Why Your Obamacare Premiums Are About To Increase Dramatically

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Your Obamacare Premiums Are About to Increase Dramatically

Facing a significant jump in your Obamacare premiums? You're not alone. Millions of Americans are bracing for potentially dramatic increases in their health insurance costs under the Affordable Care Act (ACA), also known as Obamacare. This isn't just a minor adjustment; we're talking substantial hikes that could strain household budgets. Understanding the reasons behind these increases is crucial for navigating this challenging situation.

The Perfect Storm: Multiple Factors Fueling Premium Increases

Several interconnected factors contribute to the dramatic rise in Obamacare premiums. It's not a single cause, but rather a perfect storm of economic and political influences.

1. Inflation and Rising Healthcare Costs: The Unshakeable Foundation

The most fundamental driver is the relentless rise in healthcare costs. Inflation impacts everything from hospital stays to prescription drugs, pushing up the overall cost of providing healthcare. This fundamental increase in the cost of medical services directly translates to higher premiums for consumers. The impact of inflation on healthcare is a persistent problem, and experts predict ongoing increases in the foreseeable future.

2. Fewer Insurers Participating in the Marketplaces: Less Competition, Higher Prices

In many states, the number of insurance providers participating in the ACA marketplaces has decreased. This reduced competition leads to less pressure on insurers to keep premiums low. When there are fewer options, insurers have more leverage to set higher prices, directly impacting consumers. This is particularly acute in rural areas and some smaller states where limited provider networks already exist.

3. Increased Demand for Healthcare Services: A Post-Pandemic Reality

The COVID-19 pandemic significantly impacted healthcare utilization and cost. While some procedures were delayed, pent-up demand has since surged, placing additional strain on the healthcare system. This increased demand, combined with lingering pandemic-related expenses, puts further upward pressure on premiums.

4. Political and Legislative Changes: Uncertainty and Instability

Political and legislative changes surrounding the ACA also create uncertainty and impact pricing. Ongoing debates and potential alterations to the law itself create instability in the market, making it difficult for insurers to accurately predict future costs and leading to riskier, higher-priced plans.

What Can You Do? Strategies for Navigating Higher Premiums

Facing increased premiums can be daunting, but there are strategies you can employ to mitigate the impact:

- Shop the Marketplaces Carefully: Don't automatically renew your current plan. Compare plans meticulously on healthcare.gov to find the best coverage at the most affordable price. Consider factors like deductibles, co-pays, and network coverage.

- Explore Subsidies and Tax Credits: The ACA offers subsidies and tax credits to help make healthcare more affordable. Eligibility is based on income, and these credits can significantly reduce your monthly premium. Make sure you understand and utilize these resources.

- Consider a Different Plan: Explore different levels of coverage. A higher deductible plan might offer lower premiums, but be prepared for larger out-of-pocket expenses if you need significant medical care.

- Review Your Healthcare Needs: Assess your current healthcare utilization. If you're relatively healthy, a high-deductible plan with a Health Savings Account (HSA) might be a cost-effective option.

Looking Ahead: The Future of Obamacare Premiums

The future of Obamacare premiums remains uncertain. The factors driving these increases are complex and intertwined. Continued monitoring of healthcare costs, insurer participation, and legislative changes is crucial for individuals and policymakers alike. Staying informed and actively engaging in the process is vital to ensuring access to affordable healthcare.

Call to Action: Visit healthcare.gov today to compare plans and explore available subsidies. Don't wait until the open enrollment period ends – proactive planning is key to managing your healthcare costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Your Obamacare Premiums Are About To Increase Dramatically. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From E Bay To History One Mans Journey To Verify A Potential Jfk Artifact

Aug 31, 2025

From E Bay To History One Mans Journey To Verify A Potential Jfk Artifact

Aug 31, 2025 -

Un General Assembly Looms U S Revokes Visas Of Palestinian Officials

Aug 31, 2025

Un General Assembly Looms U S Revokes Visas Of Palestinian Officials

Aug 31, 2025 -

Fbi Issues Urgent Warning New Three Phase Banking Scam Empties Accounts

Aug 31, 2025

Fbi Issues Urgent Warning New Three Phase Banking Scam Empties Accounts

Aug 31, 2025 -

Small Businesses And Private Nonprofits Accessing Drought Relief Funding

Aug 31, 2025

Small Businesses And Private Nonprofits Accessing Drought Relief Funding

Aug 31, 2025 -

New Drought Relief Program Offers Financial Assistance To Small Businesses And Nonprofits

Aug 31, 2025

New Drought Relief Program Offers Financial Assistance To Small Businesses And Nonprofits

