Wellington Management's HOOD Investment: 15,775 Shares Purchased, Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Bets on Robinhood: 15,775 Shares Purchased – What Does It Mean for HOOD Stock?

Wellington Management, a prominent global investment firm, recently revealed a new position in Robinhood Markets (HOOD), acquiring 15,775 shares according to recent SEC filings. This move has sent ripples through the financial markets, prompting speculation about the future trajectory of HOOD stock and the broader fintech sector. The investment, while seemingly modest in size compared to Wellington's overall portfolio, carries significant weight given the firm's reputation for rigorous due diligence and long-term investment strategies.

Wellington's Strategic Move: A Vote of Confidence in Robinhood?

Wellington Management's decision to invest in Robinhood is noteworthy for several reasons. Firstly, it represents a vote of confidence in Robinhood's future prospects, despite the challenges the company has faced in recent years. HOOD's stock price has experienced considerable volatility since its initial public offering (IPO), influenced by factors such as regulatory scrutiny, macroeconomic conditions, and intense competition within the brokerage industry.

Secondly, Wellington's investment strategy often focuses on companies with strong long-term growth potential. This suggests that the firm may see untapped opportunities within Robinhood's business model, potentially including its expansion into new financial products and services, its growing user base, and its potential for international expansion. This contrasts with some negative sentiment surrounding HOOD, fueled by concerns over profitability and user acquisition costs.

Market Implications and Future Outlook for HOOD

The news of Wellington Management's investment has already had a noticeable impact on HOOD's stock price, albeit a modest one. While a single institutional investment doesn't guarantee sustained growth, it can provide a positive signal to other investors, potentially sparking renewed interest in the stock. However, it's crucial to remember that the market is complex and influenced by numerous factors beyond a single investment.

Several key factors will continue to shape HOOD's future performance:

- Regulatory landscape: The evolving regulatory environment for online brokerage firms will significantly impact Robinhood's operations and profitability.

- Competition: Intense competition from established players and new entrants in the fintech sector remains a significant challenge.

- User growth and engagement: Maintaining user growth and increasing engagement levels will be critical for Robinhood's long-term success.

- Revenue diversification: Expanding revenue streams beyond trading commissions will be vital for improving profitability and reducing reliance on volatile market conditions.

Analyzing the Investment: A Deeper Dive

While the exact reasoning behind Wellington Management's investment remains undisclosed, several factors might have influenced their decision:

- Valuation: The current market valuation of HOOD may have been deemed attractive by Wellington, presenting a potential buying opportunity.

- Long-term growth potential: The firm might anticipate substantial long-term growth potential for Robinhood, particularly in emerging markets or with new product offerings.

- Portfolio diversification: The investment could simply be a strategic move to diversify Wellington's portfolio and reduce overall risk.

Conclusion: Cautious Optimism for HOOD Investors

Wellington Management's investment in Robinhood signifies a degree of optimism surrounding the company's future. However, investors should approach the situation with caution, acknowledging the inherent risks associated with investing in a volatile stock like HOOD. Further analysis of Robinhood's financial performance and its ability to navigate the challenges ahead will be crucial in determining the long-term success of this investment. Staying informed about regulatory changes and competitive developments within the fintech sector is essential for any investor considering a position in HOOD.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management's HOOD Investment: 15,775 Shares Purchased, Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Round Two U S Open Sam Burns Sinks Perfect Putt For 65

