Wall Street Resilience: Market Rebounds Despite Moody's Downgrade, S&P 500 Leads Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Resilience: Market Rebounds Despite Moody's Downgrade, S&P 500 Leads Gains

Wall Street defied expectations on Tuesday, staging a remarkable rebound despite Moody's downgrade of several US banking giants. The S&P 500 led the charge, showcasing the market's surprising resilience in the face of negative credit rating news. This unexpected surge raises questions about the long-term impact of Moody's actions and the overall health of the US banking sector.

The market's reaction, characterized by a significant upward swing, surprised many analysts who predicted a more substantial sell-off following Moody's announcement. The downgrade, affecting several major banks, highlighted concerns about the increasing credit risk within the financial sector. However, the market's response suggests a degree of confidence in the underlying strength of the US economy and the ability of these institutions to weather the storm.

S&P 500's Strong Performance: A Sign of Market Confidence?

The S&P 500's performance was particularly noteworthy, outpacing other major indices. This suggests investors are focusing on the broader economic outlook rather than solely reacting to the negative credit rating news. Several factors could contribute to this seemingly contradictory market behavior:

- Positive Earnings Reports: Strong earnings reports from several key companies may have offset the negative sentiment surrounding the banking sector downgrade. Positive corporate news often outweighs concerns in a resilient market.

- Federal Reserve's Actions: The Federal Reserve's recent actions and pronouncements regarding interest rates and monetary policy may also be contributing to investor confidence. Market participants are closely monitoring the Fed's strategy to combat inflation.

- Resilient Consumer Spending: Stronger-than-expected consumer spending data could be another factor fueling investor optimism. A healthy consumer sector is vital for overall economic growth.

Moody's Downgrade: A Deeper Look

Moody's decision to downgrade several US banks is a significant development with potential long-term implications. The agency cited concerns about the deteriorating credit quality of US banks, highlighting the challenges posed by rising interest rates and potential economic slowdowns. This downgrade is a significant event warranting continued monitoring of the banking sector's financial health. You can find more details on Moody's rationale .

What Does This Mean for Investors?

The market's resilience in the face of the Moody's downgrade presents a mixed signal for investors. While the short-term rebound is encouraging, the long-term effects of the downgrade remain uncertain. Investors should carefully consider their portfolios and risk tolerance. Diversification remains key in a volatile market. Seeking advice from a qualified financial advisor is crucial for navigating such uncertain times.

Looking Ahead: Uncertainty Remains

While Tuesday's market rebound is positive, it's crucial to avoid interpreting it as a complete dismissal of the risks highlighted by Moody's downgrade. The situation remains fluid, and continued monitoring of economic indicators and the performance of the banking sector is essential. The coming weeks will be critical in determining the long-term impact of this event on the overall market.

Keywords: Wall Street, Stock Market, Moody's Downgrade, S&P 500, Banking Sector, US Economy, Market Rebound, Credit Rating, Investment, Financial News, Economic Indicators, Federal Reserve, Interest Rates, Investor Confidence, Market Volatility

Call to Action: Stay informed about market developments by subscribing to our newsletter for daily updates and expert analysis. (Link to Newsletter signup – replace with actual link)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Resilience: Market Rebounds Despite Moody's Downgrade, S&P 500 Leads Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

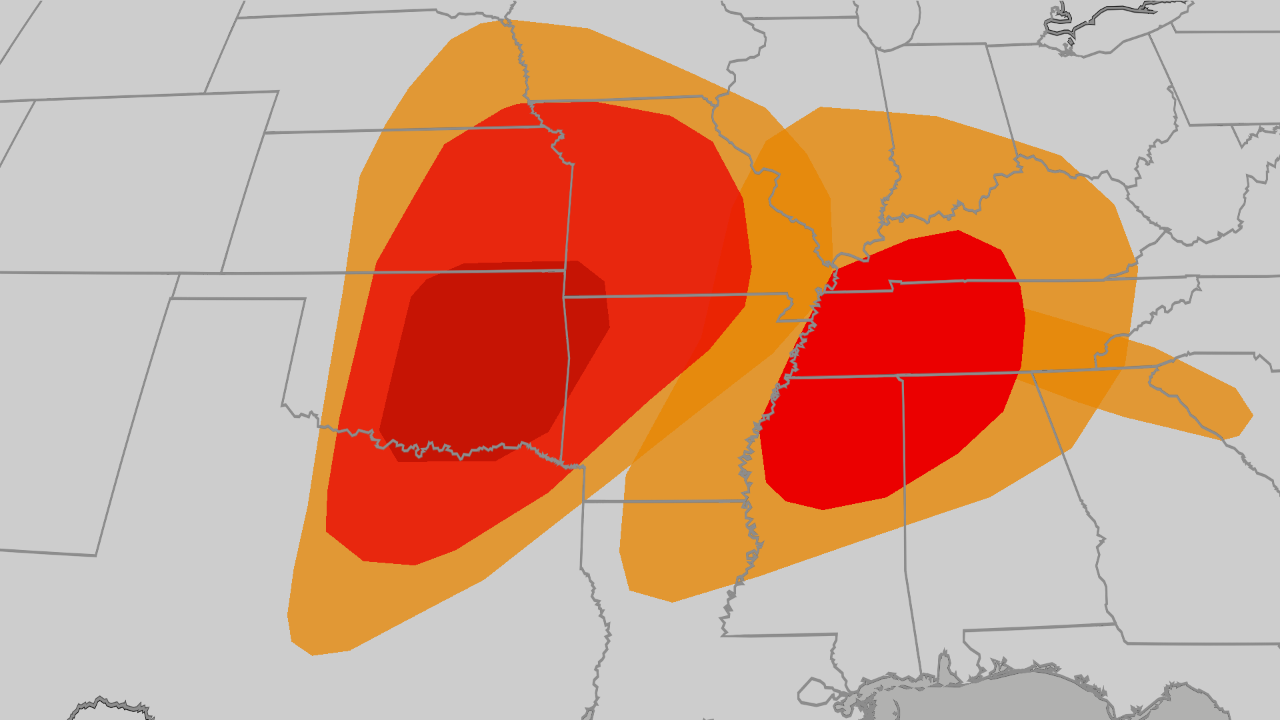

Tornado Threat Intensifies Severe Weather Impacts Plains Midwest And South

May 20, 2025

Tornado Threat Intensifies Severe Weather Impacts Plains Midwest And South

May 20, 2025 -

Netflixs Fall Of Favre Director On Navigating Favres Legacy And Controversies

May 20, 2025

Netflixs Fall Of Favre Director On Navigating Favres Legacy And Controversies

May 20, 2025 -

Supreme Court Decision Venezuelan Migrants Lose Protected Status Under Trump Era Policy

May 20, 2025

Supreme Court Decision Venezuelan Migrants Lose Protected Status Under Trump Era Policy

May 20, 2025 -

Plains Midwest And South Face Severe Weather And Tornado Risks

May 20, 2025

Plains Midwest And South Face Severe Weather And Tornado Risks

May 20, 2025 -

Near Certain Rba Rate Cut Live Stream And Market Implications

May 20, 2025

Near Certain Rba Rate Cut Live Stream And Market Implications

May 20, 2025