Wellington Management's Robinhood (HOOD) Stake Grows: 15,775 Shares Added

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Boosts Robinhood (HOOD) Stake: A Bullish Signal?

Wellington Management, a prominent Boston-based investment firm, has significantly increased its position in Robinhood Markets, Inc. (HOOD), adding a substantial 15,775 shares to its portfolio. This move has sparked renewed interest in the volatile trading app, prompting analysts to reassess the company's prospects. The increased stake signals a potential vote of confidence in Robinhood's future, despite ongoing challenges in the competitive brokerage landscape.

The recent 13F filing reveals Wellington Management now holds a total of 175,060 shares of HOOD, a notable increase that represents a significant commitment to the company. This strategic investment comes at a crucial time for Robinhood, which has been navigating a period of fluctuating stock prices and intense competition from established players like Fidelity and Charles Schwab.

Why the Increased Stake? Decoding Wellington Management's Move

Several factors could explain Wellington Management's decision to bolster its Robinhood investment. One key element is Robinhood's ongoing efforts to diversify its revenue streams beyond trading commissions. The company has been aggressively expanding its offerings, including crypto trading, options trading, and wealth management services. This diversification strategy aims to reduce reliance on trading activity and build a more resilient business model.

-

Diversification Strategy Paying Off?: Analysts suggest that the success of these diversification efforts could be a major factor influencing Wellington's decision. If Robinhood can successfully attract and retain customers across its various offerings, it could significantly improve its long-term profitability and investor confidence.

-

Potential for Growth in Underserved Markets: Robinhood's focus on attracting younger, less affluent investors remains a key differentiator. This underserved market represents a significant growth opportunity, and Wellington Management may be betting on Robinhood's ability to capture a larger share of this demographic.

-

Market Sentiment Shift?: The broader market sentiment towards fintech companies might also be influencing Wellington's decision. After a period of significant downturn, some investors are beginning to see potential for growth in the sector, leading to renewed interest in companies like Robinhood.

Robinhood's Challenges Remain

Despite this positive signal from Wellington Management, Robinhood still faces considerable challenges. The company continues to grapple with regulatory scrutiny and intense competition. Maintaining profitability and attracting and retaining customers in a highly competitive market remains a critical ongoing task. Further, volatility in the broader financial markets could impact Robinhood's performance significantly.

What This Means for Investors

The increased stake by Wellington Management serves as a noteworthy development for Robinhood investors. While not a definitive endorsement, it suggests that at least one major institutional investor sees potential for growth and profitability in the company's future. However, potential investors should conduct thorough due diligence and consider the inherent risks involved in investing in a volatile stock like HOOD.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. Investing in the stock market involves inherent risks, and you could lose money.

Related Articles:

- [Link to a relevant article about Robinhood's financial performance]

- [Link to a relevant article about the competitive landscape of online brokerages]

- [Link to a relevant article about Wellington Management's investment strategy]

Keywords: Robinhood, HOOD, Wellington Management, stock market, investment, fintech, brokerage, trading app, 13F filing, investment strategy, stock price, market volatility, diversification, financial markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management's Robinhood (HOOD) Stake Grows: 15,775 Shares Added. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Delaney Rowe Speaks Out The Truth About Her Relationship With B J Novak

