Wedbush's Positive Outlook: Oklo Inc. (OKLO) Price Target Raised To $55

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wedbush's Bullish Outlook Sends Oklo Inc. (OKLO) Stock Soaring: Price Target Raised to $55

Oklo Inc. (OKLO), a leading developer of advanced nuclear fission technology, is experiencing a surge in its stock price following a significant upgrade from Wedbush Securities. The investment firm boosted its price target for OKLO stock from $30 to a remarkable $55, representing a substantial increase in their confidence in the company's future prospects. This move reflects a growing optimism within the investment community regarding Oklo's innovative approach to nuclear energy and its potential to disrupt the industry.

This bullish forecast comes on the heels of several key developments for Oklo, solidifying its position as a major player in the advanced nuclear sector. The company has made significant strides in its research and development efforts, demonstrating the viability of its technology and attracting significant attention from both investors and industry experts.

Why the Price Target Hike? Wedbush's Rationale

Wedbush's decision to significantly raise its price target for Oklo stock wasn't arbitrary. Their analysis points to several key factors driving this positive outlook:

- Technological Breakthroughs: Oklo's innovative approach to nuclear fission, focusing on smaller, more efficient reactors, is seen as a game-changer. Their technology promises to address some of the long-standing concerns surrounding nuclear energy, including waste management and safety.

- Growing Market Demand: The global push for cleaner and more sustainable energy sources is creating a burgeoning market for advanced nuclear technologies. Oklo is well-positioned to capitalize on this growing demand, potentially securing significant contracts in the coming years.

- Strong Leadership and Management Team: Wedbush highlighted Oklo's experienced and highly skilled management team, crucial for navigating the complex regulatory landscape and technological hurdles inherent in the nuclear energy industry.

- Strategic Partnerships: Oklo's strategic partnerships with key players in the energy sector further solidify its position and enhance its potential for growth. These collaborations provide access to resources, expertise, and potential markets.

Oklo Inc.: A Closer Look at the Company and its Potential

Oklo is pioneering the development of advanced nuclear fission reactors that are smaller, safer, and more efficient than traditional designs. Their technology promises to significantly reduce nuclear waste and improve the overall safety profile of nuclear energy production. This makes them a compelling investment for those seeking exposure to the rapidly growing clean energy sector.

What this means for investors:

The increased price target from Wedbush represents a significant vote of confidence in Oklo's potential. While it's important to remember that this is just one analyst's opinion and that investing in the stock market always carries risk, the upward revision signifies a positive sentiment towards the company's future. Investors should conduct their own thorough due diligence before making any investment decisions.

Looking Ahead: Potential Challenges and Opportunities

While the outlook for Oklo is promising, it's crucial to acknowledge potential challenges. The nuclear energy sector is heavily regulated, and navigating regulatory hurdles can be time-consuming and expensive. Furthermore, the long lead times associated with the construction and deployment of nuclear reactors represent a potential obstacle. However, Oklo's innovative technology and strong management team position the company well to overcome these challenges.

Call to Action: Stay informed about Oklo Inc.'s progress by following their investor relations page and keeping an eye on industry news related to advanced nuclear technology. Remember to always consult with a financial advisor before making investment decisions.

Keywords: Oklo Inc., OKLO stock, Wedbush, price target, nuclear energy, advanced nuclear fission, clean energy, sustainable energy, investment, stock market, nuclear reactors, energy sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wedbush's Positive Outlook: Oklo Inc. (OKLO) Price Target Raised To $55. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beatriz Haddad Maia Vs Hailey Baptiste A Deep Dive Into The French Open 2025 Clash

May 27, 2025

Beatriz Haddad Maia Vs Hailey Baptiste A Deep Dive Into The French Open 2025 Clash

May 27, 2025 -

Fourth Annual Juneteenth Celebration At Summit A Community Event

May 27, 2025

Fourth Annual Juneteenth Celebration At Summit A Community Event

May 27, 2025 -

Sustainable Energy Investment Analyzing Oklos Potential For Growth

May 27, 2025

Sustainable Energy Investment Analyzing Oklos Potential For Growth

May 27, 2025 -

167 Million Powerball Jackpot Winning Numbers For May 24 Announced

May 27, 2025

167 Million Powerball Jackpot Winning Numbers For May 24 Announced

May 27, 2025 -

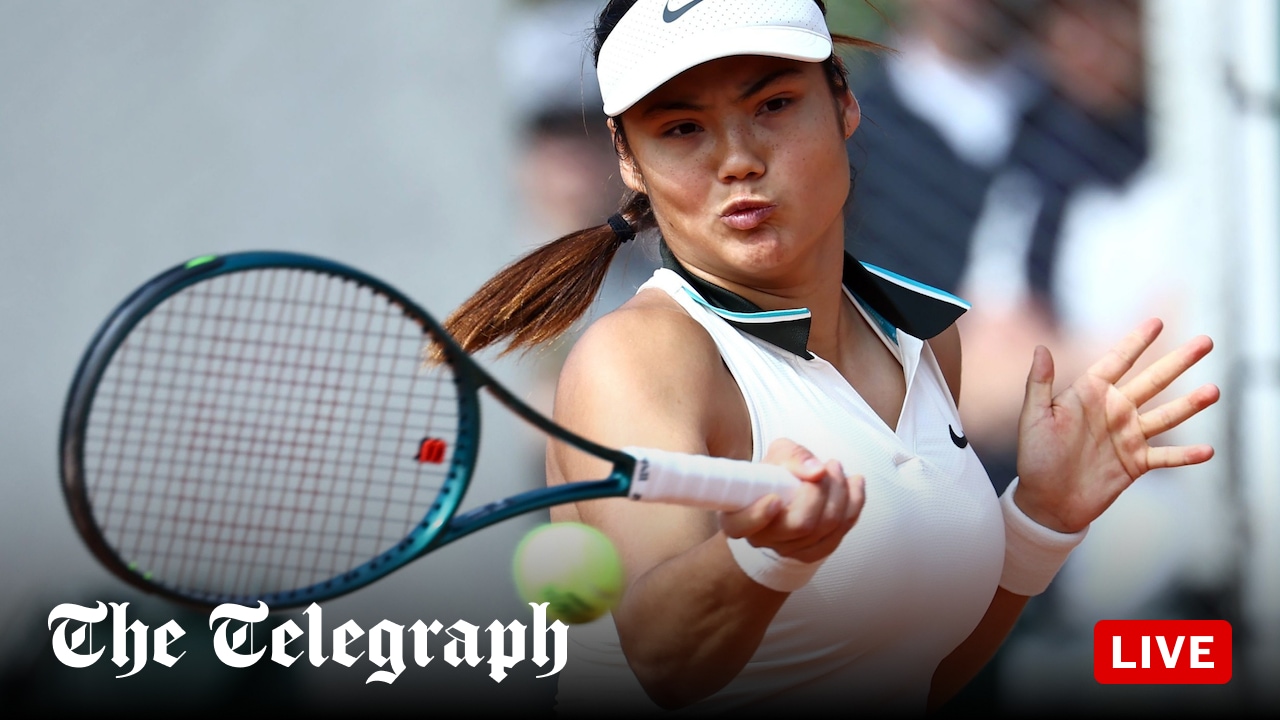

Raducanu Wang Xinyu Showdown French Open Live Scores And Commentary

May 27, 2025

Raducanu Wang Xinyu Showdown French Open Live Scores And Commentary

May 27, 2025