Wellington Management's Recent Purchase Of 15,775 Robinhood Shares (HOOD)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Bets Big on Robinhood: 15,775 Shares Acquired

Wellington Management, a prominent global investment firm, has made a significant move, purchasing 15,775 shares of Robinhood Markets, Inc. (HOOD). This acquisition, reported in recent SEC filings, signals a potential vote of confidence in the struggling but resilient brokerage platform. While the exact reasons behind the investment remain undisclosed, the move sparks interesting speculation about the future direction of Robinhood and the broader fintech market.

This strategic purchase comes at a crucial time for Robinhood, which has faced considerable challenges in recent years. The company, known for its commission-free trading platform and user-friendly interface, has struggled to maintain its initial explosive growth. Factors contributing to this include increased competition, regulatory scrutiny, and a general downturn in the broader technology sector.

Why is Wellington Management Investing in Robinhood Now?

Several factors could explain Wellington Management's recent investment in HOOD stock. It's important to remember that this is speculation based on public information and market analysis:

-

Long-term Growth Potential: Despite its current struggles, Robinhood retains a large and engaged user base. Wellington Management may be betting on Robinhood's long-term growth potential, anticipating a recovery as market conditions improve and the company implements its strategic initiatives.

-

Undervalued Asset: The current market price of HOOD stock may be considered undervalued by Wellington Management, representing a compelling investment opportunity. A strategic buy-in at this price point could yield significant returns if the company's fortunes turn around.

-

Diversification Strategy: This acquisition could simply be part of a broader diversification strategy for Wellington Management's portfolio. Adding Robinhood shares might offer a unique risk-reward profile, balancing out other investments within their holdings.

-

Strategic Partnerships: While not explicitly stated, the investment could pave the way for future strategic partnerships between Wellington Management and Robinhood. This could involve collaborative initiatives in areas such as financial technology development or investment strategies.

What Does This Mean for Robinhood Investors?

The news of Wellington Management's investment could be viewed positively by existing Robinhood investors. The involvement of a large and respected investment firm like Wellington Management lends a degree of credibility and confidence to the company's future prospects. This might lead to increased investor interest and potentially support a rise in HOOD's stock price.

However, it's crucial to remember that investment decisions should always be based on thorough research and individual risk tolerance. While this news is encouraging, it doesn't guarantee future success for Robinhood.

The Future of Robinhood

Robinhood's future trajectory remains uncertain. The company faces ongoing challenges, but it also possesses significant strengths, including a massive user base and a brand that's become synonymous with accessible investing. Whether Wellington Management's investment represents a turning point in Robinhood's story remains to be seen. Time will tell if this strategic move will significantly impact the company's performance and market position. Further analysis and reporting are needed to fully understand the implications of this investment.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Always conduct thorough research before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management's Recent Purchase Of 15,775 Robinhood Shares (HOOD). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

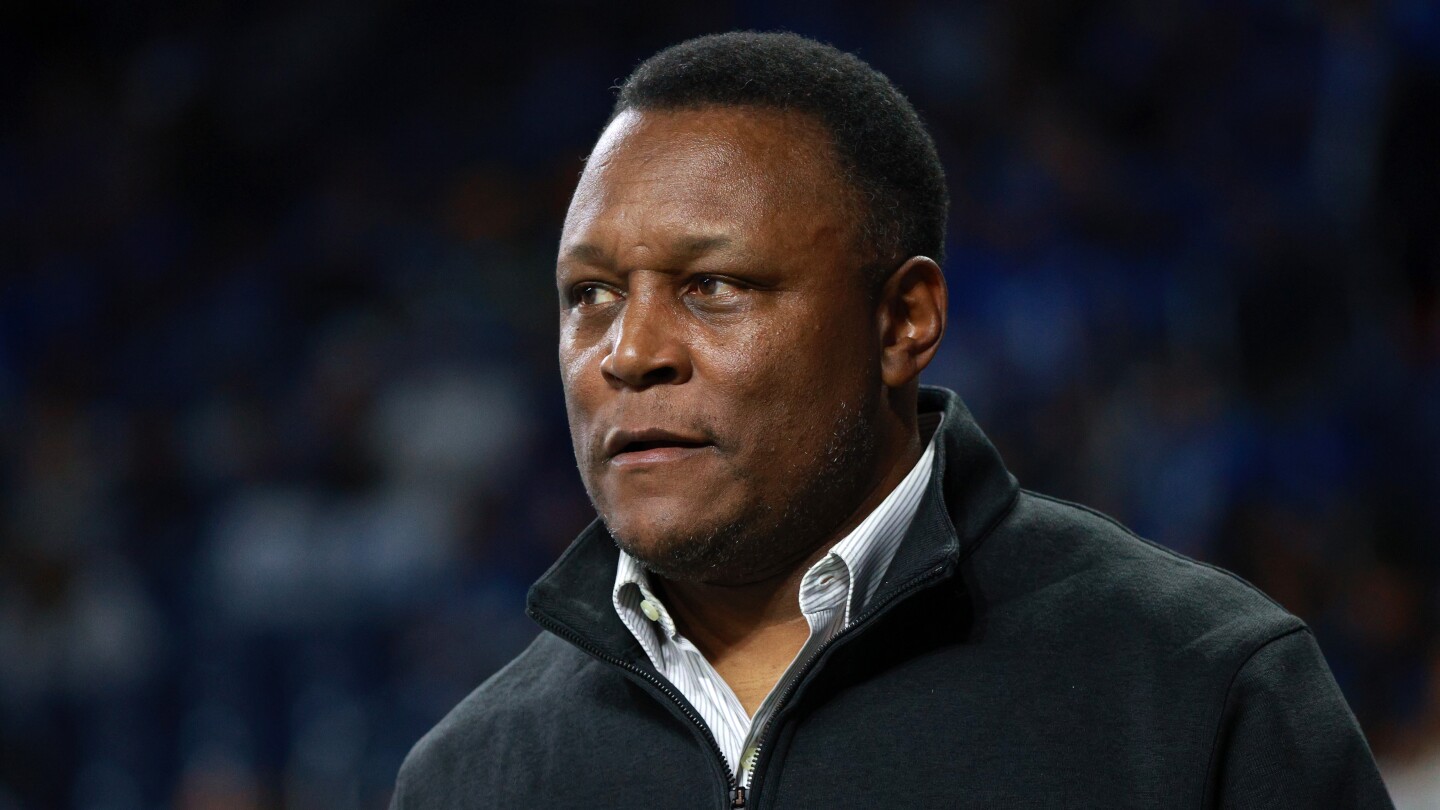

Barry Sanders Advocating For Heart Health Following A Near Fatal Event

Jun 14, 2025

Barry Sanders Advocating For Heart Health Following A Near Fatal Event

Jun 14, 2025 -

Increased Law Enforcement Presence Anticipated For No Kings Day Protests In Los Angeles

Jun 14, 2025

Increased Law Enforcement Presence Anticipated For No Kings Day Protests In Los Angeles

Jun 14, 2025 -

Barry Sanders Heart Attack A Year Later His Focus On Awareness

Jun 14, 2025

Barry Sanders Heart Attack A Year Later His Focus On Awareness

Jun 14, 2025 -

Mens College World Series Official Schedule And Bracket Released

Jun 14, 2025

Mens College World Series Official Schedule And Bracket Released

Jun 14, 2025 -

Upsets And Victories Navarros Thrilling Escape And Dominant Performances By Keys Anisimova At Queens

Jun 14, 2025

Upsets And Victories Navarros Thrilling Escape And Dominant Performances By Keys Anisimova At Queens

Jun 14, 2025