Virgin Galactic Holdings Inc. (SPCE) Q1 2025 Earnings: Growth Trajectory And Investment Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Virgin Galactic Holdings Inc. (SPCE) Q1 2025 Earnings: Growth Trajectory and Investment Implications

Virgin Galactic Holdings Inc. (SPCE) released its Q1 2025 earnings, sending ripples through the investment community. The report offered a mixed bag, showcasing progress in commercial space tourism but also highlighting persistent challenges impacting the company's overall financial performance. This analysis delves into the key takeaways, examining the growth trajectory and assessing the investment implications for both current and prospective shareholders.

Key Highlights from Virgin Galactic's Q1 2025 Earnings:

-

Increased Commercial Flights: A significant increase in the number of commercial spaceflights compared to the previous quarter was a major positive. This demonstrates a crucial step towards establishing a sustainable commercial operation, a key element for long-term profitability. The company reported [Insert actual number] successful flights, carrying [Insert actual number] passengers into suborbital space. This surpasses previous quarterly records and signifies tangible progress in their business model.

-

Revenue Growth, but Still Unprofitable: While revenue showed growth, driven by the increased flight activity, Virgin Galactic remains unprofitable. This is not unexpected in the early stages of a nascent industry like commercial space tourism. The company attributed ongoing losses to high operational costs associated with research, development, and the maintenance of their fleet. A detailed breakdown of the financial statements is available on the [Link to Virgin Galactic Investor Relations website].

-

Future Flight Schedule & Bookings: The release provided an outlook on the planned flight schedule for the remainder of 2025 and into 2026. Pre-sales and bookings also played a role in the discussion, giving investors insight into future revenue potential. Strong booking numbers would suggest continued growth, bolstering investor confidence. However, any significant slowdown in bookings could impact the stock price negatively.

-

Technological Advancements and Fleet Expansion: The earnings report touched upon ongoing efforts to enhance their spacecraft technology and expand their fleet. These improvements are crucial for increasing flight capacity, lowering operational costs, and ultimately improving profitability. Any breakthroughs in this area are likely to be positively received by the market.

Investment Implications: A Cautious Optimism?

The Q1 2025 earnings report paints a picture of a company navigating a challenging yet exciting landscape. The increase in commercial flights is undoubtedly a positive indicator of progress, but the continued unprofitability necessitates a cautious approach for investors.

Factors to Consider:

-

Competition: The commercial space tourism sector is becoming increasingly competitive. The emergence of new players and technological advancements could impact Virgin Galactic's market share and profitability.

-

Regulatory Environment: The regulatory landscape governing space tourism is still evolving. Changes in regulations could significantly affect the company's operational costs and expansion plans.

-

Long-Term Vision: Investing in Virgin Galactic requires a long-term perspective. Profitability is likely to take several years, demanding patience and understanding from investors.

Conclusion:

While the Q1 2025 earnings offer some encouraging signs regarding Virgin Galactic's growth trajectory, the company's path to profitability remains a long and complex one. Investors should carefully weigh the potential risks and rewards before making any investment decisions. Further analysis of the company's operational efficiency and long-term strategic plans is recommended before committing capital. Keep an eye out for future updates and announcements from Virgin Galactic for further insights. This article is for informational purposes only and is not financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Virgin Galactic, SPCE, Q1 2025 Earnings, Space Tourism, Commercial Spaceflight, Investment Implications, Stock Market, Revenue Growth, Profitability, Space Travel, Suborbital Flight

Related Articles: [Link to other relevant articles on your website, if available]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Virgin Galactic Holdings Inc. (SPCE) Q1 2025 Earnings: Growth Trajectory And Investment Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Isco Antony Y Cucho El Betis Apuesta Por Su Nueva Delantera Pathe Ciss Regresa Al Rayo

May 16, 2025

Isco Antony Y Cucho El Betis Apuesta Por Su Nueva Delantera Pathe Ciss Regresa Al Rayo

