What Sunnova's Bankruptcy Filing Means For Solar Energy Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What Sunnova's Bankruptcy Filing Means for Solar Energy Growth

Sunnova Energy International Inc.'s recent Chapter 11 bankruptcy filing sent shockwaves through the solar industry, raising questions about the future of residential solar growth and the broader renewable energy sector. While the company itself maintains it's restructuring to strengthen its financial position, the event underscores the inherent risks and challenges within the rapidly evolving solar landscape. This article delves into the implications of Sunnova's bankruptcy, examining its potential impact on solar energy growth and the wider market.

Understanding Sunnova's Situation

Sunnova, a prominent player in the residential solar market, cited "significant debt load" as a primary reason for its bankruptcy filing. The company aims to restructure its debt through the Chapter 11 process, aiming for a more sustainable financial future. This move, however, has sparked concern amongst investors and consumers alike, questioning the stability of the residential solar sector and the reliability of solar power purchase agreements (PPAs).

Implications for the Residential Solar Market

Sunnova's bankruptcy could have several significant implications for the residential solar market:

-

Increased Scrutiny of PPAs: Sunnova's reliance on PPAs, a financing model where customers pay for solar energy usage rather than owning the system outright, is now under intense scrutiny. The bankruptcy highlights potential risks associated with PPAs, particularly regarding long-term cost certainty and service guarantees. This might lead to increased caution from consumers and potentially slower adoption rates in the short term.

-

Impact on Investor Confidence: The filing could negatively impact investor confidence in the residential solar sector as a whole. This may result in decreased investment in new projects and potentially hinder the growth of smaller solar companies.

-

Potential for Consolidation: The bankruptcy could trigger a wave of consolidation within the residential solar industry. Larger, more financially stable companies might acquire struggling competitors, leading to a more concentrated market.

-

Focus on Financial Stability: The incident underscores the importance of financial prudence in the solar industry. Companies will likely face increased pressure to demonstrate robust financial planning and risk management strategies to attract investors and customers.

The Broader Context: Solar Energy's Continued Growth

Despite Sunnova's challenges, the overall outlook for solar energy remains positive. The sector continues to experience strong growth globally, driven by factors such as declining solar panel costs, increasing government incentives (like the ), and growing environmental concerns. Sunnova's bankruptcy is a setback, but it's unlikely to derail the long-term trajectory of the solar energy revolution.

What to Expect Moving Forward

While the immediate future might involve market adjustments and a period of uncertainty, the solar industry is resilient. We can expect to see:

- Increased transparency in financing models: Companies will likely focus on providing clearer and more transparent information about their financing options, including PPAs.

- Enhanced due diligence by consumers: Consumers will likely conduct more thorough research before choosing a solar provider, paying closer attention to financial stability and customer reviews.

- Continued innovation and technological advancements: The solar industry is known for its constant innovation. Expect to see further advancements in solar technology, leading to even greater efficiency and cost reductions.

Conclusion: Sunnova's bankruptcy is a significant event, highlighting the risks within the solar industry's rapid expansion. However, it's crucial to view this in the context of the broader, long-term growth of renewable energy. The solar energy market remains robust, and while challenges exist, the transition to a cleaner energy future continues. The key takeaway is the need for financial prudence and transparency to ensure sustainable growth across the sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What Sunnova's Bankruptcy Filing Means For Solar Energy Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

River Plate Vence Urawa Reds Na Copa Do Mundo De Clubes Veja Os Gols

Jun 17, 2025

River Plate Vence Urawa Reds Na Copa Do Mundo De Clubes Veja Os Gols

Jun 17, 2025 -

Chelsea Goal Of The Season 2024 25 Winner Announced

Jun 17, 2025

Chelsea Goal Of The Season 2024 25 Winner Announced

Jun 17, 2025 -

Previsao O Time Do Benfica Para A Primeira Partida Do Mundial De Clubes

Jun 17, 2025

Previsao O Time Do Benfica Para A Primeira Partida Do Mundial De Clubes

Jun 17, 2025 -

Confronto Boca Juniors X Benfica Analise Das Escalacoes E Desfalques 16 06

Jun 17, 2025

Confronto Boca Juniors X Benfica Analise Das Escalacoes E Desfalques 16 06

Jun 17, 2025 -

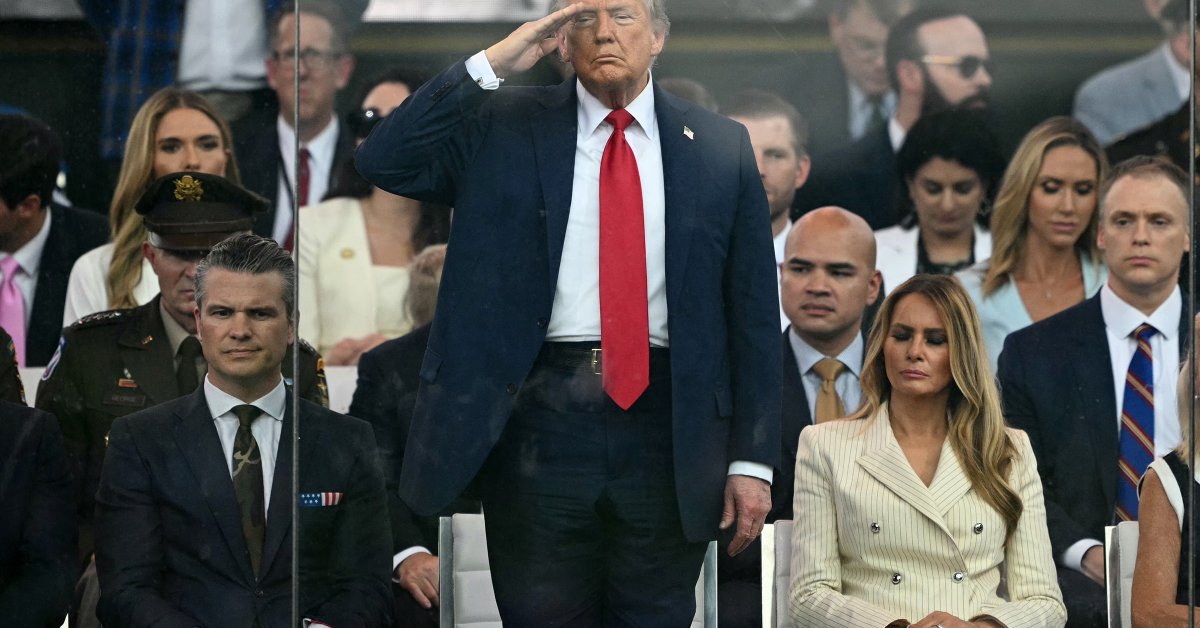

Controversial Military Parade In Washington Trump Faces Widespread Protests

Jun 17, 2025

Controversial Military Parade In Washington Trump Faces Widespread Protests

Jun 17, 2025