Why Did Lucid Stock Fall More Than 4% Today? Investor Concerns Explored

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did Lucid Stock Fall More Than 4% Today? Investor Concerns Explored

Lucid Group (LCID), the electric vehicle (EV) maker, experienced a significant drop of over 4% in its stock price today. This decline sparked immediate speculation amongst investors, prompting a closer look at the underlying factors contributing to this market downturn. While pinpointing a single cause is challenging, several contributing factors are likely at play.

H2: Production Challenges and Delivery Shortfalls:

One major concern consistently weighing on Lucid's stock performance is its production capacity and delivery targets. The company has faced challenges in scaling up production to meet ambitious sales goals. Analysts point to potential bottlenecks in the supply chain, manufacturing hurdles, and difficulties in ramping up production at its Arizona factory as key reasons for the shortfall in vehicle deliveries. This persistent underperformance against projected targets fuels investor uncertainty and contributes to downward pressure on the stock price. Falling short of projected deliveries can significantly impact investor confidence and lead to sell-offs.

H2: The Broader EV Market Slowdown:

The broader electric vehicle market is currently experiencing a period of slower growth than initially anticipated. Rising interest rates, inflation, and a potential economic slowdown are all contributing factors. This broader market trend impacts all EV manufacturers, including Lucid, exacerbating the negative sentiment surrounding the company's individual challenges. The overall market climate plays a crucial role in investor sentiment, and a bearish market environment can amplify even minor negative news.

H3: Competition in the Luxury EV Segment:

Lucid operates in the highly competitive luxury EV segment, facing stiff competition from established players like Tesla, and emerging rivals. This competitive landscape means Lucid needs to consistently innovate and deliver exceptional products to maintain market share and attract investors. Failure to differentiate effectively or meet consumer expectations can result in decreased sales and subsequently impact stock performance.

H2: Financial Performance and Future Outlook:

Lucid's financial performance, particularly profitability, remains a key concern for investors. The company is currently operating at a loss, and achieving profitability is a critical milestone for long-term sustainability and investor confidence. Any perceived weakness in the company's financial outlook or concerns about its ability to reach profitability can trigger negative market reactions. Investors carefully scrutinize financial reports and future projections, and any deviation from expectations can significantly impact stock prices.

H2: Analyst Ratings and Price Target Adjustments:

Changes in analyst ratings and price target adjustments can also significantly influence stock prices. Negative revisions in analyst forecasts or downgrades in ratings often lead to sell-offs. It's crucial to consider the consensus view among financial analysts when analyzing stock market fluctuations. Checking reputable financial news sources for the latest analyst ratings on LCID can provide valuable insights.

H2: What's Next for Lucid Investors?

The recent stock decline highlights the inherent volatility in the EV market and the specific challenges faced by Lucid. Investors should carefully consider the long-term prospects of the company, weighing the potential for future growth against the current headwinds. Diversification of investment portfolios is always a wise strategy to mitigate risk. Staying informed about industry news, analyst reports, and company announcements is crucial for making informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did Lucid Stock Fall More Than 4% Today? Investor Concerns Explored. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Larry Birds Nba Impact Securing His Place Among The All Time Top 6

