Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Climb Despite Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's: S&P 500, Dow, and Nasdaq Climb Despite Downgrade

A surprising surge: Wall Street shrugged off Moody's downgrade of US government debt, with the major indices – the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite – all posting gains on [Date of publication]. This unexpected resilience highlights the complex interplay of factors influencing market sentiment and challenges the conventional wisdom surrounding credit rating impacts.

The news from Moody's, which lowered the US government's credit rating from AAA to Aa1, citing concerns about fiscal strength and rising debt, was expected to trigger a significant market sell-off. However, the markets reacted quite differently, showcasing a surprising level of optimism. This counter-intuitive response warrants a closer examination of the contributing factors.

Why Did the Market Ignore the Downgrade?

Several factors likely contributed to Wall Street's defiance of Moody's assessment:

-

Resilient Economic Data: Recent economic indicators, including strong employment numbers and relatively stable inflation figures, have bolstered investor confidence. This positive economic backdrop seemingly overshadowed the concerns raised by Moody's. The robust job market, in particular, continues to be a key driver of market optimism. Learn more about the latest [link to relevant economic data source].

-

Market Anticipation: Many analysts believe the market had already priced in a potential downgrade, mitigating the immediate impact of the announcement. This preemptive adjustment lessened the severity of the reaction. The ongoing debate surrounding the US debt ceiling likely played a role in this anticipation.

-

Strong Corporate Earnings: The recent reporting season has seen many companies exceeding expectations, further fueling positive sentiment. Strong earnings reports often outweigh macroeconomic concerns, especially in a climate of relatively low interest rates. [Link to relevant corporate earnings reports].

-

Technical Factors: Some analysts point to technical factors, such as short covering and bargain hunting, as contributing to the market's upward trajectory. These activities can temporarily influence market direction, irrespective of fundamental economic news.

Long-Term Implications Remain Unclear

While the immediate market reaction was positive, the long-term implications of Moody's downgrade remain uncertain. The reduced credit rating could lead to higher borrowing costs for the US government, potentially impacting future economic growth. This could, in turn, eventually ripple through the markets.

Further considerations:

- Inflationary pressures: While inflation appears to be cooling, persistent inflationary pressures could still impact future interest rate decisions by the Federal Reserve. This remains a crucial factor to watch.

- Geopolitical risks: Ongoing geopolitical instability across the globe continues to present a risk to global markets. These external factors can often outweigh domestic news cycles.

What This Means for Investors

The market's unexpected resilience raises questions about the weight given to credit rating agencies in the current climate. While credit ratings remain an important factor, they are only one piece of the puzzle. Investors should continue to diversify their portfolios and maintain a long-term investment strategy. Consider consulting with a financial advisor to assess your individual risk tolerance and investment objectives.

Conclusion:

The market's response to Moody's downgrade is a complex event with multiple contributing factors. While the short-term outlook appears positive, long-term uncertainties remain. This situation underscores the importance of staying informed and adapting your investment strategy to the evolving economic and geopolitical landscape. Keep an eye on future economic indicators and news related to the US debt ceiling for a clearer picture of the road ahead.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Climb Despite Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New York Attorney General Under Federal Investigation Fbi Confirms

