potential job displacement in fossil fuel industries and ensure a just transition for workers.

- Long-term sustainability: The long-term economic viability of clean energy projects is crucial. Incentives should not create unsustainable dependencies on government support.

- Global competition: International competition for clean energy investment requires countries to create attractive and competitive incentive schemes.

Case Studies and Future Outlook:

Several countries have already implemented significant clean energy tax incentives, offering valuable case studies. The success of these initiatives varies, highlighting the importance of well-designed and adaptable policies. For example, [link to a relevant case study, e.g., a report on renewable energy investment in Germany]. Further research is needed to fully understand the long-term economic consequences and optimize strategies for maximum impact.

Conclusion:

Clean energy tax incentives hold significant potential to drive economic growth, creating jobs, stimulating innovation, and improving public health and energy security. However, realizing this potential requires careful policy design, addressing equity concerns, and fostering long-term sustainability. The future of economic growth may well be intertwined with our ability to successfully navigate the transition to a cleaner energy future. Continued monitoring, evaluation, and adaptation of policies will be crucial to maximizing the economic benefits of this vital transition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Incentives Drive Economic Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Putins Assertiveness Underscores Trumps Waning Global Impact

May 21, 2025

Putins Assertiveness Underscores Trumps Waning Global Impact

May 21, 2025 -

Fbi Director Confirms Investigation Into New York Attorney Generals Office

May 21, 2025

Fbi Director Confirms Investigation Into New York Attorney Generals Office

May 21, 2025 -

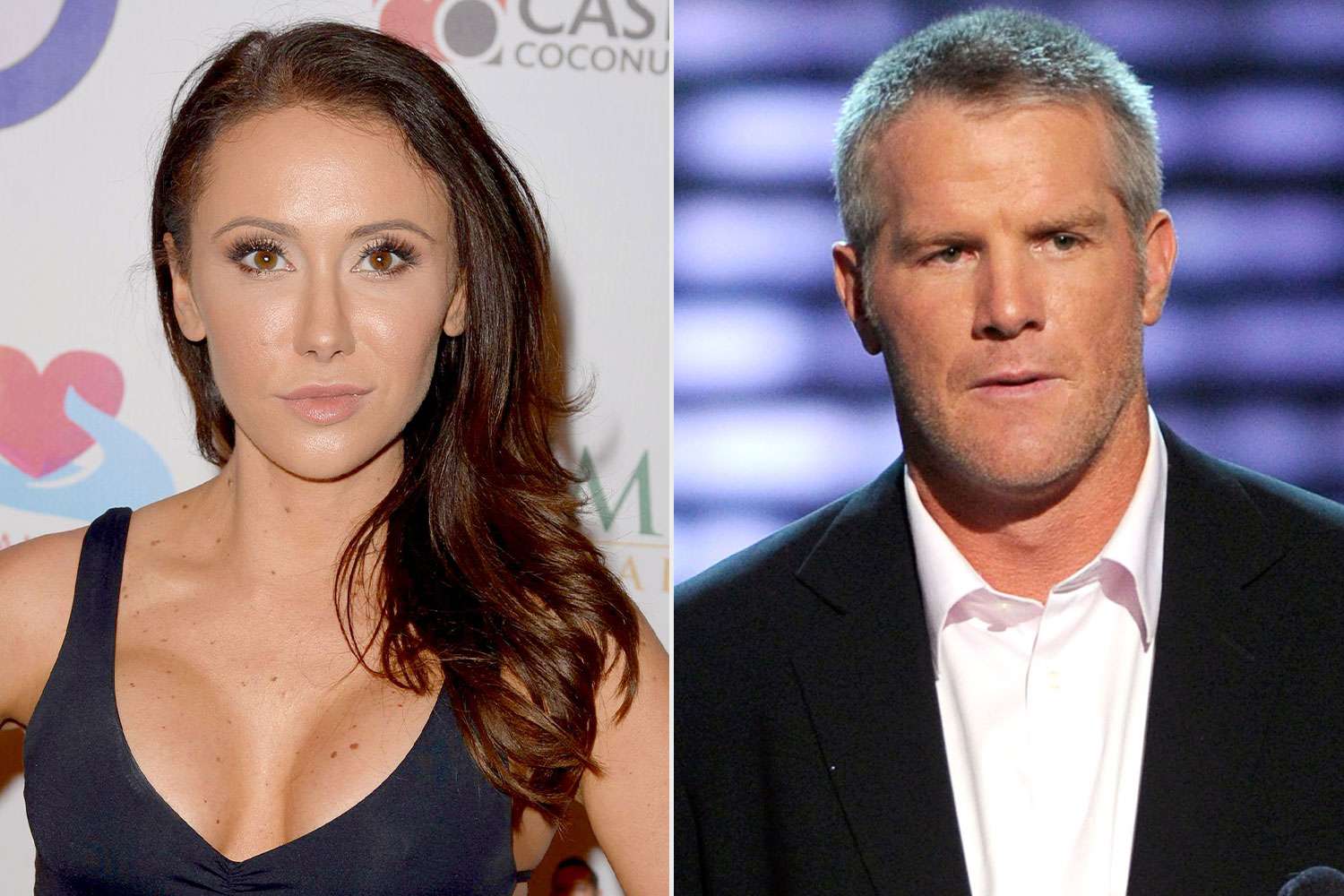

The Brett Favre Sexting Scandal Jenn Stergers Perspective On The Fallout

May 21, 2025

The Brett Favre Sexting Scandal Jenn Stergers Perspective On The Fallout

May 21, 2025 -

Balis Tourism Safety A Joint Effort With International Partners

May 21, 2025

Balis Tourism Safety A Joint Effort With International Partners

May 21, 2025 -

Unlocking Taylor Jenkins Reids Publishing Success Strategies And Insights

May 21, 2025

Unlocking Taylor Jenkins Reids Publishing Success Strategies And Insights

May 21, 2025