Why Did Lucid Stock Fall More Than 4% Today?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did Lucid Stock Fall More Than 4% Today? Investors React to Production Miss and Wider Losses

Lucid Group (LCID), the electric vehicle (EV) maker, saw its stock price plummet over 4% today, leaving investors wondering what triggered the sharp decline. While the broader market experienced some volatility, Lucid's drop was significantly steeper, fueled by a combination of factors that cast doubt on the company's near-term prospects.

Production Woes and Widening Losses: The primary culprit behind the stock's fall was the company's latest production figures and financial results. Lucid reported significantly lower-than-expected vehicle production for the second quarter of 2023, failing to meet its previously announced targets. This missed production goal, coupled with widening losses, sent a clear signal to investors that the company is still struggling to ramp up production efficiently and achieve profitability.

Missed Production Targets: A Sign of Deeper Issues? Analysts had anticipated a certain level of production, and Lucid's failure to reach this benchmark raised concerns about potential supply chain bottlenecks, manufacturing inefficiencies, or even underlying demand issues. The production shortfall casts a shadow on the company's ambitious growth plans and its ability to compete effectively in the increasingly crowded EV market. This isn't just about the current quarter; it raises questions about Lucid's long-term production scalability.

<h3>The Impact of Macroeconomic Factors</h3>

Beyond Lucid's internal challenges, macroeconomic factors also played a role in the stock's decline. The current economic climate, with persistent inflation and rising interest rates, is making investors more cautious about growth stocks, particularly those in the EV sector that are still burning through significant cash. This general market sentiment likely contributed to the amplified negative reaction to Lucid's disappointing news.

<h3>Competition Heats Up in the EV Market</h3>

Lucid faces stiff competition from established automakers like Tesla, Ford, and General Motors, as well as other emerging EV players. The intense rivalry for market share puts pressure on Lucid to accelerate its production and improve its cost structure to remain competitive. Investors are clearly scrutinizing Lucid's progress in this increasingly crowded landscape.

<h3>What's Next for Lucid?</h3>

The market reaction underscores the importance of Lucid meeting its future production targets and demonstrating a clear path to profitability. Investors will be closely watching for any updates on production improvements, cost-cutting measures, and strategies to bolster demand. The company's upcoming financial reports and any announcements regarding new models or partnerships will be crucial in determining the future trajectory of its stock price.

Key Takeaways:

- Production Miss: Lucid failed to meet its Q2 2023 production targets.

- Widening Losses: The company reported increased financial losses.

- Macroeconomic Headwinds: The current economic climate is impacting investor sentiment towards growth stocks.

- Intense Competition: Lucid faces a highly competitive EV market.

Looking Ahead: While today's stock drop is significant, it's important to remember that the EV market is dynamic and subject to volatility. Lucid's long-term success will depend on its ability to overcome its current challenges and execute its strategic plan effectively. Investors will be closely watching for signs of improvement in the coming months. For more in-depth analysis on the EV market, consider reading [link to a relevant article on a reputable financial news site].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did Lucid Stock Fall More Than 4% Today?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Protests Against Trump Administration Sweep The Us Key Issues And Locations