Jun 14, 2025

Round Two U S Open Sam Burns Sinks Perfect Putt For 65

Jun 14, 2025 -

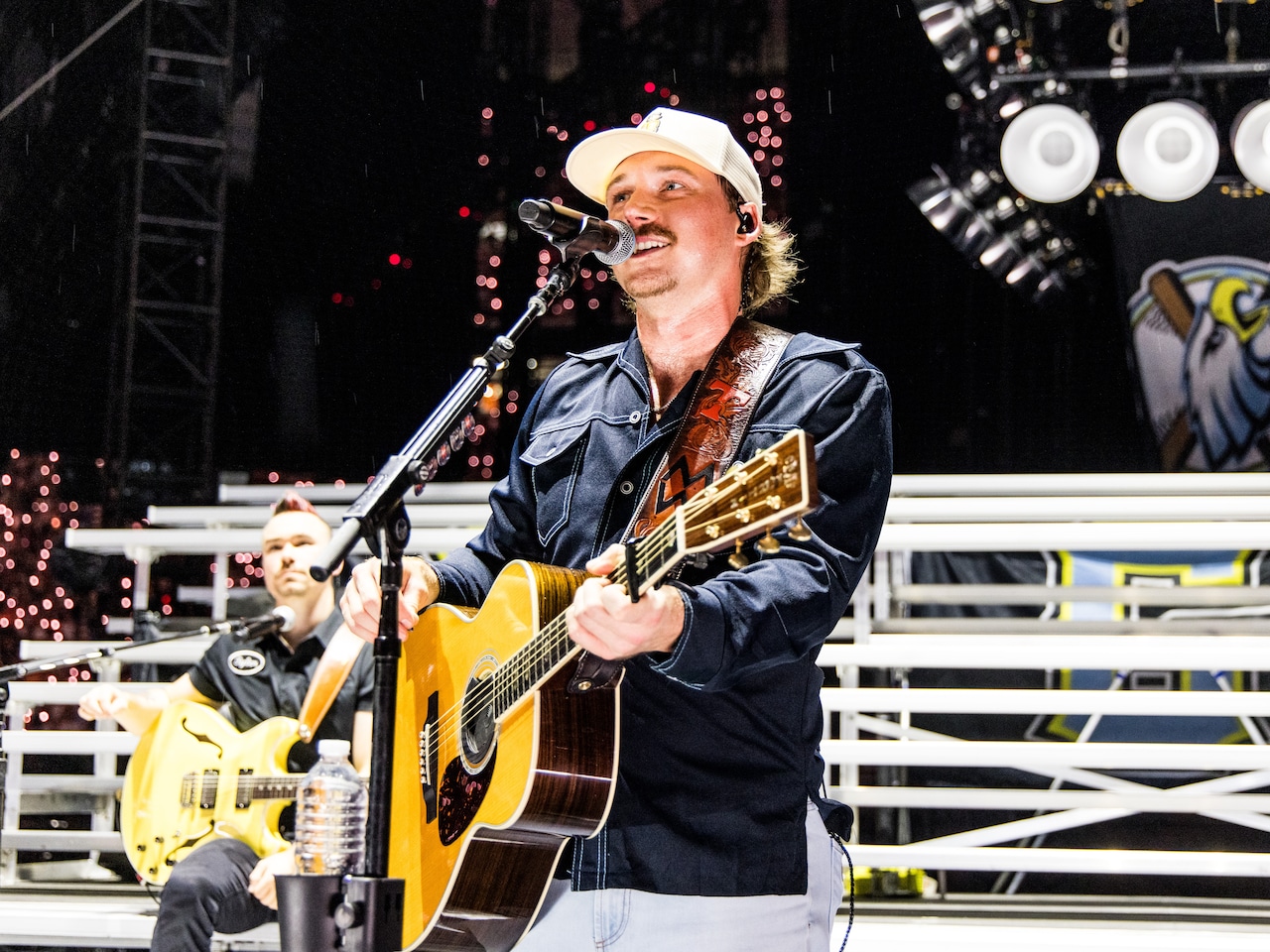

Budget Friendly Morgan Wallen Tickets Houston I M The Problem Tour Dates June 20 21

Jun 14, 2025

Budget Friendly Morgan Wallen Tickets Houston I M The Problem Tour Dates June 20 21

