Wall Street's Resilience: S&P 500, Dow, And Nasdaq Climb Despite Moody's Rating Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's Resilience: S&P 500, Dow, and Nasdaq Climb Despite Moody's Rating Cut

Wall Street defied expectations on Tuesday, with major indices posting gains despite Moody's downgrade of several US banking institutions. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all saw significant increases, showcasing a remarkable resilience in the face of negative credit rating news. This unexpected surge raises questions about the overall health of the US economy and the market's reaction to credit rating agencies.

The move by Moody's, which downgraded 10 mid-sized banks and placed several more on review for potential downgrades, sent ripples through the financial sector. Many analysts predicted a significant market downturn following the announcement. However, the market responded differently, demonstrating a level of confidence that surprised many experts.

<h3>Why Did the Market Rise Despite the Downgrade?</h3>

Several factors likely contributed to the market's positive performance despite the Moody's rating cut.

-

Strong Earnings Reports: Several major companies released strong second-quarter earnings reports in the preceding days, bolstering investor confidence. These positive results overshadowed the concerns raised by Moody's. This highlights the importance of individual company performance within the broader economic picture.

-

Resilient Banking Sector: While the Moody's downgrade targeted smaller and mid-sized banks, the largest institutions remained largely unaffected. This suggests a degree of compartmentalization within the banking sector, with the impact of the downgrade potentially limited. Further analysis is needed to fully understand the long-term implications for the sector.

-

Anticipation of Fed Rate Pause: Market participants are increasingly anticipating a pause in the Federal Reserve's interest rate hikes. This expectation, fueled by recent economic data showing signs of cooling inflation, might have offset the negative sentiment stemming from the credit rating downgrade. The future trajectory of interest rates remains a crucial factor influencing market sentiment.

-

Market Oversold Conditions: Some analysts believe the market was oversold before the Moody's announcement, creating an opportunity for a technical rebound. This theory suggests that the market's rise was partly a correction, rather than a purely optimistic reaction to the news.

<h3>Long-Term Implications and Future Outlook</h3>

While Tuesday's market performance was encouraging, it's crucial to avoid reading too much into a single day's trading activity. The long-term implications of Moody's downgrade remain uncertain. Further analysis is required to assess the full impact on the financial system and broader economy.

The next few weeks will be critical in determining whether this resilience is sustainable. Key factors to watch include:

- Further rating agency actions: The possibility of further downgrades from Moody's or other agencies remains a significant risk.

- Economic data releases: Upcoming reports on inflation, employment, and economic growth will provide valuable insights into the overall economic health.

- Federal Reserve policy decisions: The Fed's future actions regarding interest rates will continue to heavily influence market sentiment.

This unexpected market rally raises important questions about the current state of the US economy and the interplay between credit ratings, investor sentiment, and market performance. Investors should remain vigilant and monitor these developments closely. Understanding the complex factors influencing market behavior is crucial for informed investment decisions. For more in-depth analysis on the US economy and financial markets, visit [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Resilience: S&P 500, Dow, And Nasdaq Climb Despite Moody's Rating Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Higher Mortgage Rates Reflect Stronger Than Expected Economy

May 20, 2025

Higher Mortgage Rates Reflect Stronger Than Expected Economy

May 20, 2025 -

Did The Ufc Withhold Information About Tom Aspinalls Injury Jones Says Yes

May 20, 2025

Did The Ufc Withhold Information About Tom Aspinalls Injury Jones Says Yes

May 20, 2025 -

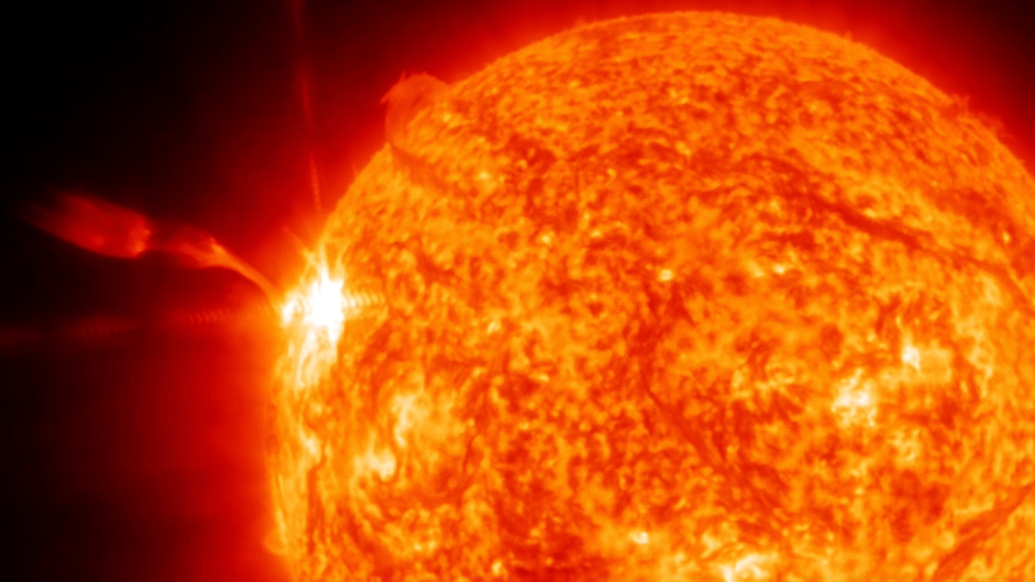

Major Solar Flare Widespread Radio Blackouts Hit Europe Asia And The Middle East Video

May 20, 2025

Major Solar Flare Widespread Radio Blackouts Hit Europe Asia And The Middle East Video

May 20, 2025 -

Beyond The Screen Jamie Lee Curtiss Honest Account Of Her Relationship With Lindsay Lohan

May 20, 2025

Beyond The Screen Jamie Lee Curtiss Honest Account Of Her Relationship With Lindsay Lohan

May 20, 2025 -

Ufc Controversy Jon Jones Strip The Duck Comment On Tom Aspinall Causes Stir

May 20, 2025

Ufc Controversy Jon Jones Strip The Duck Comment On Tom Aspinall Causes Stir

May 20, 2025