Aug 31, 2025

Latest Posts

-

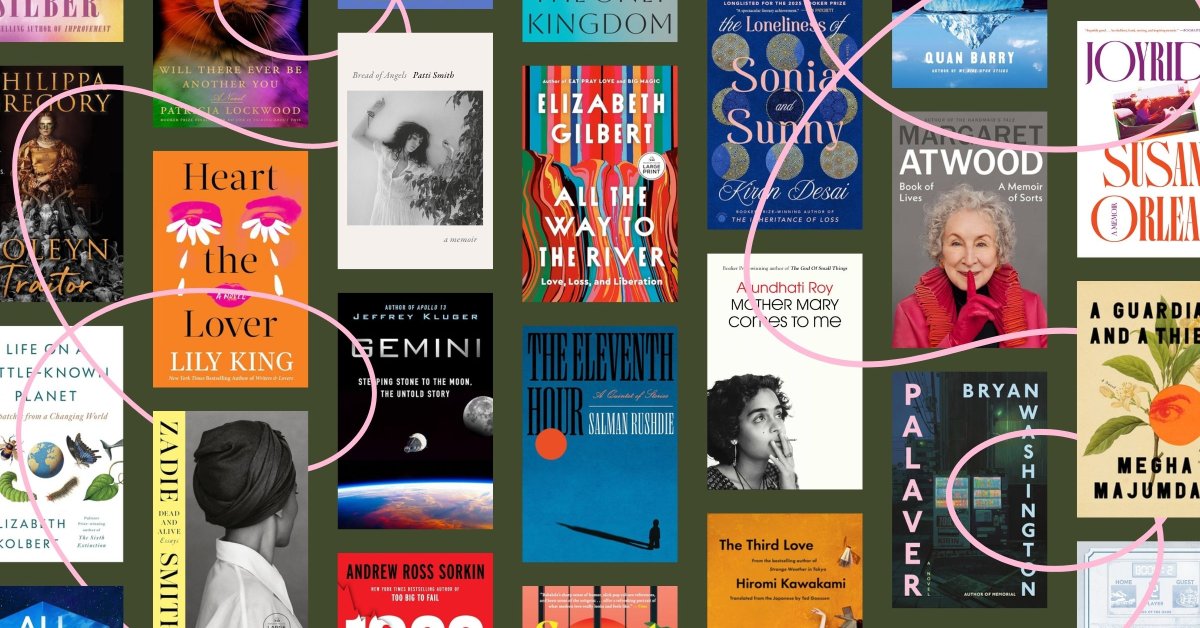

Fall 2025s Must Read Books 24 Highly Anticipated Novels

Sep 04, 2025

Fall 2025s Must Read Books 24 Highly Anticipated Novels

Sep 04, 2025 -

Jackson Oswalt The Boy Who Built A Nuclear Fusion Reactor

Sep 04, 2025

Jackson Oswalt The Boy Who Built A Nuclear Fusion Reactor

Sep 04, 2025 -

Check The Nh Lottery Results Powerball And Lucky For Life Numbers For Sept 1 2025

Sep 04, 2025

Check The Nh Lottery Results Powerball And Lucky For Life Numbers For Sept 1 2025

Sep 04, 2025 -

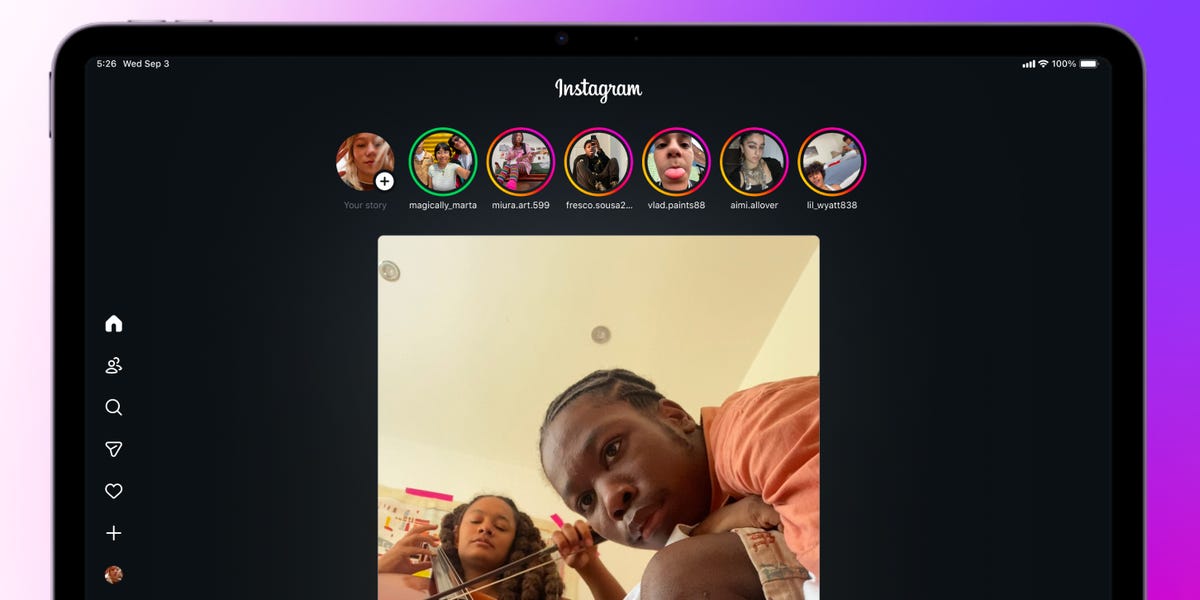

Is Instagrams New I Pad App Worth The Hype

Sep 04, 2025

Is Instagrams New I Pad App Worth The Hype

Sep 04, 2025 -

Desert Receives Unprecedented Precipitation Following Severe Storm

Sep 04, 2025

Desert Receives Unprecedented Precipitation Following Severe Storm

Sep 04, 2025