Wellington Management Group's Investment In Robinhood (HOOD): Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management's Robinhood Investment: A Deeper Dive into the Implications

Wellington Management, a global investment giant, recently increased its stake in Robinhood Markets (HOOD), sending ripples through the financial world. This move, signaling a vote of confidence in the controversial trading platform, warrants a closer look at its implications for both Robinhood and the broader investment landscape. This article analyzes the investment, exploring potential drivers and the wider ramifications for investors.

Wellington's Strategic Play: Why Robinhood?

Wellington Management, known for its long-term, value-oriented approach, isn't typically associated with high-growth, volatile stocks like Robinhood. This strategic investment, therefore, begs the question: why Robinhood? Several factors could be at play:

-

Undervalued Asset: Despite its turbulent history, Robinhood possesses a substantial user base and a recognizable brand. Wellington may see the current market valuation as significantly below the company's intrinsic value, presenting a compelling buying opportunity. This aligns with their history of identifying undervalued assets in the market.

-

Long-Term Growth Potential: Robinhood's platform, while initially focused on commission-free trading, is expanding its services. The introduction of new features like crypto trading and wealth management tools suggests a broader vision for the company's long-term growth. Wellington's investment could indicate a belief in this diversification strategy.

-

Market Share Consolidation: The online brokerage industry remains fiercely competitive. Wellington's investment might be a bet on Robinhood's ability to consolidate market share and establish itself as a leading player in the evolving fintech landscape.

Implications for Robinhood:

This investment provides a crucial boost to Robinhood's credibility. The involvement of a respected firm like Wellington Management can instill confidence among investors wary of the platform's past controversies and volatile performance. The influx of capital could also support Robinhood's ongoing efforts to improve its technology, expand its offerings, and enhance its regulatory compliance.

Wider Market Implications:

Wellington's move could influence other institutional investors to reconsider their stance on Robinhood. This renewed interest might lead to increased trading volume and a potential re-evaluation of HOOD's stock price. Furthermore, the investment highlights the growing interest in the fintech sector, particularly in platforms offering accessible and innovative financial services.

Risks and Challenges Remain:

Despite the positive implications, it’s crucial to acknowledge the ongoing challenges faced by Robinhood. Regulatory scrutiny, competition from established players and newer fintech startups, and the inherent volatility of the brokerage industry remain significant hurdles.

Conclusion:

Wellington Management's increased investment in Robinhood is a noteworthy event with far-reaching consequences. While risks remain, the move suggests a belief in Robinhood's long-term potential and could signal a turning point for the company. Investors should carefully consider the risks and rewards before making any investment decisions related to HOOD. Further analysis of Robinhood's financial performance and regulatory developments will be crucial in assessing the long-term success of this strategic bet.

Further Reading:

- (replace with actual link)

- (replace with actual link)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wellington Management Group's Investment In Robinhood (HOOD): Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Air India Plane Crash Official Statements Victim Identification And Next Steps

Jun 14, 2025

Air India Plane Crash Official Statements Victim Identification And Next Steps

Jun 14, 2025 -

Scottish Golf Course Tests Robert Mac Intyres Iron Game

Jun 14, 2025

Scottish Golf Course Tests Robert Mac Intyres Iron Game

Jun 14, 2025 -

La Landlord Mike Nijjar Faces Lawsuit From State Attorney General

Jun 14, 2025

La Landlord Mike Nijjar Faces Lawsuit From State Attorney General

Jun 14, 2025 -

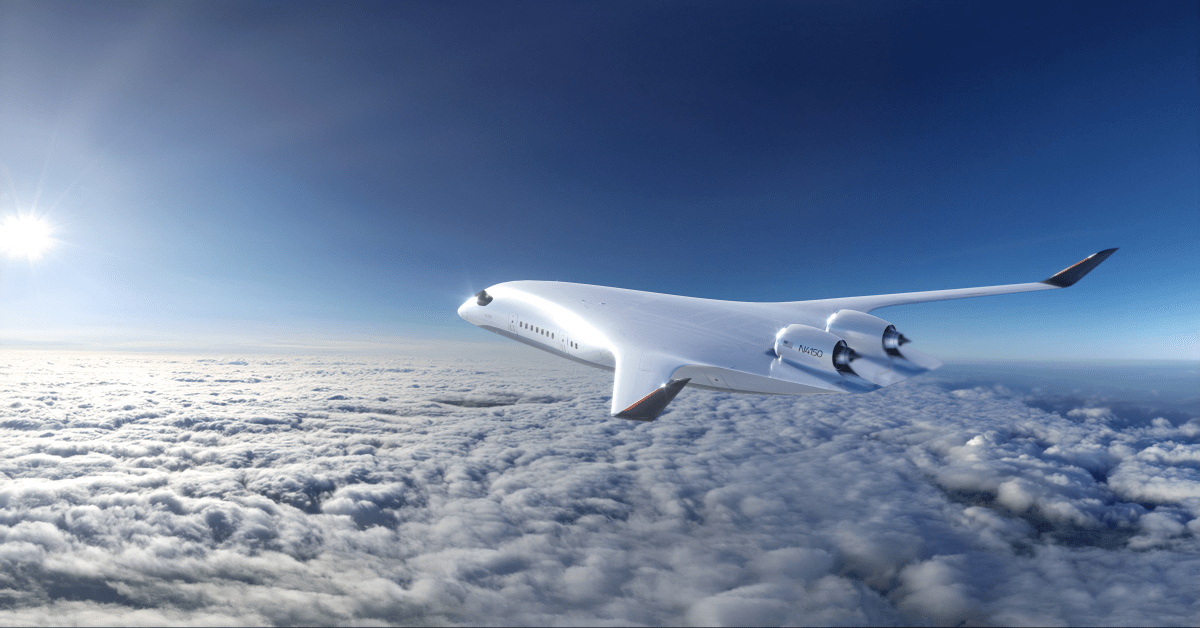

Green Skies Ahead One Companys Plan For Low Carbon Flight

Jun 14, 2025

Green Skies Ahead One Companys Plan For Low Carbon Flight

Jun 14, 2025 -

2025 U S Open Leaderboard Sam Burns Charge Up The Ranks

Jun 14, 2025

2025 U S Open Leaderboard Sam Burns Charge Up The Ranks

Jun 14, 2025