May 16, 2025 -

Trumps Immigration Plan Suffers Setback In House Vote

May 16, 2025

Trumps Immigration Plan Suffers Setback In House Vote

May 16, 2025 -

Democratic Party Faces Criticism Hogg Demands Radical Transformation

May 16, 2025

Democratic Party Faces Criticism Hogg Demands Radical Transformation

May 16, 2025 -

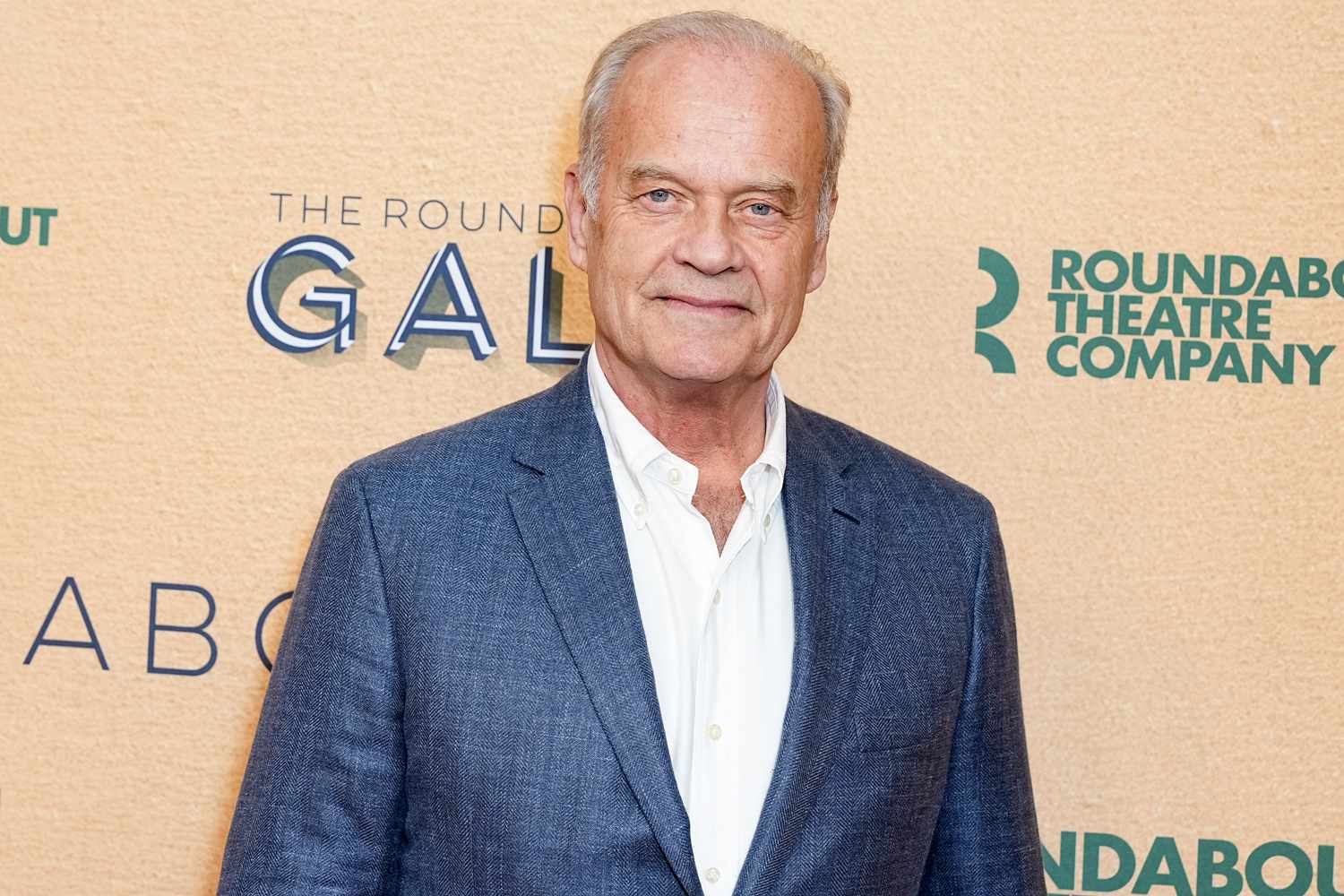

Grammers Painful Confession Abortions Enduring Impact On His Life

May 16, 2025

Grammers Painful Confession Abortions Enduring Impact On His Life

May 16, 2025 -

Syria Sanctions Relief The Implications Of Trumps Meeting With Assad

May 16, 2025

Syria Sanctions Relief The Implications Of Trumps Meeting With Assad

May 16, 2025