Wellington Management Group's Investment In Robinhood (NASDAQ:HOOD): 15,775 Shares Acquired

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Bets Big on Robinhood: 15,775 Shares Acquired

Wellington Management Group, a prominent Boston-based investment firm, has signaled its confidence in the future of commission-free trading platform Robinhood (NASDAQ:HOOD) by acquiring 15,775 shares, according to recent SEC filings. This strategic investment comes at a pivotal moment for Robinhood, as it navigates a challenging market environment and seeks to solidify its position in the competitive fintech landscape. The move has sparked renewed interest in HOOD stock and its long-term prospects.

This investment isn't just a small ripple; it represents a significant vote of confidence from a highly respected player in the investment world. Wellington Management, known for its long-term, value-oriented approach, manages trillions of dollars in assets globally. Their decision to acquire a stake in Robinhood suggests a belief in the company's underlying potential for growth and profitability despite recent headwinds.

<h3>Decoding Wellington Management's Robinhood Investment</h3>

Several factors could explain Wellington Management's strategic decision:

-

Long-Term Growth Potential: Despite recent volatility in its stock price, Robinhood retains a substantial user base and a strong brand recognition among millennial and Gen Z investors. Wellington may be betting on Robinhood’s ability to capitalize on the growing interest in retail investing and expand its product offerings.

-

Strategic Diversification: The investment could be part of a broader diversification strategy for Wellington Management's portfolio. Robinhood, as a disruptive force in the fintech sector, could offer unique growth opportunities that complement existing holdings.

-

Undervalued Asset: It's possible that Wellington Management views Robinhood's current stock price as undervalued relative to its long-term potential. This would align with their typical value investing approach.

-

Expansion Beyond Trading: Robinhood is actively expanding its services beyond simple stock trading. Features like crypto trading, cash management accounts, and upcoming offerings could drive future revenue growth, attracting Wellington's attention.

<h3>Robinhood's Ongoing Transformation</h3>

Robinhood has faced challenges in recent years, including regulatory scrutiny and intense competition. However, the company is actively working to address these issues and solidify its position in the market. This includes focusing on:

- Improving profitability: Robinhood is implementing strategies to boost its revenue streams and improve its operating margins.

- Enhancing the user experience: The company is continually investing in improving its platform and making it more user-friendly.

- Expanding product offerings: The addition of new features and services is crucial for attracting and retaining users.

<h3>What Does This Mean for HOOD Stock?</h3>

While Wellington Management's investment doesn't guarantee future price increases, it certainly provides a bullish signal. The involvement of such a respected institutional investor could attract other investors and boost investor confidence in HOOD stock. However, it's crucial to remember that investing in the stock market always involves risk. Before making any investment decisions, it is essential to conduct thorough research and consider your own risk tolerance.

<h3>Looking Ahead</h3>

The acquisition of Robinhood shares by Wellington Management represents a significant development in the narrative surrounding the company. It remains to be seen how this investment will play out in the long term, but it undeniably adds another layer of intrigue to the ongoing story of Robinhood and its place in the future of finance. Keep an eye on upcoming earnings reports and company announcements for further insights into Robinhood's progress and performance. What are your thoughts on this investment? Share your opinions in the comments below.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management Group's Investment In Robinhood (NASDAQ:HOOD): 15,775 Shares Acquired. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Institutional Investing 15 775 Robinhood Shares Acquired By Wellington Management

Jun 14, 2025

Institutional Investing 15 775 Robinhood Shares Acquired By Wellington Management

Jun 14, 2025 -

Robinhoods Q Quarter Record 255 B In Assets Trading Volume Explodes

Jun 14, 2025

Robinhoods Q Quarter Record 255 B In Assets Trading Volume Explodes

Jun 14, 2025 -

World Premiere Film Festival Showcases Finding Faith This Weekend

Jun 14, 2025

World Premiere Film Festival Showcases Finding Faith This Weekend

Jun 14, 2025 -

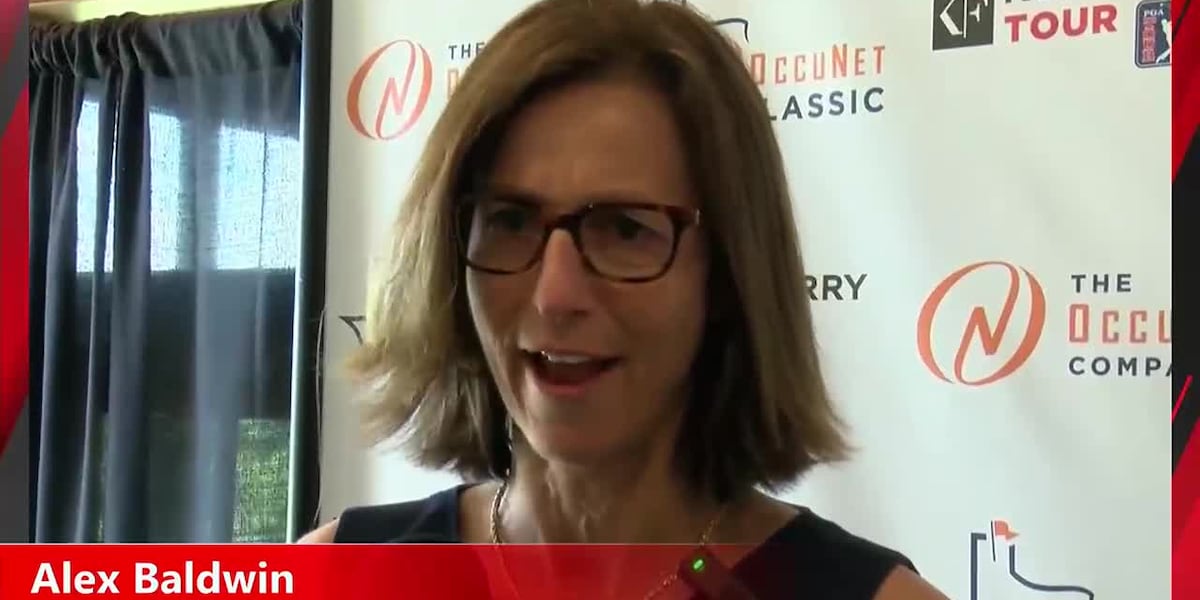

In Depth Report The Korn Ferry Tours Recent News Conference

Jun 14, 2025

In Depth Report The Korn Ferry Tours Recent News Conference

Jun 14, 2025 -

Robinhoods Financial Report Massive Asset Growth And Significant Increase In Trading Activity

Jun 14, 2025

Robinhoods Financial Report Massive Asset Growth And Significant Increase In Trading Activity

Jun 14, 2025