Jun 14, 2025

Delaney Rowe Speaks Out The Truth About Her Relationship With B J Novak

Jun 14, 2025 -

U S Open Sam Burns 65 Fueled By Perfect Final Putt

Jun 14, 2025

U S Open Sam Burns 65 Fueled By Perfect Final Putt

Jun 14, 2025 -

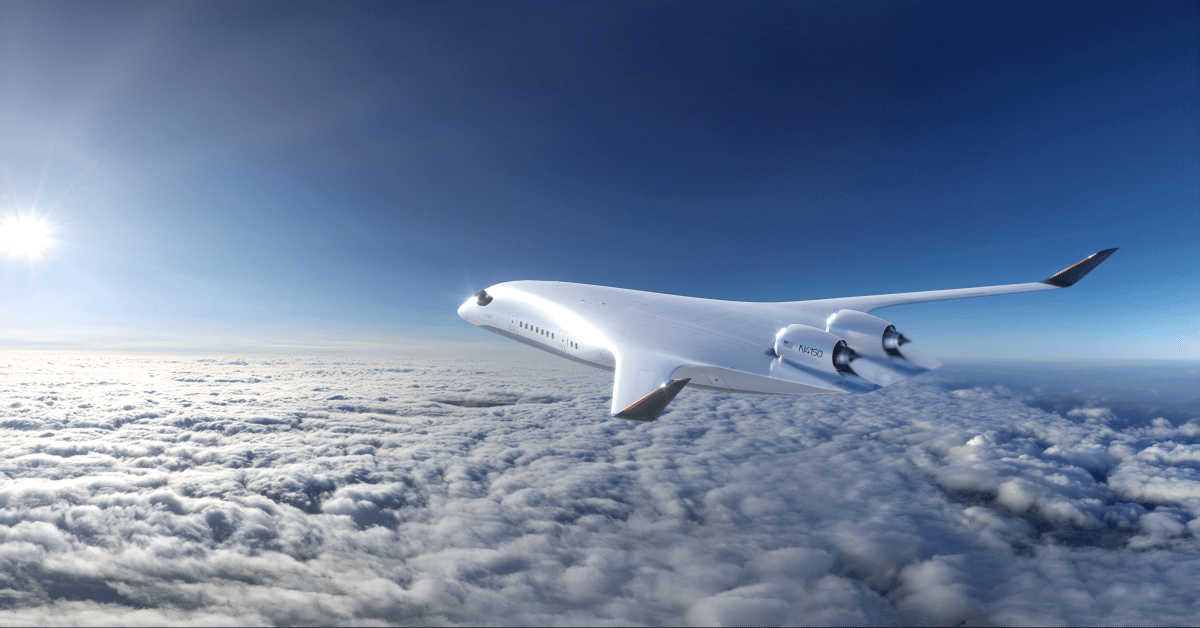

This Companys Game Changing Technology For Low Carbon Air Travel

Jun 14, 2025

This Companys Game Changing Technology For Low Carbon Air Travel

Jun 14, 2025 -

Viral Video Fallout Kittles Strong Support For Deebo Samuel

Jun 14, 2025

Viral Video Fallout Kittles Strong Support For Deebo Samuel

Jun 14, 2025 -

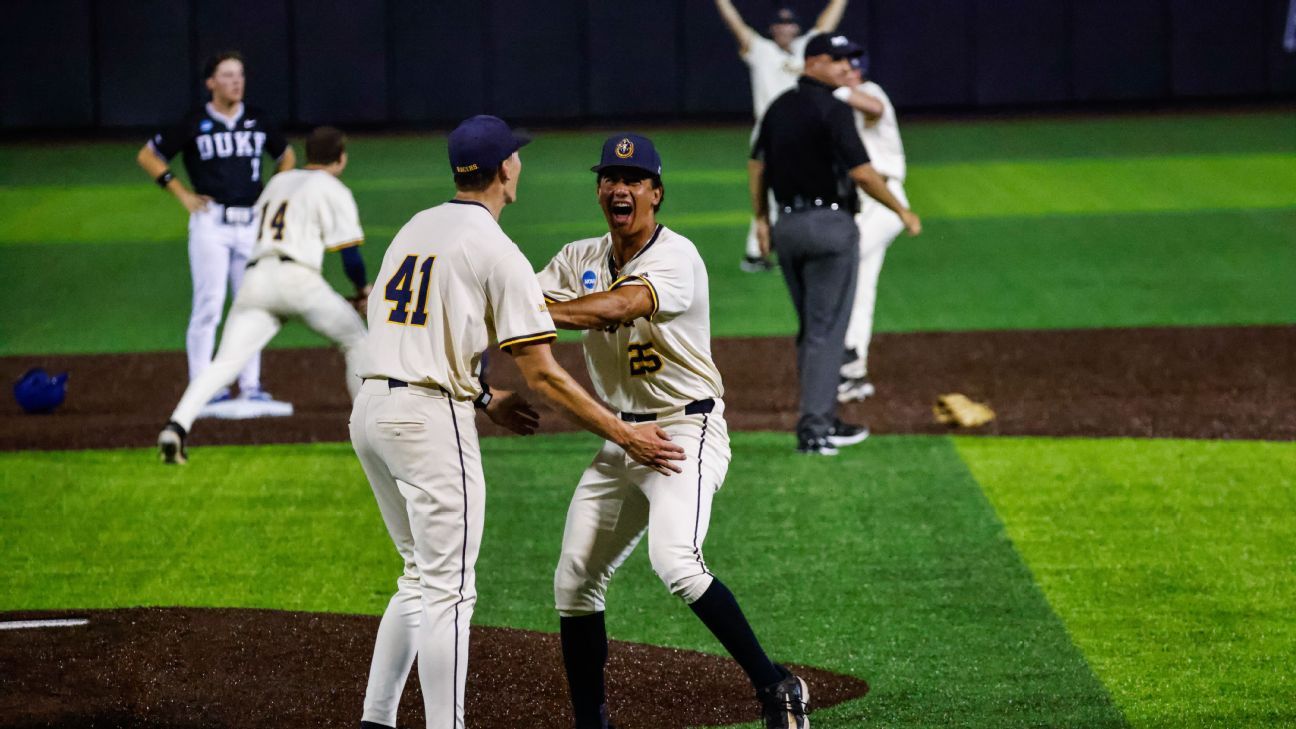

Cinderella Story Murray State Baseballs Journey From Small Town Roots To Omaha

Jun 14, 2025

Cinderella Story Murray State Baseballs Journey From Small Town Roots To Omaha

Jun 14, 2025