Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Post Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's Downgrade: A Bullish Day for Stocks

Moody's Investors Service recently downgraded the credit rating of several US banks, citing concerns about the rising interest rate environment and potential for loan losses. This action sent ripples through the financial markets, with many anticipating a negative reaction from Wall Street. However, in a surprising turn of events, the major US stock indices defied expectations, posting impressive gains. This unexpected resilience begs the question: Why did the market shrug off Moody's downgrade?

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all saw significant increases, bucking the trend predicted by many analysts. This unexpected positive performance highlights the complex and often unpredictable nature of the stock market. Let's delve deeper into the reasons behind this surprising market reaction.

Market Resilience in the Face of Downgrade

While Moody's downgrade was a significant event, several factors likely contributed to the market's surprisingly positive response:

-

Stronger-than-Expected Economic Data: Recent economic indicators, including positive jobs reports and consumer spending data, may have boosted investor confidence, outweighing the concerns raised by the credit rating downgrade. This positive economic narrative countered the negative sentiment surrounding the Moody's action.

-

Anticipation Already Priced In: Some analysts believe that the market had already, to some extent, priced in the possibility of a downgrade. The news, therefore, might have had less impact than initially feared. This suggests a degree of market efficiency in anticipating potential risks.

-

Focus on Individual Company Performance: Investors may have shifted their focus from macroeconomic concerns to the individual performance of companies. Strong earnings reports and positive outlooks from specific sectors could have driven the market's upward trajectory. This highlights the importance of fundamental analysis alongside broader market trends.

-

Bargain Hunting: The initial dip following the Moody's announcement may have presented attractive entry points for some investors, leading to bargain hunting and subsequent upward pressure on prices. This suggests a proactive approach from investors looking to capitalize on perceived market undervaluation.

What Does This Mean for Investors?

The market's surprising resilience offers a complex picture for investors. While the positive gains are encouraging, it's crucial to remember that market volatility remains a significant factor. The long-term implications of Moody's downgrade are still unfolding, and investors should proceed with caution.

Further Considerations:

-

Interest Rate Hikes: The ongoing impact of the Federal Reserve's interest rate hikes remains a key factor influencing market performance. Continued rate increases could still put pressure on the economy and potentially reverse the recent gains.

-

Geopolitical Risks: Global geopolitical instability continues to pose a threat to market stability. Investors need to stay informed about international events that could significantly impact the market.

-

Inflationary Pressures: Persistent inflationary pressures could erode investor confidence and lead to further market corrections. Monitoring inflation data remains crucial for making informed investment decisions.

Call to Action: While this positive market reaction is encouraging, maintaining a diversified investment portfolio and conducting thorough due diligence before making any investment decisions remain vital. Stay informed and consult with a financial advisor to navigate the complexities of the current market environment. [Link to reputable financial advice website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Post Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Remembering Latonya Pottain My 600 Lb Life Star Passes Away

May 20, 2025

Remembering Latonya Pottain My 600 Lb Life Star Passes Away

May 20, 2025 -

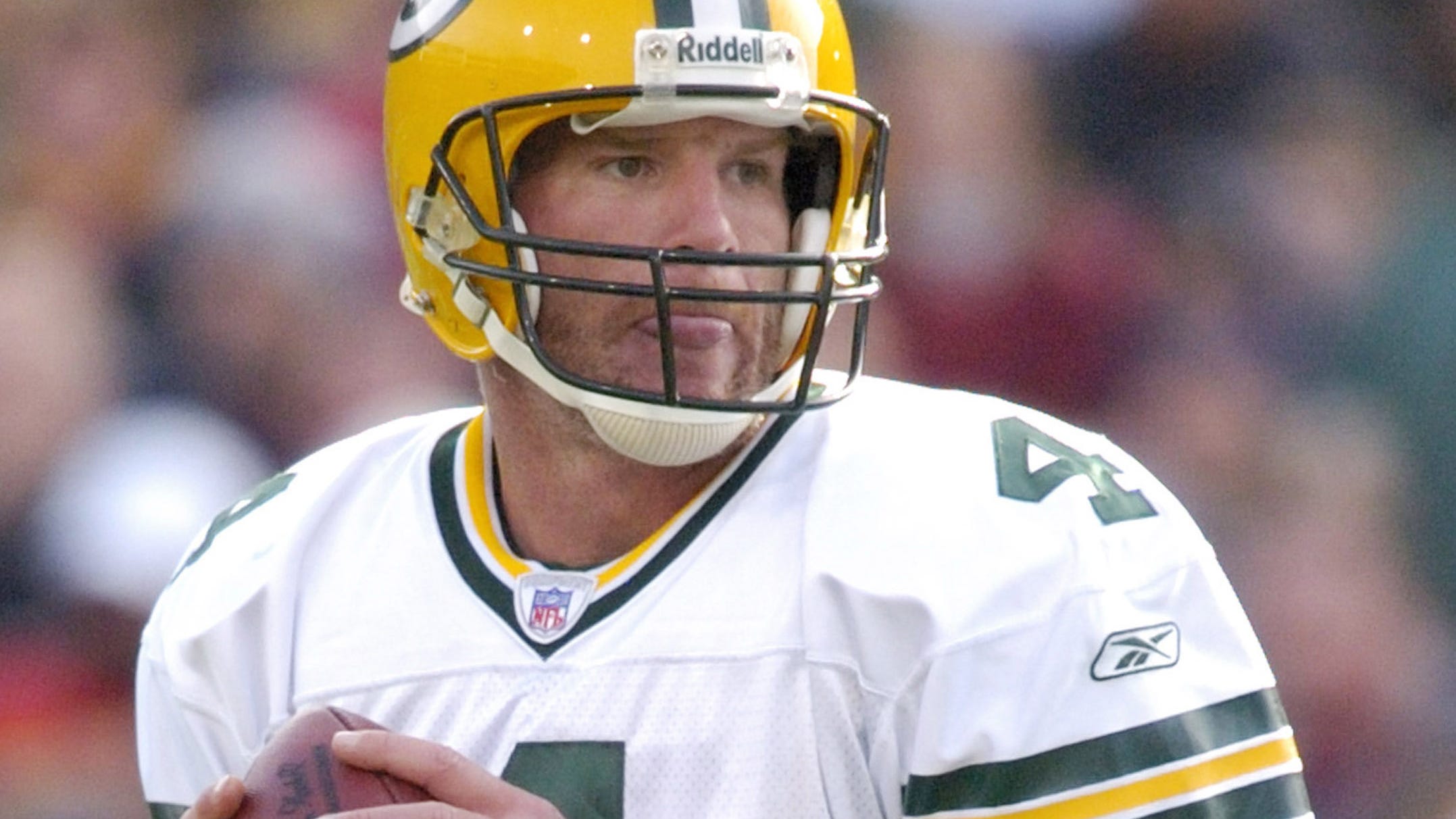

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Challenges

May 20, 2025

Balancing Act The Director Of Netflixs Fall Of Favre On The Films Challenges

May 20, 2025 -

Over 5 Billion Inflows Bitcoin Etf Investment Soars

May 20, 2025

Over 5 Billion Inflows Bitcoin Etf Investment Soars

May 20, 2025 -

From Labs To Lives The Real World Benefits Of American Medical And Scientific Research

May 20, 2025

From Labs To Lives The Real World Benefits Of American Medical And Scientific Research

May 20, 2025 -

Helldivers 2 Warbond Event Masters Of Ceremony Content Drops May 15th

May 20, 2025

Helldivers 2 Warbond Event Masters Of Ceremony Content Drops May 15th

May 20, 2025