Wall Street Zen's Negative CoreWeave (CRWV) Rating: A Deeper Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Zen's Negative CoreWeave (CRWV) Rating: A Deeper Dive

Wall Street Zen, a popular platform for investment research and analysis, recently issued a negative rating for CoreWeave (CRWV), sending ripples through the tech investment community. This isn't just another analyst downgrade; it raises crucial questions about CoreWeave's long-term prospects and the current state of the cloud computing market. This article delves deeper into Wall Street Zen's assessment, exploring the reasons behind the negative rating and its implications for investors.

Why the Negative Rating? Understanding Wall Street Zen's Concerns

Wall Street Zen's analysis points to several key factors contributing to their negative outlook on CoreWeave. While the company is a significant player in the burgeoning cloud computing sector, specializing in high-performance computing (HPC) for AI applications, the analysts highlight concerns about:

-

Valuation: A primary concern revolves around CoreWeave's current valuation. The analysts argue that the market may be overestimating the company's long-term growth potential, leading to an inflated stock price. They suggest a more conservative valuation is warranted, potentially implying significant downside risk.

-

Competition: The cloud computing market is fiercely competitive. Established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) pose a significant threat to CoreWeave's market share. Wall Street Zen's analysis likely considers CoreWeave's ability to compete effectively against these well-established players with extensive resources and market penetration.

-

Profitability: While CoreWeave is experiencing rapid growth, profitability remains a concern. The analysts' assessment likely scrutinized CoreWeave's operating margins and cash flow, questioning the sustainability of its current business model in the face of increasing competition and operational costs. This is a crucial aspect for long-term investors.

-

Market Saturation: The rapid expansion of the AI market and the subsequent demand for HPC resources might be reaching a saturation point. Wall Street Zen's analysis might incorporate a projection that the current growth trajectory is unsustainable in the medium to long term. This is a key consideration for investors evaluating future growth prospects.

Beyond the Negative: Nuances and Counterarguments

It's important to note that Wall Street Zen's assessment is just one perspective. While their concerns are valid and warrant consideration, investors should not solely rely on a single analysis. Several counterarguments could be made:

-

First-Mover Advantage: CoreWeave's early entry into the specialized HPC market for AI could give them a significant first-mover advantage, allowing them to establish a strong client base and brand recognition before competitors fully enter the space.

-

Technological Innovation: CoreWeave's focus on innovation and adapting to the evolving needs of the AI market could differentiate them from competitors and sustain their growth.

-

Strategic Partnerships: Future strategic partnerships and collaborations could significantly boost CoreWeave's market position and enhance their profitability.

What This Means for Investors

Wall Street Zen's negative rating serves as a crucial cautionary signal. Investors should conduct thorough due diligence, considering both the positive and negative aspects before making any investment decisions. It's vital to diversify your portfolio and avoid concentrating your investments heavily in any single stock, especially one facing significant headwinds.

Further Research and Due Diligence

Before making any investment decisions regarding CRWV, it is crucial to conduct thorough independent research. Consult reputable financial news sources, analyze financial statements, and consider seeking advice from a qualified financial advisor. Understanding the risks involved is paramount. This article is for informational purposes only and does not constitute financial advice.

Call to Action: Stay informed about market trends and company performance by regularly reviewing reputable financial news sources and conducting thorough due diligence before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Zen's Negative CoreWeave (CRWV) Rating: A Deeper Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open 2025 Upset Fritz And Navarro Exit In First Round

May 28, 2025

French Open 2025 Upset Fritz And Navarro Exit In First Round

May 28, 2025 -

Financial Boost For Buzz Feed Bzfd 40 Million Loan Secured

May 28, 2025

Financial Boost For Buzz Feed Bzfd 40 Million Loan Secured

May 28, 2025 -

Chaos And Clashes First Day Of Us Aid In Gaza Marked By Violence

May 28, 2025

Chaos And Clashes First Day Of Us Aid In Gaza Marked By Violence

May 28, 2025 -

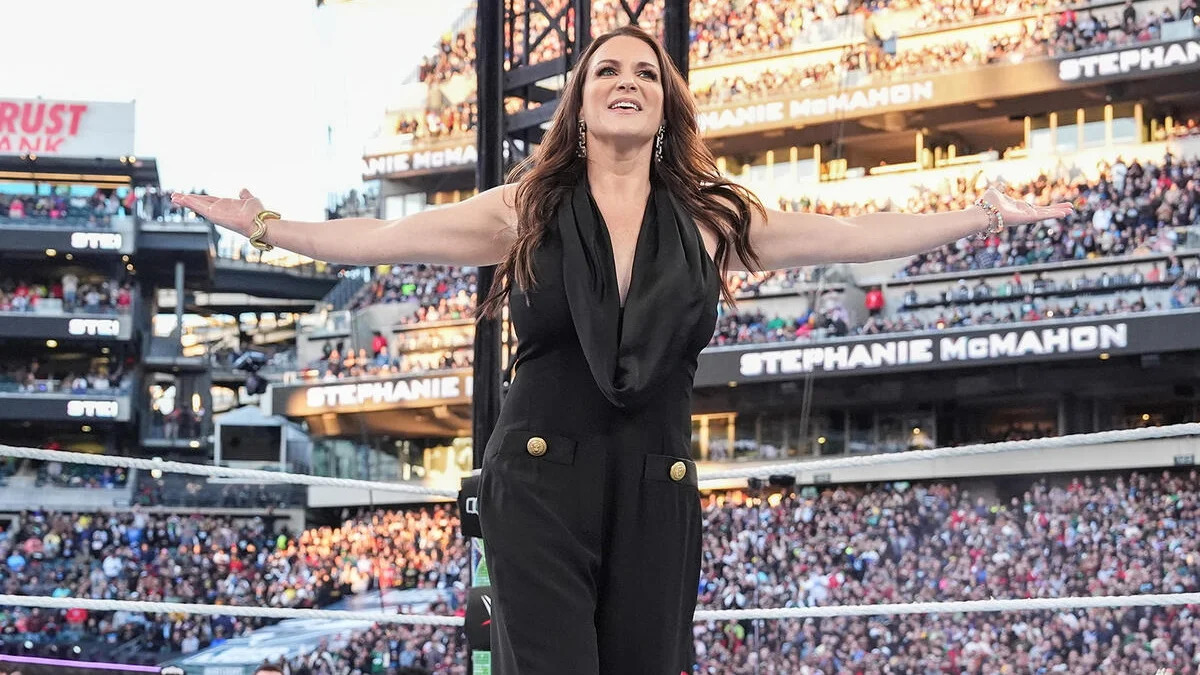

Stephanie Mc Mahons Regretted Tattoo A Thank God Moment Revealed

May 28, 2025

Stephanie Mc Mahons Regretted Tattoo A Thank God Moment Revealed

May 28, 2025 -

Former Wwe Co Ceo Stephanie Mc Mahon Reflects On A Tattoo Decision

May 28, 2025

Former Wwe Co Ceo Stephanie Mc Mahon Reflects On A Tattoo Decision

May 28, 2025