Sep 02, 2025

Larry Birds Nba Impact Securing His Place Among The All Time Top 6

Sep 02, 2025 -

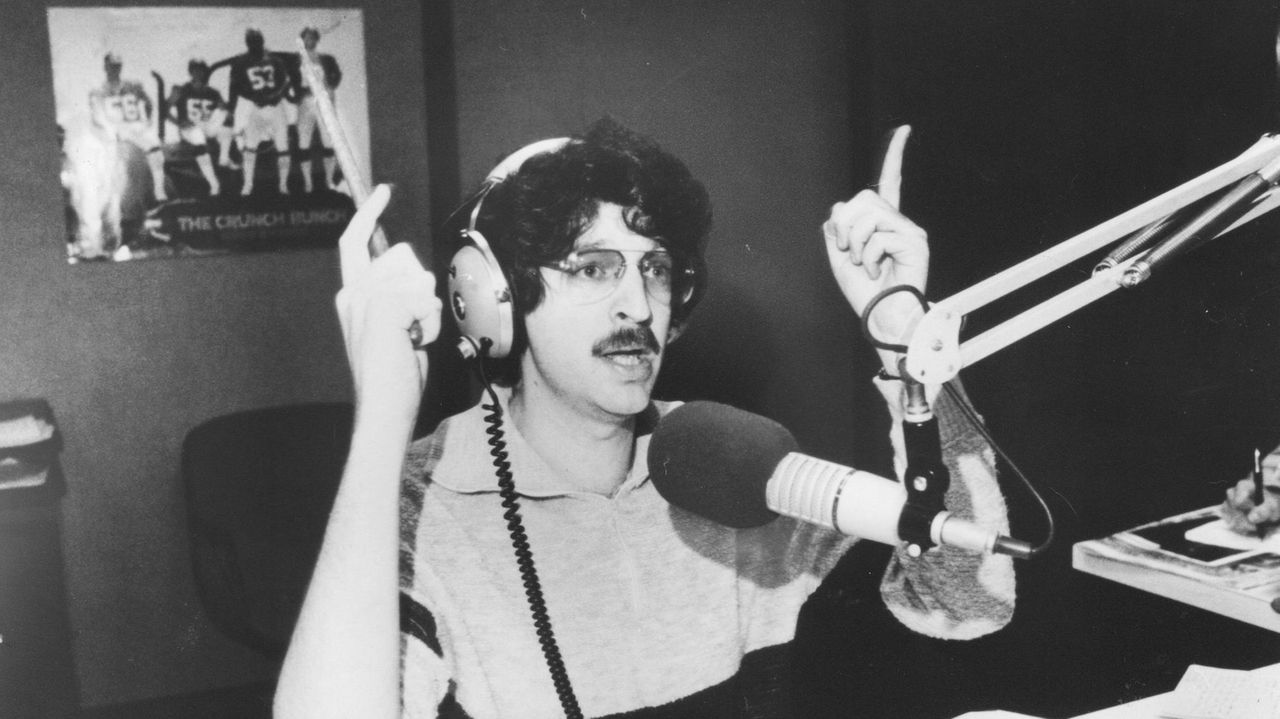

Howard Sterns New York Radio Years A Retrospective

Sep 02, 2025

Howard Sterns New York Radio Years A Retrospective

Sep 02, 2025 -

Shock Jock To Icon Howard Sterns Impact On New York Radio

Sep 02, 2025

Shock Jock To Icon Howard Sterns Impact On New York Radio

Sep 02, 2025 -

Helldivers 2 Into The Unjust Launches September 2nd Prepare For Strategic Warfare

Sep 02, 2025

Helldivers 2 Into The Unjust Launches September 2nd Prepare For Strategic Warfare

Sep 02, 2025 -

Gta Vi Rockstars 300 Million Water Technology Detailed In New Report

Sep 02, 2025

Gta Vi Rockstars 300 Million Water Technology Detailed In New Report

Sep 02, 2025

Latest Posts

-

Man City Sign Donnarumma Ederson Departure To Fenerbahce Confirmed

Sep 02, 2025

Man City Sign Donnarumma Ederson Departure To Fenerbahce Confirmed

Sep 02, 2025 -

Legal Blow To Trump Court Decision On Tariffs And Future Trade Policy

Sep 02, 2025

Legal Blow To Trump Court Decision On Tariffs And Future Trade Policy

Sep 02, 2025 -

Trump Tariffs Major Portion Ruled Illegal Analysis And Outlook

Sep 02, 2025

Trump Tariffs Major Portion Ruled Illegal Analysis And Outlook

Sep 02, 2025 -

Howard Sterns Post Summer Break Absence A Family Matter

Sep 02, 2025

Howard Sterns Post Summer Break Absence A Family Matter

Sep 02, 2025 -

Analyst Price Target For Lucid Group Lcid Stock Reaches 25 94

Sep 02, 2025

Analyst Price Target For Lucid Group Lcid Stock Reaches 25 94

Sep 02, 2025