Wall Street Zen's Stock Rating Revision Impacts CoreWeave (CRWV): A Deeper Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Zen's Stock Rating Revision Impacts CoreWeave (CRWV): A Deeper Dive

CoreWeave (CRWV), the rapidly growing cloud computing company specializing in AI infrastructure, recently experienced a ripple effect following a stock rating revision by Wall Street Zen. This shift in analyst sentiment has sent waves through the investment community, prompting investors to reassess their positions and consider the implications for CRWV's future trajectory. This article delves deeper into the specifics of the revision and its potential impact.

Wall Street Zen's Downgrade: A Closer Look

Wall Street Zen, a well-regarded investment research platform, recently downgraded its rating on CoreWeave. While the exact details of the revision may vary depending on the specific report, the underlying reasons typically revolve around concerns regarding valuation, market competition, or potential risks within the broader technology sector. These concerns often include factors such as:

- Valuation Concerns: Rapid growth often leads to high valuations, which may not always align with the company's current profitability or long-term prospects. A high valuation makes the stock price susceptible to corrections if growth falters.

- Increased Competition: The cloud computing market is fiercely competitive, with established giants like AWS, Azure, and Google Cloud constantly innovating. New entrants also pose a threat, increasing the pressure on CoreWeave to maintain its market share.

- Economic Uncertainty: Macroeconomic factors, such as inflation and interest rate hikes, can significantly impact investor sentiment and lead to a reassessment of riskier growth stocks like CRWV.

Impact on CoreWeave's Stock Price and Investor Sentiment:

The Wall Street Zen downgrade likely contributed to a decline in CoreWeave's stock price. Such revisions can trigger a sell-off as investors react to the perceived increased risk. The impact can be amplified by herd mentality, where investors follow the actions of others, leading to a cascading effect on the stock price. This highlights the importance of independent research and a thorough understanding of the company's fundamentals before making investment decisions.

Analyzing the Long-Term Outlook for CoreWeave:

Despite the negative sentiment following the downgrade, CoreWeave’s long-term prospects remain a subject of debate. The company's focus on AI infrastructure positions it within a rapidly expanding market with significant growth potential. However, successfully navigating the competitive landscape and managing operational expenses will be crucial for sustained success.

Factors to consider when assessing the long-term outlook include:

- Technological Innovation: CoreWeave's ability to innovate and offer cutting-edge AI infrastructure solutions will be critical in maintaining a competitive edge.

- Client Acquisition and Retention: Securing and retaining large enterprise clients will be essential for driving revenue growth.

- Financial Performance: Consistent profitability and positive cash flow will be key indicators of the company's long-term viability.

What Investors Should Do:

The Wall Street Zen revision serves as a reminder of the importance of conducting thorough due diligence before investing in any stock. Investors should:

- Conduct Independent Research: Don't rely solely on one analyst's opinion. Gather information from multiple sources and analyze the company's financials and competitive landscape.

- Understand the Risks: Investing in growth stocks always carries inherent risk. Be aware of the potential downsides before investing.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification is crucial to mitigate risk.

Conclusion:

The Wall Street Zen rating revision on CoreWeave (CRWV) underscores the dynamic nature of the stock market and the importance of continuous monitoring and analysis. While the short-term impact may be negative, the long-term outlook for CoreWeave hinges on its ability to execute its business strategy effectively within a highly competitive market. Investors should carefully consider all available information and assess their risk tolerance before making any investment decisions. This situation highlights the necessity of remaining informed and adaptable in the ever-evolving world of financial markets. Further research and monitoring of CRWV's performance are crucial for informed investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Zen's Stock Rating Revision Impacts CoreWeave (CRWV): A Deeper Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mc Mahon Family Crest Stephanies Close Call With A Tattoo

May 28, 2025

Mc Mahon Family Crest Stephanies Close Call With A Tattoo

May 28, 2025 -

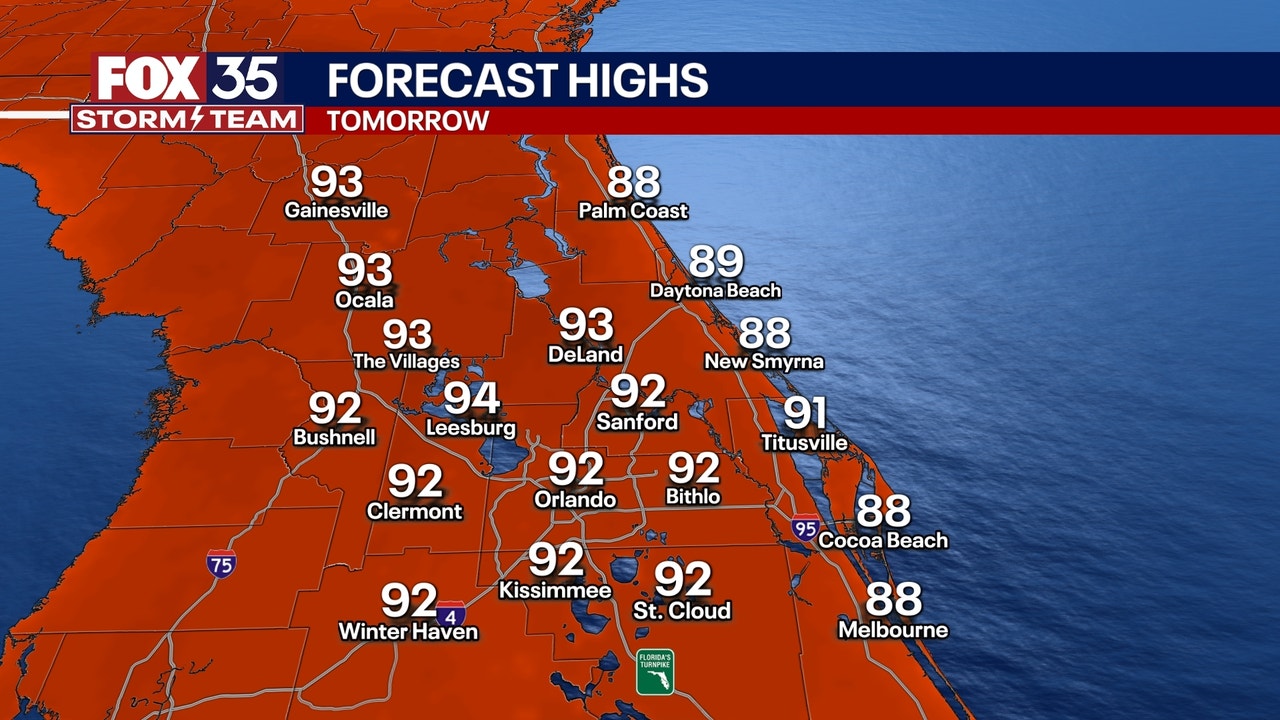

Orlando Weather Update Heat Index Soars Rain Chances Increase Midweek

May 28, 2025

Orlando Weather Update Heat Index Soars Rain Chances Increase Midweek

May 28, 2025 -

Core Weave Crwv Stock Wall Street Zen Issues Downgraded Rating

May 28, 2025

Core Weave Crwv Stock Wall Street Zen Issues Downgraded Rating

May 28, 2025 -

Investing In Ai This Stocks 150 Gain Rivals Palantirs Success

May 28, 2025

Investing In Ai This Stocks 150 Gain Rivals Palantirs Success

May 28, 2025 -

Cameron Brink Knee Injury Latest Update From The Los Angeles Sparks

May 28, 2025

Cameron Brink Knee Injury Latest Update From The Los Angeles Sparks

May 28, 2025