Sep 03, 2025

Protests Against Trump Administration Sweep The Us Key Issues And Locations

Sep 03, 2025 -

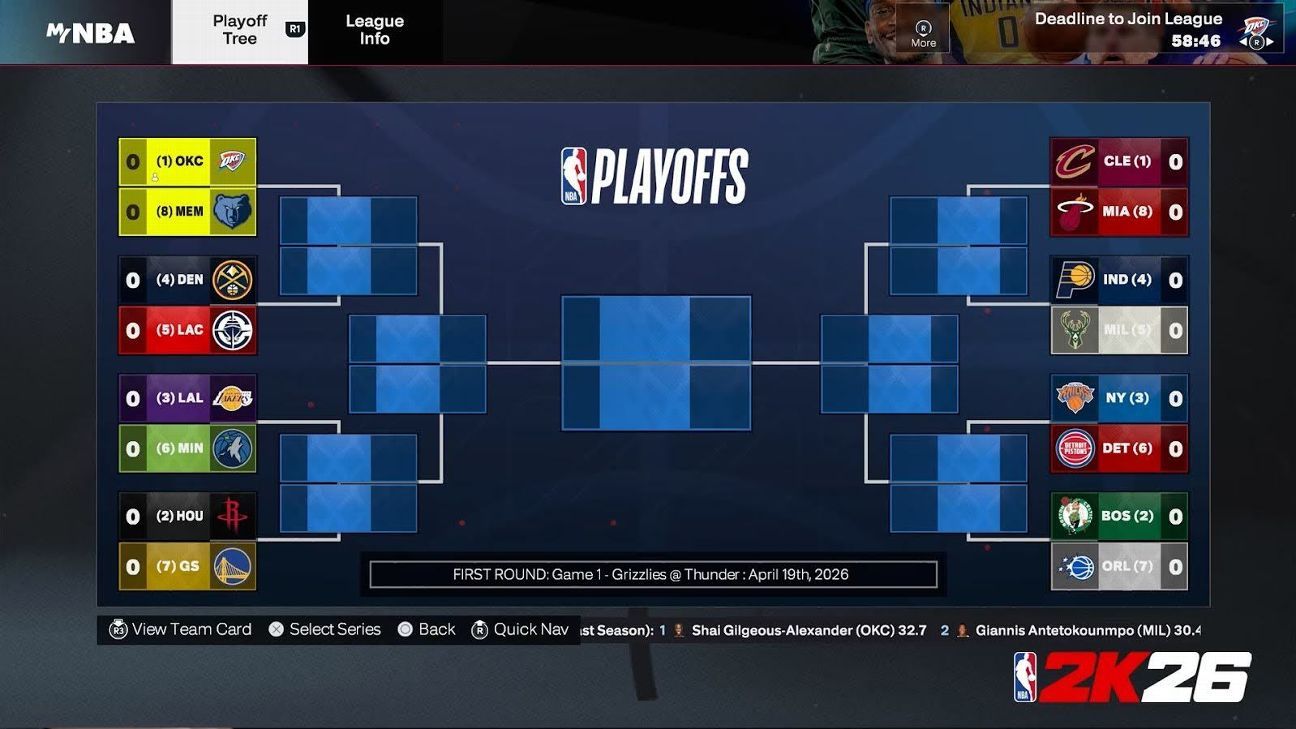

Nba 2 K26 Early Access Details Release Date Editions And Virtual Currency Breakdown

Sep 03, 2025

Nba 2 K26 Early Access Details Release Date Editions And Virtual Currency Breakdown

Sep 03, 2025 -

Nba 2 K26 Significant My Nba And My Gm Changes Announced

Sep 03, 2025

Nba 2 K26 Significant My Nba And My Gm Changes Announced

Sep 03, 2025 -

British Science Festival Liverpool 10 Reasons To Attend

Sep 03, 2025

British Science Festival Liverpool 10 Reasons To Attend

Sep 03, 2025 -

Lucid Group Lcid Stock Brokerage Price Targets And Outlook

Sep 03, 2025

Lucid Group Lcid Stock Brokerage Price Targets And Outlook

Sep 03, 2025

Latest Posts

-

Analysis How Us Tariffs Negated Usmca Gains For Mazda Exports

Sep 03, 2025

Analysis How Us Tariffs Negated Usmca Gains For Mazda Exports

Sep 03, 2025 -

This Christian Influencers Honest Reason For No Longer Attending Church

Sep 03, 2025

This Christian Influencers Honest Reason For No Longer Attending Church

Sep 03, 2025 -

Liverpool One Unveils Spectacular New Light Installation

Sep 03, 2025

Liverpool One Unveils Spectacular New Light Installation

Sep 03, 2025 -

Quinshon Judkins Fantasy Football A Comprehensive Draft Guide

Sep 03, 2025

Quinshon Judkins Fantasy Football A Comprehensive Draft Guide

Sep 03, 2025 -

Drafting Quinshon Judkins Analyzing His Fantasy Football Potential

Sep 03, 2025

Drafting Quinshon Judkins Analyzing His Fantasy Football Potential

Sep 03, 2025