May 21, 2025

New York Attorney General Under Federal Investigation Fbi Confirms

May 21, 2025 -

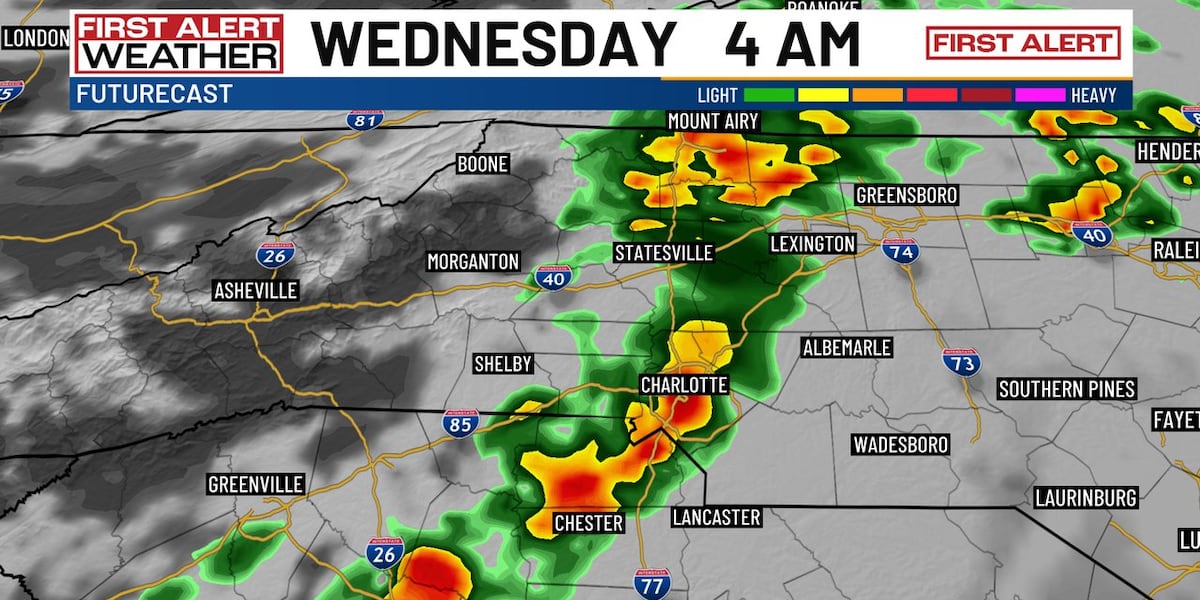

Charlotte Weather Alert Overnight Storms Expected Before Temperature Drop

May 21, 2025

Charlotte Weather Alert Overnight Storms Expected Before Temperature Drop

May 21, 2025 -

160 Esg 13

May 21, 2025

160 Esg 13

May 21, 2025 -

Tornadoes Pummel Midwest And South Emergency Crews Respond To Catastrophe

May 21, 2025

Tornadoes Pummel Midwest And South Emergency Crews Respond To Catastrophe

May 21, 2025 -

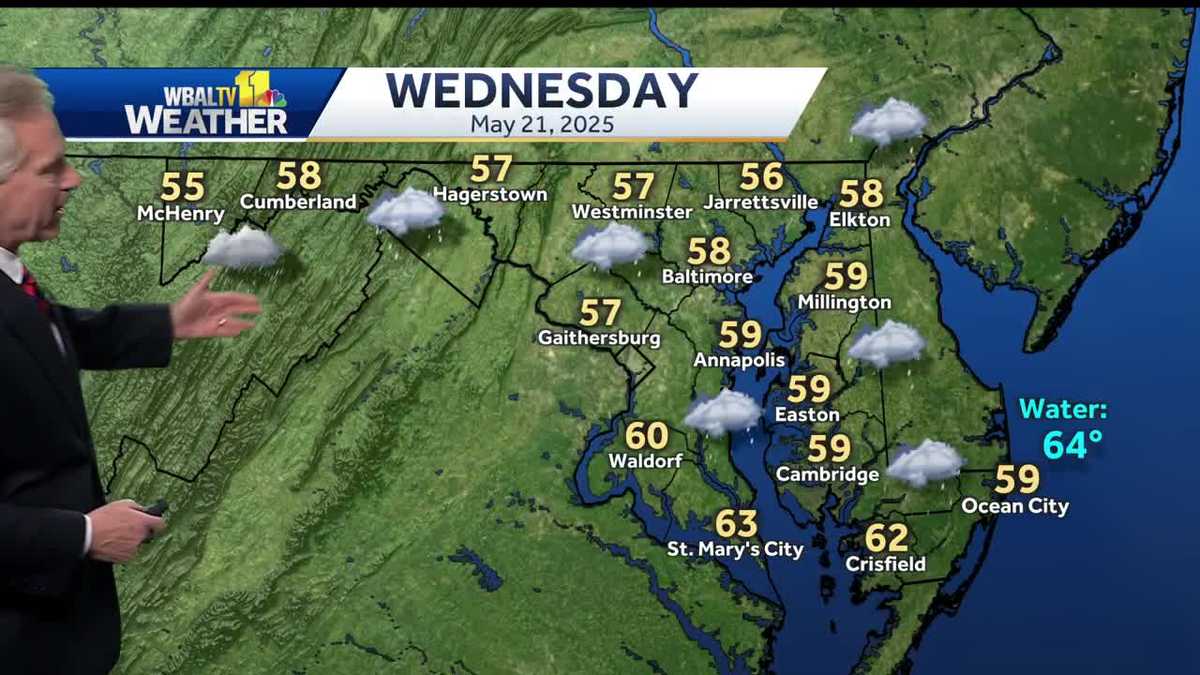

Chilly Rain To Impact Region Throughout Wednesday

May 21, 2025

Chilly Rain To Impact Region Throughout Wednesday

May 21, 2025