Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Downgrade

Wall Street staged a remarkable rebound on Tuesday, with the S&P 500 extending its winning streak despite a negative outlook from Moody's Investors Service. The unexpected surge defied expectations, showcasing the resilience of the market even amidst growing economic uncertainty. This positive movement comes as investors grapple with rising interest rates and the potential for a prolonged period of slower economic growth.

Moody's Downgrade and Market Reaction:

Moody's decision to downgrade the credit ratings of several small and mid-sized US banks sent ripples through the financial sector earlier this week. The agency cited concerns about the banking sector's vulnerability to potential economic downturns and the rising interest rate environment. While this news initially sparked fears of a broader market correction, the S&P 500's performance on Tuesday suggests investor sentiment remains relatively robust. This resilience highlights the complexities of market prediction and the often unpredictable nature of investor behavior.

Factors Contributing to the Rebound:

Several factors likely contributed to the market's positive performance. These include:

- Stronger-than-expected corporate earnings: Recent earnings reports from major corporations have exceeded analysts' expectations, bolstering investor confidence. This positive news helped offset the negative sentiment stemming from Moody's downgrade.

- Resilient consumer spending: Despite inflation remaining a concern, consumer spending has shown surprising resilience, suggesting continued strength in the overall economy. This data point provides a counterbalance to the more pessimistic economic forecasts.

- Potential for a Fed pivot: Some analysts believe the Federal Reserve may soon pause its interest rate hikes, or even begin to cut rates, in response to slowing economic growth. This expectation has helped to mitigate some of the concerns surrounding higher borrowing costs.

- Technical buying: The market's recent pullback may have created attractive entry points for some investors, leading to a wave of technical buying that helped fuel the rebound.

S&P 500 Performance and Outlook:

The S&P 500's continued upward trajectory is a noteworthy development, especially in light of the recent economic headwinds. The index's performance underlines the inherent volatility of the stock market and the capacity for unexpected shifts in sentiment. However, the long-term outlook remains uncertain, with analysts divided on whether the current rebound is sustainable.

Navigating Market Uncertainty:

The current market climate underscores the importance of diversification and a long-term investment strategy. Investors should carefully consider their risk tolerance and consult with financial advisors before making any significant investment decisions. Staying informed about macroeconomic trends and corporate earnings reports is crucial for navigating the complexities of the financial markets.

Further Research and Resources:

For more in-depth analysis on the S&P 500 and the current market conditions, we recommend consulting reputable financial news sources such as [link to a reputable financial news source, e.g., Bloomberg, Reuters, etc.]. Understanding these dynamics is vital for informed decision-making in the ever-evolving world of finance.

Call to Action: Stay tuned for further updates on market trends and economic developments. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nfl News Nick Siriannis Contract Extension With Philadelphia Eagles

May 20, 2025

Nfl News Nick Siriannis Contract Extension With Philadelphia Eagles

May 20, 2025 -

Moodys Downgrade Impact Stock Market Remains Strong S And P 500 Continues Rally

May 20, 2025

Moodys Downgrade Impact Stock Market Remains Strong S And P 500 Continues Rally

May 20, 2025 -

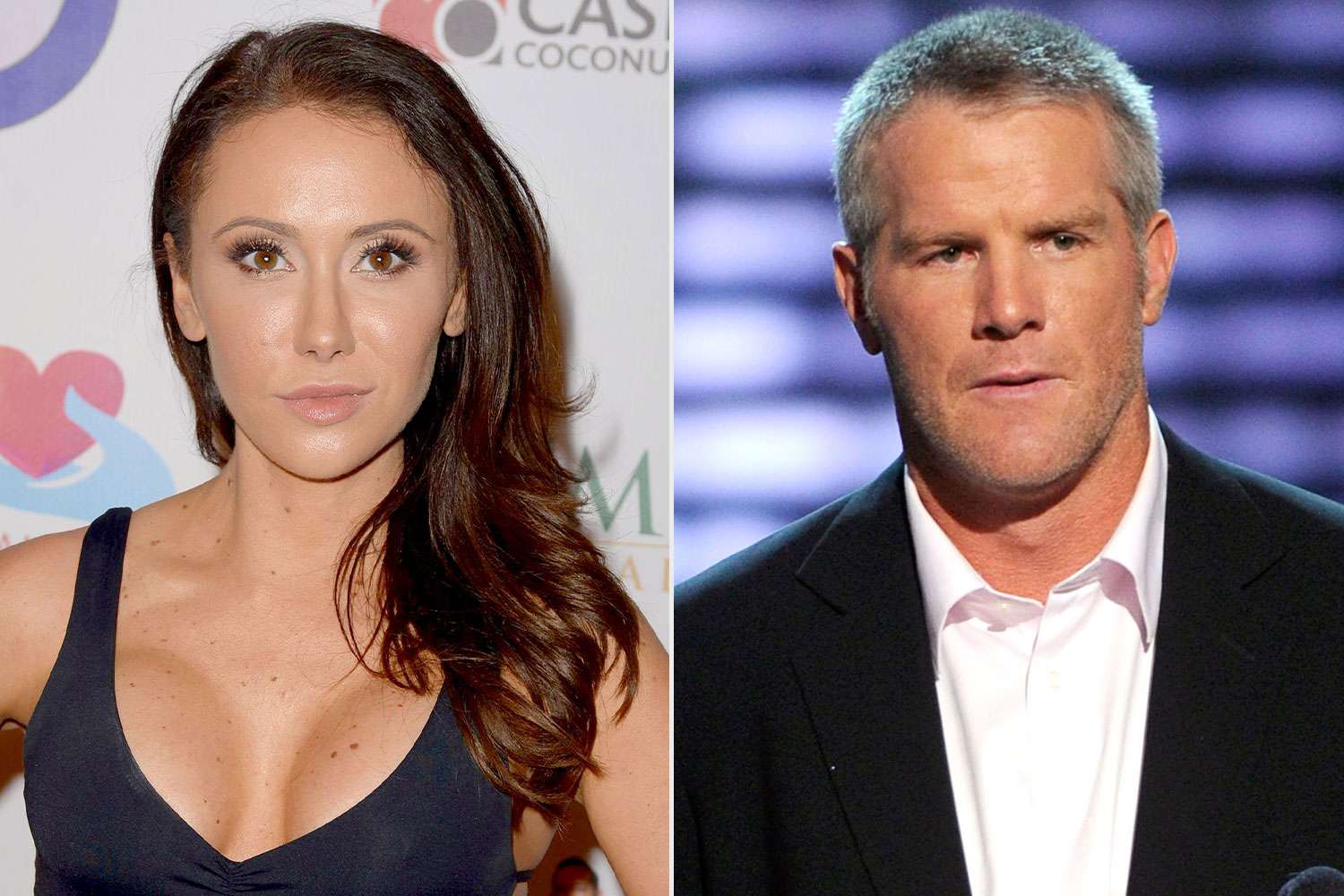

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Lack Of Respect

May 20, 2025

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Lack Of Respect

May 20, 2025 -

Did The Ufc Mislead Fans Jon Jones Accusation Against The Promotion

May 20, 2025

Did The Ufc Mislead Fans Jon Jones Accusation Against The Promotion

May 20, 2025 -

Confirmed A New Peaky Blinders Series Is Coming But With A Twist

May 20, 2025

Confirmed A New Peaky Blinders Series Is Coming But With A Twist

May 20, 2025