Jun 14, 2025 -

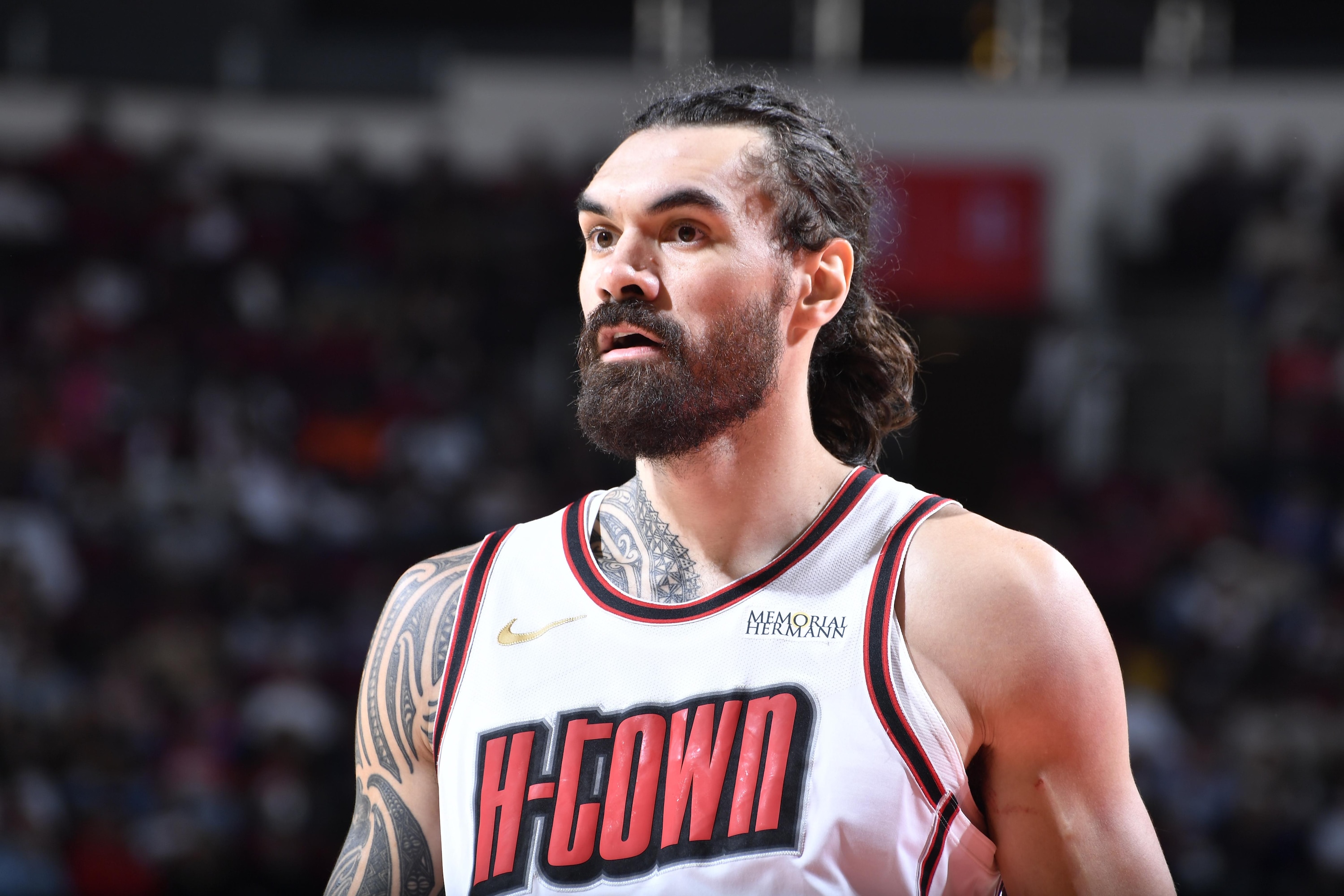

Steven Adams Three Year Extension With Houston Rockets Confirmed

Jun 14, 2025

Steven Adams Three Year Extension With Houston Rockets Confirmed

Jun 14, 2025 -

Report Steven Adams Signs 39 Million Extension With The Houston Rockets

Jun 14, 2025

Report Steven Adams Signs 39 Million Extension With The Houston Rockets

Jun 14, 2025 -

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025