Why Is Crypto Down Today? A Deep Dive Into The Market Crash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is Crypto Down Today? A Deep Dive into the Market Crash

The cryptocurrency market's volatility is legendary. One day, Bitcoin's soaring; the next, it's plummeting. For those invested in the crypto space, understanding the reasons behind these dramatic swings is crucial. So, why is crypto down today? Let's delve into the potential factors contributing to this recent market crash.

The Interconnected Web of Crypto Influences:

It's rarely a single event that causes a crypto market downturn. Instead, it's usually a confluence of factors, each amplifying the others' effects. Think of it as a complex web, where pulling one thread can unravel the whole thing.

1. Macroeconomic Factors:

-

Inflation and Interest Rates: The Federal Reserve's (and other central banks') actions regarding inflation significantly impact crypto. Higher interest rates generally make riskier assets, like cryptocurrencies, less attractive compared to safer options like bonds. Investors often shift their portfolios towards more conservative investments during periods of economic uncertainty. This "risk-off" sentiment directly affects crypto prices.

-

Global Economic Uncertainty: Geopolitical instability, looming recessions, and other global economic anxieties contribute to a general market downturn, including the crypto market. Investors tend to pull back from riskier investments during uncertain times.

2. Regulatory Uncertainty:

-

Government Crackdowns: Increased regulatory scrutiny and potential government crackdowns on crypto exchanges and activities can severely impact investor confidence. News of stricter regulations often leads to immediate sell-offs.

-

Unclear Legal Frameworks: The lack of clear and consistent regulatory frameworks across different jurisdictions creates uncertainty for investors. This ambiguity can make investors hesitant, leading to decreased market activity and price drops.

3. Market Sentiment and Fear, Uncertainty, and Doubt (FUD):

-

Whale Activity: Large-scale selling by "whales" (individuals or entities holding significant amounts of cryptocurrency) can trigger cascading sell-offs, creating a downward spiral.

-

Negative News and FUD: Negative news cycles, scams, hacks, or even social media-driven narratives can spread fear and uncertainty, leading to panic selling and price drops. FUD is a powerful force in the volatile crypto market.

4. Specific Cryptocurrency Events:

-

Project Failures: The failure or collapse of a prominent cryptocurrency project can have a ripple effect across the entire market. The recent FTX collapse is a prime example of how a single event can trigger widespread negative sentiment.

-

Security Breaches: Major hacks or security breaches on exchanges or DeFi protocols can erode investor trust and lead to a sharp decline in prices.

5. Technical Indicators:

-

Support and Resistance Levels: Cryptocurrency prices often fluctuate around key support and resistance levels. Breaking through these levels can trigger significant price movements, either up or down, depending on the direction of the break.

-

Trading Volume: Decreased trading volume often indicates weakening market interest and can precede a price drop.

What Does This Mean for the Future?

Predicting the future of crypto is impossible. The market's volatility is inherent to its nature. However, staying informed about macroeconomic trends, regulatory developments, and major events within the crypto space is vital for navigating the market successfully. Diversification and careful risk management are essential strategies for any investor in this dynamic market.

Call to Action: Stay updated on the latest news and analyses to make informed decisions. Consider following reputable crypto news sources and engaging in responsible research before making any investment choices. Remember, investing in cryptocurrency involves significant risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is Crypto Down Today? A Deep Dive Into The Market Crash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pentagon Faces Backlash New Journalist Restrictions Spark Intimidation Claims

Sep 23, 2025

Pentagon Faces Backlash New Journalist Restrictions Spark Intimidation Claims

Sep 23, 2025 -

Why Is Sol Ascendent A Deep Dive Into Solar Energys Success

Sep 23, 2025

Why Is Sol Ascendent A Deep Dive Into Solar Energys Success

Sep 23, 2025 -

Nyt Mini Crossword Solution September 22nd Monday

Sep 23, 2025

Nyt Mini Crossword Solution September 22nd Monday

Sep 23, 2025 -

Netflixs Black Rabbit Get To Know The Cast Of Jason Batemans New Thriller

Sep 23, 2025

Netflixs Black Rabbit Get To Know The Cast Of Jason Batemans New Thriller

Sep 23, 2025 -

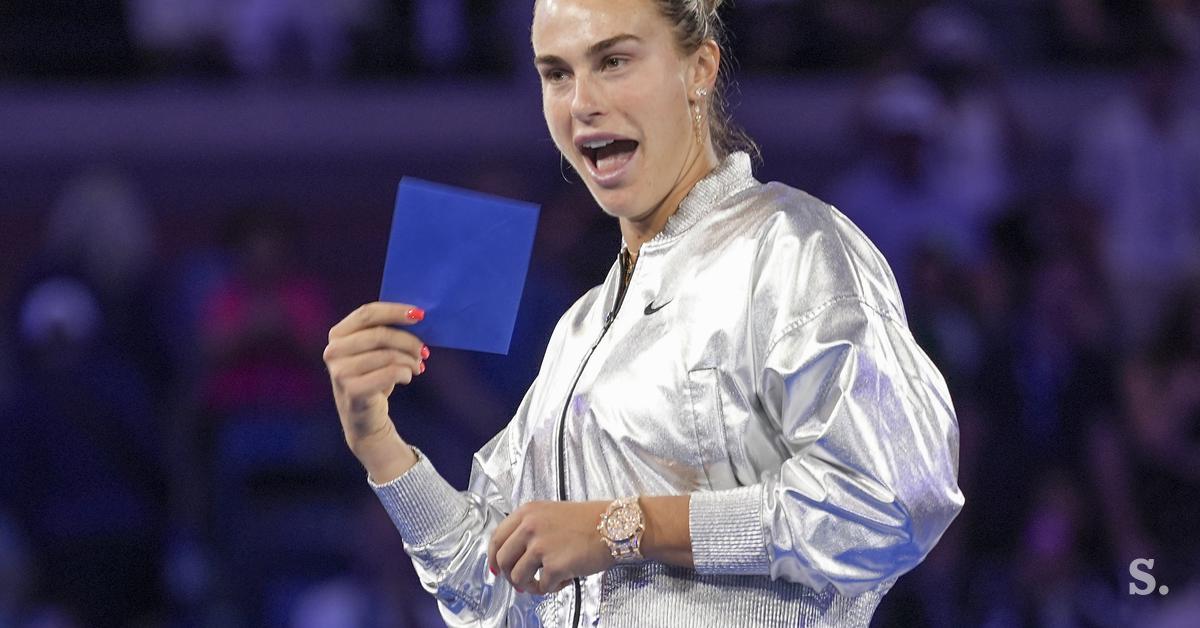

Sabalenka Postane Najboljsa Tenisacica Sveta Erjavec Najboljsa Slovenka

Sep 23, 2025

Sabalenka Postane Najboljsa Tenisacica Sveta Erjavec Najboljsa Slovenka

Sep 23, 2025