Wellington Management Invests In Robinhood: 15,775 Shares Acquired

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Takes a Stake in Robinhood: 15,775 Shares Acquired

Investing giant Wellington Management has quietly added Robinhood Markets, Inc. (HOOD) to its portfolio, acquiring 15,775 shares, according to a recent 13F filing. This move signals a potential vote of confidence in the controversial yet popular trading platform, despite its recent struggles. The investment, while relatively small in the context of Wellington's overall portfolio, sparks intrigue within the financial community and raises questions about Robinhood's future trajectory.

The 13F filing, which discloses the equity holdings of institutional investors, revealed Wellington's purchase during the second quarter of 2024. While the exact purchase price isn't specified, the investment represents a calculated bet on Robinhood's long-term prospects. This strategic move comes at a time when Robinhood is navigating a challenging market landscape, facing increased competition and regulatory scrutiny.

Robinhood's Recent Performance and Challenges

Robinhood, known for its commission-free trading platform and user-friendly interface, experienced a meteoric rise during the pandemic-fueled retail investing boom. However, the subsequent market downturn and increased competition from established players have significantly impacted its performance. The company has faced criticism for its handling of certain events, including the GameStop short squeeze, and has been grappling with regulatory hurdles. These factors have contributed to a decline in its stock price and overall market valuation.

Despite these challenges, Robinhood continues to boast a large and engaged user base. The platform's ongoing efforts to diversify its revenue streams beyond trading commissions, including the introduction of new financial products and services, are key factors that may have influenced Wellington Management's decision.

What Wellington Management's Investment Could Mean

Wellington Management's investment could be interpreted in several ways:

- A bet on long-term growth: Wellington, known for its long-term investment strategy, might see potential for significant growth in Robinhood's future. The company's large user base and potential for innovation could be attractive factors.

- A strategic move into the retail brokerage sector: The investment could represent a strategic entry point for Wellington into the rapidly evolving retail brokerage market.

- A contrarian investment: Some might view the investment as a contrarian bet, capitalizing on a potentially undervalued asset.

It's crucial to note that this is a relatively small investment for a firm of Wellington Management's size. Therefore, it's difficult to definitively state the underlying reasons for the investment without further information. However, it undeniably adds to the ongoing discussion surrounding Robinhood's future.

The Future of Robinhood

The long-term prospects for Robinhood remain uncertain. The company's success will hinge on its ability to overcome current challenges, innovate its offerings, and maintain user engagement in a competitive market. This acquisition by Wellington Management, however small, offers a glimmer of hope for investors who believe in Robinhood's potential for recovery and growth.

Further research into Robinhood's financial statements and future strategic initiatives is recommended for investors interested in learning more. Staying updated on regulatory developments impacting the brokerage industry is also crucial for understanding the potential risks and rewards associated with investing in Robinhood.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management Invests In Robinhood: 15,775 Shares Acquired. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

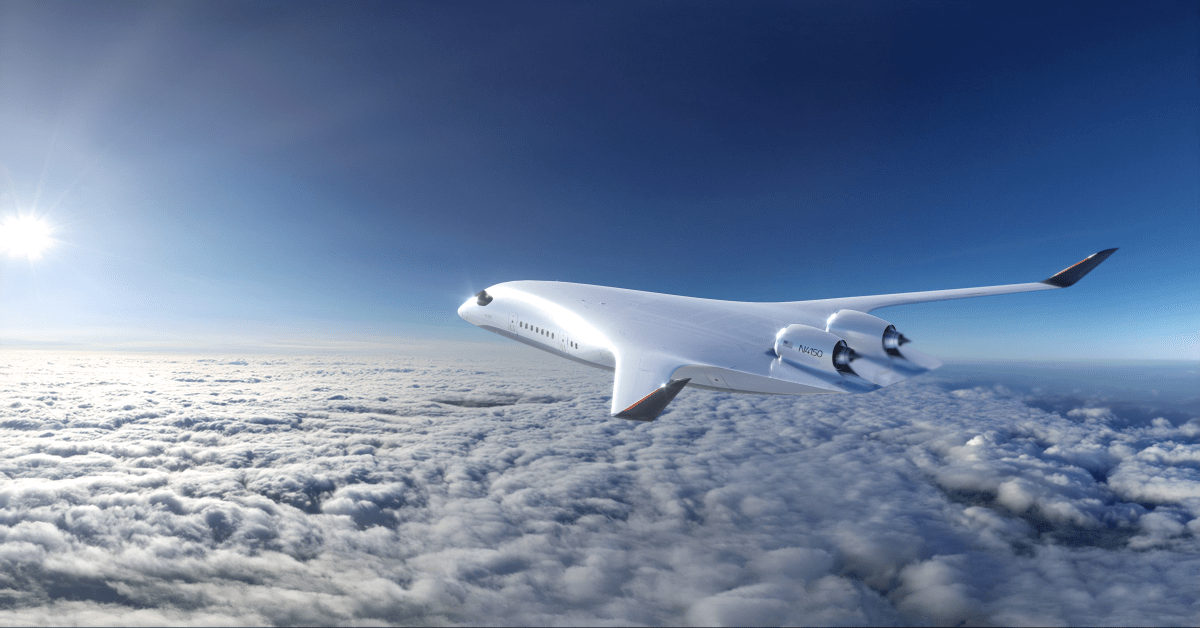

The Future Of Flight A Low Carbon Revolution Is Taking Off

Jun 14, 2025

The Future Of Flight A Low Carbon Revolution Is Taking Off

Jun 14, 2025 -

Oakmonts 2025 U S Open Sam Burns Low Round Sets New Standard

Jun 14, 2025

Oakmonts 2025 U S Open Sam Burns Low Round Sets New Standard

Jun 14, 2025 -

Delaney Rowe Speaks Out Clarifying Relationship Status Amidst B J Novak Speculation

Jun 14, 2025

Delaney Rowe Speaks Out Clarifying Relationship Status Amidst B J Novak Speculation

Jun 14, 2025 -

49ers Kittle Speaks Out Supporting Deebo Samuel After Viral Video Incident

Jun 14, 2025

49ers Kittle Speaks Out Supporting Deebo Samuel After Viral Video Incident

Jun 14, 2025 -

Los Angeles Braces For No Kings Protests Against New Ice Raid Strategies

Jun 14, 2025

Los Angeles Braces For No Kings Protests Against New Ice Raid Strategies

Jun 14, 2025